By now it’s no longer restricted to individual companies or even to the internet sector. It has spread across a wide range of products, services, and economic sectors, including insurance, retail, healthcare, finance, entertainment, education, transportation, and more, birthing whole new ecosystems of suppliers, producers, customers, market-makers, and market players. Nearly every product or service that begins with the word “smart” or “personalised”, every internet-enabled device, every “digital assistant”, is simply a supply-chain interface for the unobstructed flow of behavioural data on its way to predicting our futures in a surveillance economy.

– From the must read piece: ‘The Goal Is to Automate Us’: Welcome to the Age of Surveillance Capitalism

A lot of my content over the past couple of years has focused on the momentous geopolitical changes I see on the horizon, and this macro perspective reaches two significant conclusions. First, that the planet is moving away from a unipolar world dominated almost entirely by the U.S. toward a more multi-polar world. Second, that this fundamental shift in geopolitical landscape, coupled with what appears to be a forthcoming reckoning with the largest global debt bubble in human history, will lead to a once in a generation reset of the world economy and the global financial system that keeps it functioning.

As has become increasingly clear in recent months, the two primary protagonists in this major historical shift are the U.S. and China. While I’ve speculated about how increased tensions between these two economic giants will likely usher in the end of globalization as we know it (and possibly a bifurcated global economy), I’ve spent less time talking about what the internal situations will look like within individual countries themselves. This is a major oversight because what really matters to Chinese and U.S. citizens ten years from now isn’t which nation has more military bases abroad, but what will everyday life be like for regular people?

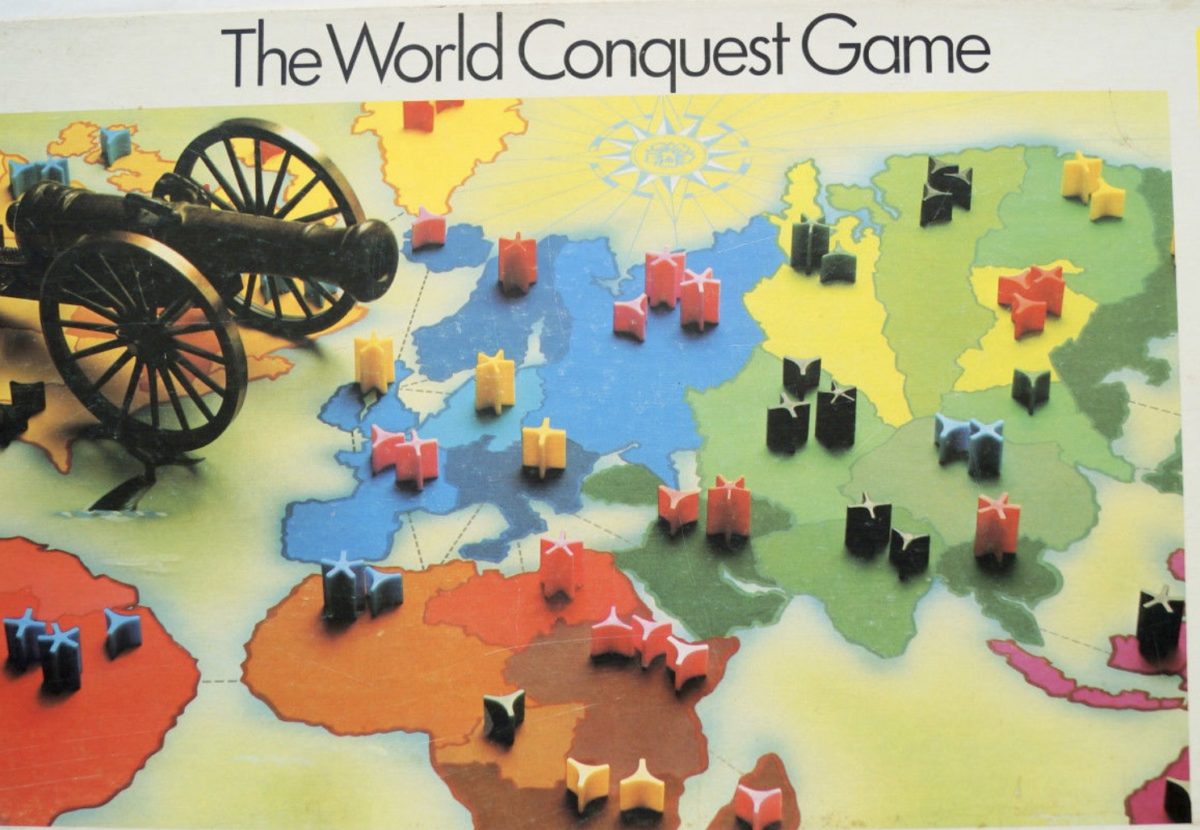

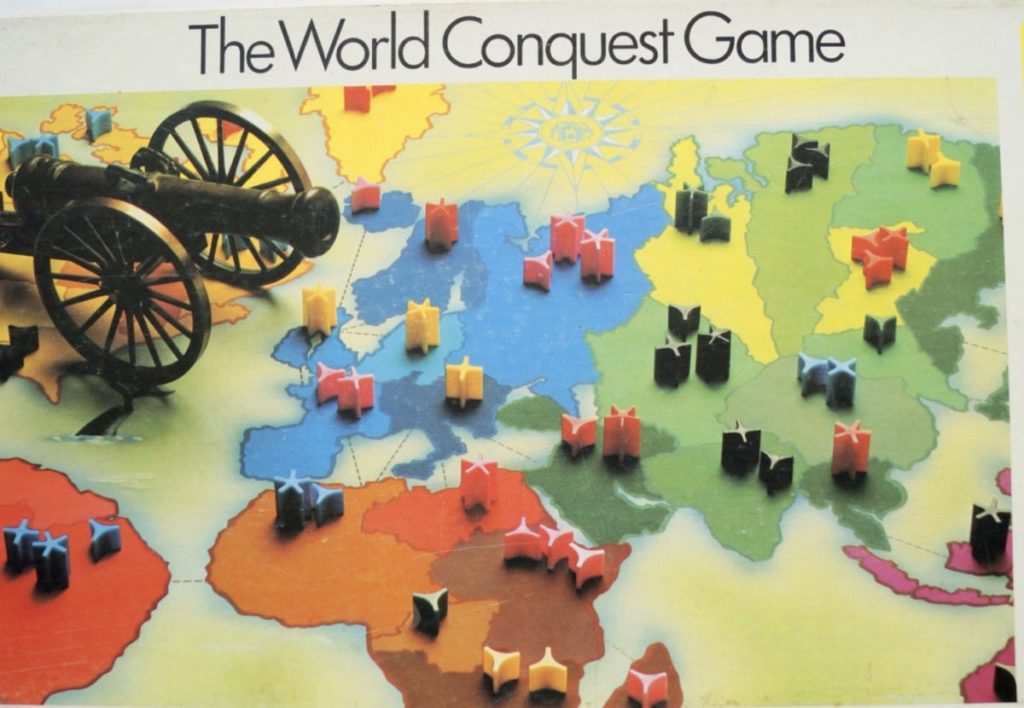

In this regard, China and the U.S. both seem to be headed in similar and very dystopian directions when it comes to the freedom-destroying marriage of overbearing government and ubiquitous surveillance technology. I read a couple of excellent articles on this topic over the past week, which forced the issue to the top of my mind. In other words, does it really matter who wins the geopolitical game of risk if “we the people” end up being controlled, surveilled and completely subjugated by the very technology we so eagerly embraced and assumed would make the world a more liberated place just a few years ago?

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.