Bernanke and the Federal Reserve are nothing but criminal butlers for the oligarchy. The proof is undeniable at this point. While this unaccountable banking cartel promised us that 0% rates would help the economy, America’s growing underclasses are paying 100% rates for loans to buy sofas and pay for food, more than five years into this so-called “recovery. Meanwhile, the only segment of society with access to low interest rates are the very wealthy financial oligarchs who leverage this cheap money to speculate on financial assets and real estate. So yes, the Fed (Central Banking in general) is completely to blame for the world’s growing inequality, as are their submissive, compliant defenders in academia, “journalism” and within the halls of power in Washington D.C.

From the post: Another Tale from the Oligarch Recovery – How a $1,500 Sofa Costs $4,150 When You’re Poor

There is no recovery. The only thing we’ve experienced over the past eight years of Obama is a historic plundering and strip mining of the U.S. economy by a handful of oligarchs and their political and bureaucratic minions.

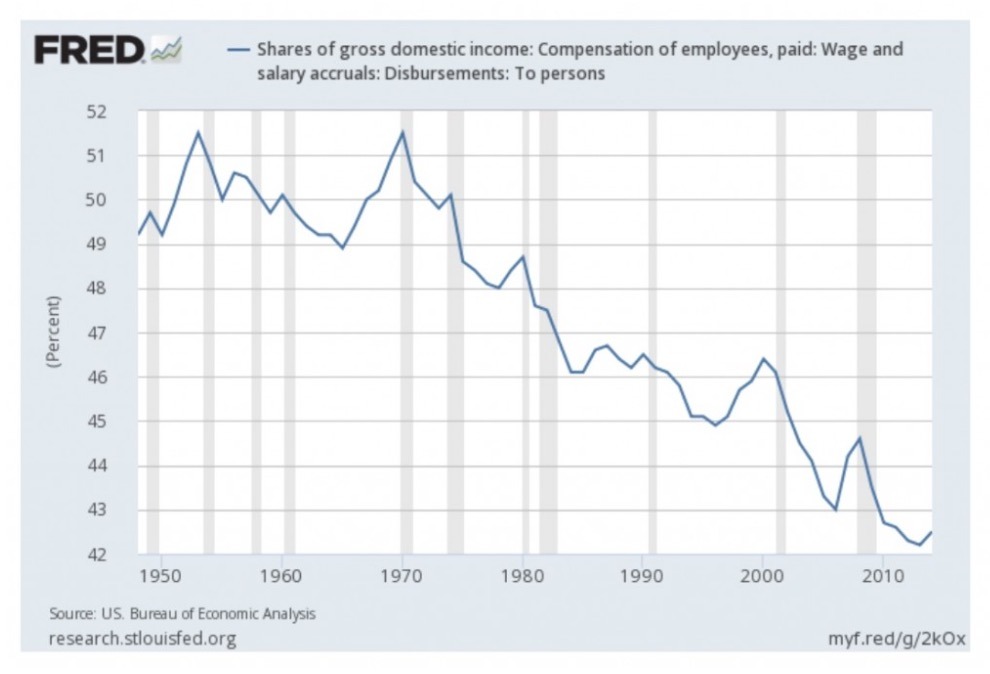

The evidence has been clear for years. Fully employed Americans have been borrowing from payday lenders at egregious rates in order to pay for normal everyday living expenses, while a small group of executives grab as much as possible for themselves. You can see this in corporate profits margins at historically high levels and in the use of cash to buyback shares as opposed to paying employees a living wage. To see just how grotesquely out of whack the economy has become under the crony policies of Obama and the Federal Reserve, let’s revisit what I like to call the “Serfdom Chart.”

If the above chart looks like the inverse of the S&P 500 index to you, this is no illusion. Share prices in America aren’t at all time highs because the country is doing well. Share prices are at all time highs because executives and shareholders are extracting a historically dangerous piece of the overall economic pie. If this trend continues, someone like Donald Trump will be the least of our concerns.

It appears companies are coming to the realization that their employees are so broke they’re resorting to payday lenders just to survive. Rather than boost wages, many are resorting to offering loans.

