New York City’s method of assessing property values is so out of whack that the buyer of the most expensive apartment ever sold — a $100 million duplex overlooking Central Park — pays taxes as if the place were worth just $6.5 million.

With controversial tax breaks granted to the One57 condo tower, the total property tax bill for the spectacular penthouse is just $17,268, an effective rate of 0.017 percent of its sale price.

By contrast, the owner of a nearby condo at 224 E. 52nd St. that recently sold for $1.02 million is paying an effective rate of 2.38 percent, or $24,279, according to data compiled for The Post by the Revaluate.com real-estate information website.

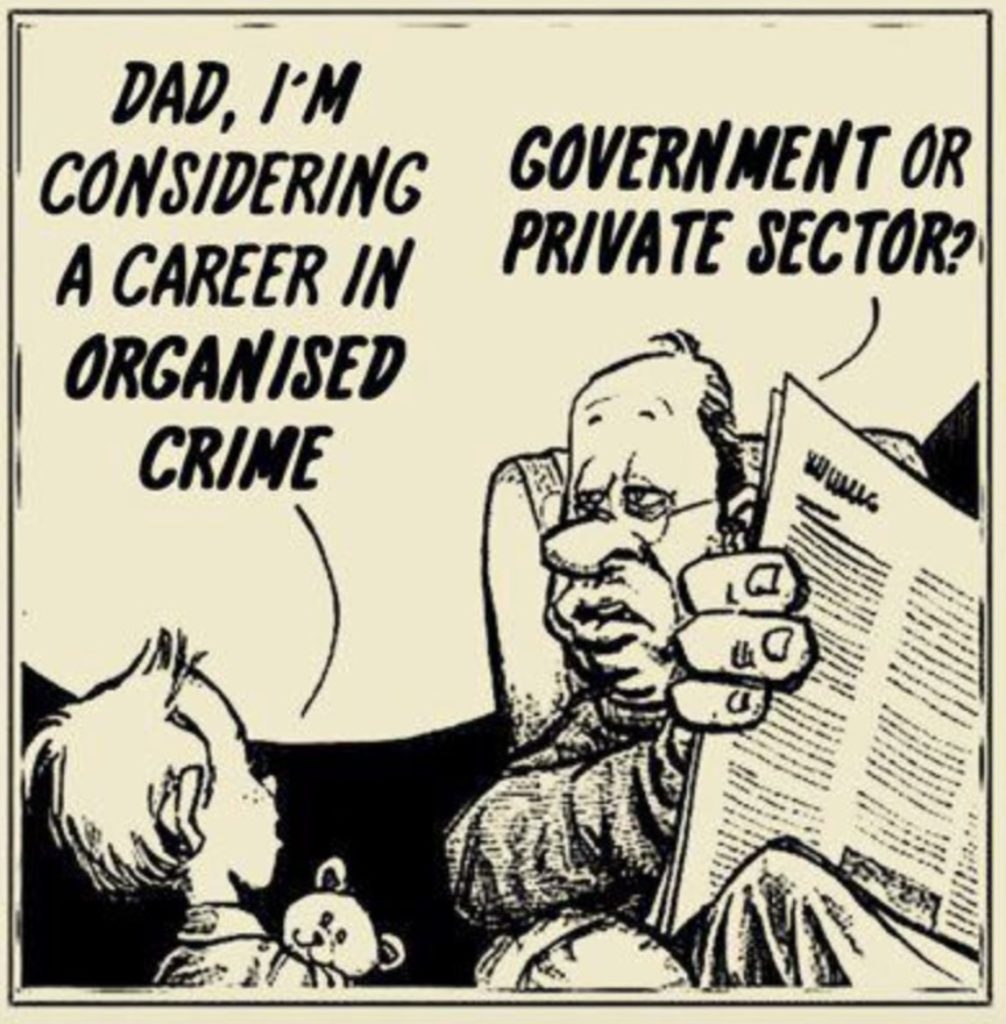

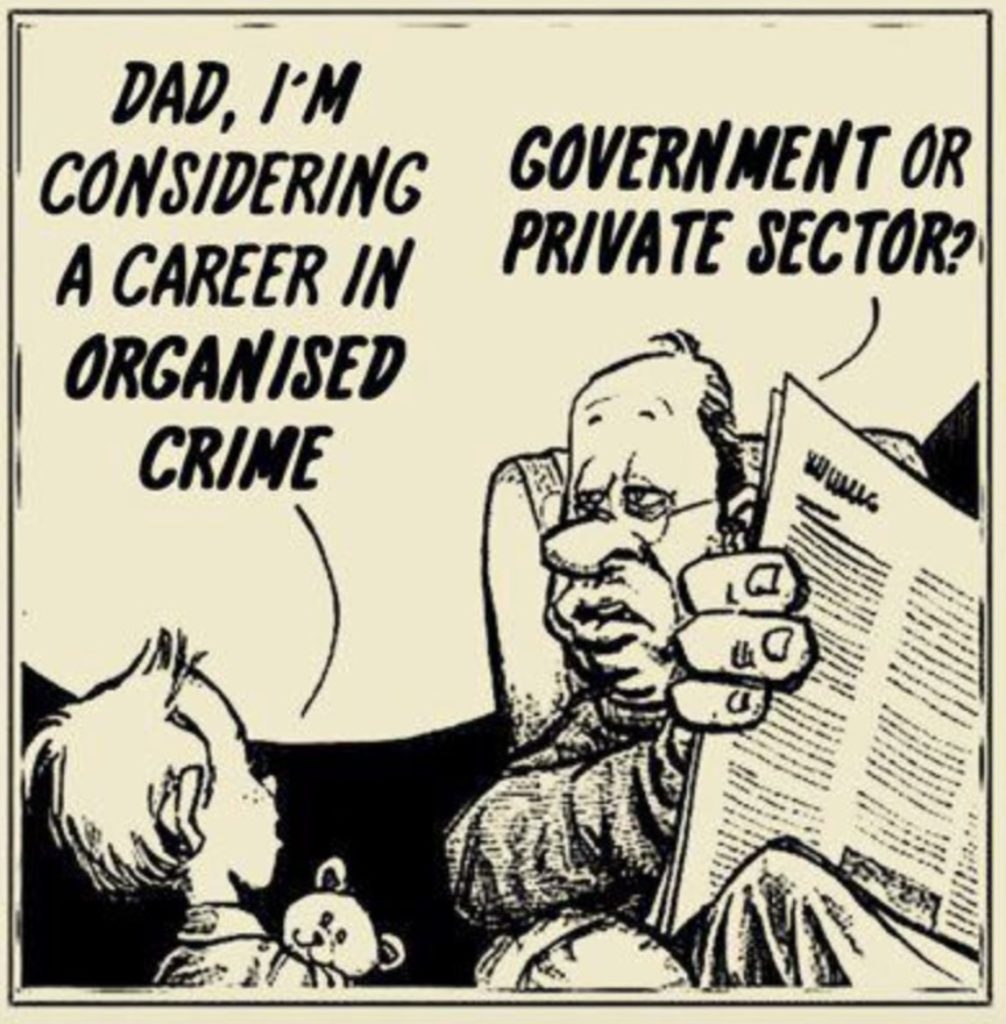

– From the post: Tax Breaks for Oligarchs – The $100 Million Manhattan Apartment with a Property Tax Rate of 0.017%

If anyone deserves a steep pay raise it’s New York City Councilmembers. Never mind the fact that average wages for regular citizens haven’t budged in years, leading to some fully employed individuals living in homeless shelters. After all, ensuring billionaires get favorable tax breaks is hard work.

From Gothamist:

In New York City, the median household income is $52,259, a number that has barely risen since the economic crisis began in 2008. The average New Yorker currently makes just $32,000. A New York cop makes $76,600 after five years on the job, while a New York public school teacher makes somewhere between $50,812 and $63,534. Meanwhile, New York City’s $110 billion debt burden is on track to increase by $30 billion thanks to Mayor de Blasio’s capital plan. So you could understand why members of New York’s City Council would want to keep their plan to raise their own salary to $192,500 secret.

Read more

Follow me on Twitter.

In July, I published a post titled,

In July, I published a post titled,