Here, as in other roosting places of the superrich, the recent influx of foreign money has gone hand in hand with the rising use of shell companies — generally limited liability companies. Shell companies were used in three-quarters of purchases of over $5 million in Los Angeles over the last three years, a higher rate even than the roughly 55 percent in New York, according to a New York Times analysis of data from PropertyShark. What is more, in Los Angeles, where so many of the new palaces are spec houses — luxury magnets for global wealth — not only are the buyers shielded by shell companies, but the developers are, too.

– From the New York Times article: A Mansion, a Shell Company and Resentment in Bel Air

While New York City and London are already well known as top destinations for shady, foreign-money laundering oligarchs who often attain untold riches by thieving from their own people, the Los Angeles area has likewise morphed into a criminal real estate hub.

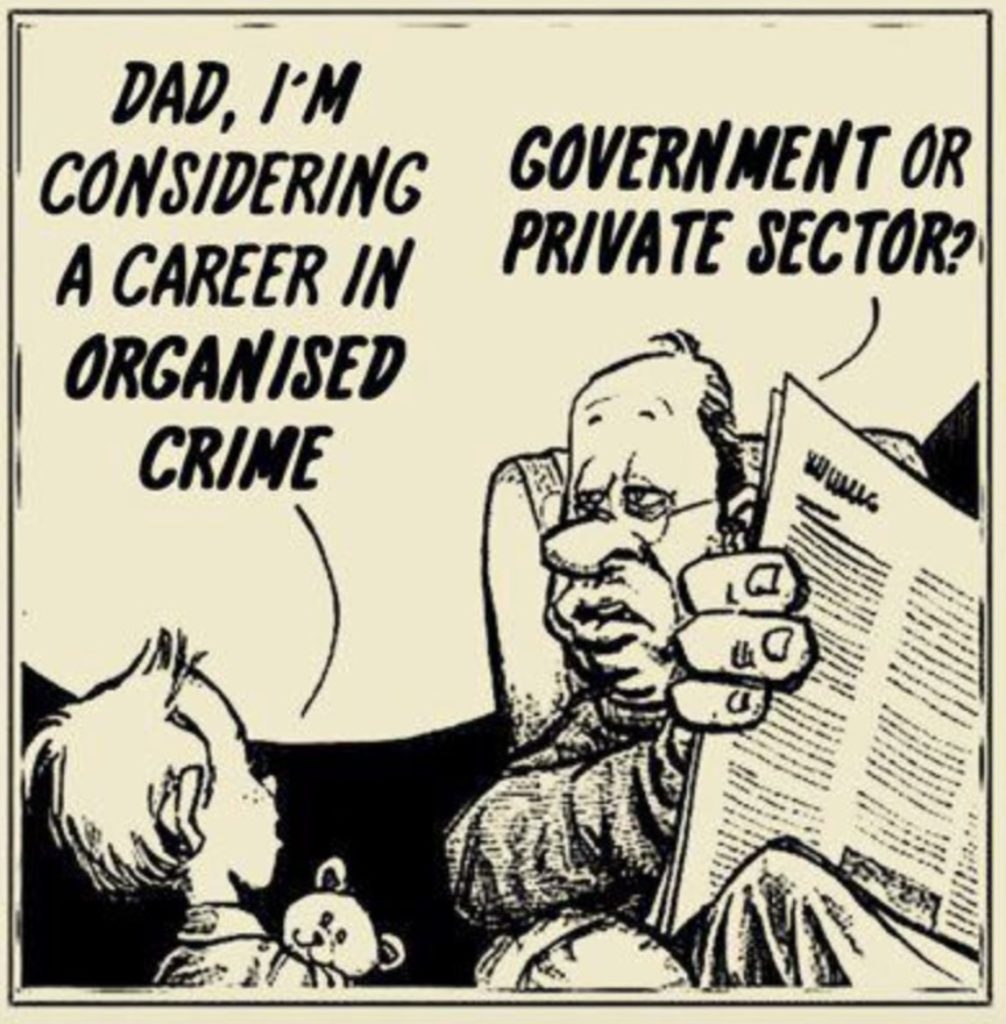

Monday’s article in the New York Times, titled, A Mansion, a Shell Company and Resentment in Bel Air, sums up so much of what is wrong about the U.S. economy and society as we reflect on how far we’ve fallen in 2015. A culture in which not only are the rich and powerful above the law, but where foreign criminals also can do whatever the heck they want and get away with it as long as they have billions to throw around. The fact that no one seems to be doing anything about any of it tells you all you need to know.

What follows are a few excerpts, but you should really read the entire article. From the New York Times:

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.