The Wall Street Journal reports:

Pam Dimitro, the controller at JNET Communications LLC, realized employees were often turning to payday lenders or high-interest credit cards in a financial pinch.

So the Warren, N.J., employer of call-center workers and cable installers began offering employees a new benefit: low-interest loans to help pay for things such as car repairs and health expenses.

Worried about their financially strapped workforce, a handful of companies are stepping in to offer employees alternatives to payday loans and other expensive financial products.

While few other employers go that far, managers know that financial worries are taking a toll on U.S. workers. A recent PwC survey of 1,600 full-time employed adults found that 40% find it difficult to meet monthly household expenses and 51% consistently carry balances on their credit cards.

Payday loans, which are typically made in small amounts and come due on a person’s next payday, can carry fees equivalent to an annual percentage rate of almost 400%, according to the federal Consumer Financial Protection Bureau.

Some 12 million Americans use payday loans each year, according to Alex Horowitz, senior research officer with the Pew Charitable Trusts’ small-dollar loans project.

Retirement borrowing remains common, too. According to the Employee Benefit Research Institute, 20% of all eligible 401(k) participants had loans outstanding against their 401(k) plan accounts at the end of 2014, up from 18% in 2008.

As an alternative, employers are joining with firms such as Kashable LLC, Ziero Financial Inc. and Zebit Inc. to help fund and service loans. Some companies are offering those products in conjunction with employee-focused seminars about saving, budgeting and debt.

Such loans could end up putting employees further into debt, critics say, especially if workers are unable to keep their spending in check. Loans “need to be utilized with some caution,” said Kent Allison,national leader of consulting firm PwC’s employee financial wellness practice.

Some employers aren’t eager to offer loans, either, but say their employees lack other good options.

Barbara Snyder, vice president of human resources at Atlantic American Corp., said she didn’t want to get into the loan business.

Many of the 100 employees of the Atlanta insurance provider “live paycheck to paycheck,” she said, and were borrowing against their 401(k)s. After realizing the company wouldn’t be liable if employees defaulted, she signed up with Kashable about two years ago.

Kashable’s interest rates typically range from about 6% to the high teens, lower than what people with middling or low credit might get on their own, said founder Einat Steklov.

While a far better option than payday loans, “6% to the high teens” is still a huge interest rate considering pension funds can’t find anywhere to reasonably invest and earn such a return. It also shows you that the 0% interest rate targeted by the Federal Reserve doesn’t trickle down to the peasants. It only further enriches the financial parasite class.

Loan payments are deducted from employee paychecks, with loan terms lasting from six months to three years. If employees leave their jobs, they continue paying from their own bank accounts, said Ms. Steklov.

“Not offering a low-cost loan option is not going to prevent people from getting a loan,” she adds. “By not offering, we are going to force them to do something worse.”

Perhaps the above is true. Perhaps many of these companies really are trying to help. That’s actually besides the point. The much bigger point is that employed American citizens are so destitute they can’t survive without taking out loans for everyday expenses.

Perhaps Adam Smith was onto something when he wrote the following in The Wealth of Nations:

Our merchants and master-manufacturers complain much of the bad effects of high wages in raising the price, and thereby lessening the sale of their goods both at home and abroad. They say nothing concerning the bad effects of high profits. They are silent with regard to the pernicious effects of their own gains. They complain only of those of other people.

But the rate of profit does not, like rent and wages, rise with the prosperity and fall with the declension of the society. On the contrary, it is naturally low in rich and high in poor countries, and it is always highest in the countries which are going fastest to ruin.

If nothing else, this should prove to everyone that the U.S. economy has become a grotesque, unsustainable, cancerous monster. It’s an unethical creation of oligarchy for oligarchy; a parasitic blob that solely exists to reward the already rich and powerful. What no longer benefits the nation’s citizens in any meaningful way needs to be fundamentally transformed before the entire fabric of society snaps and we are left with a far worse outcome. The clock is ticking.

For more on this very disturbing and well established trend, see:

The Status Quo Plan – Convince the American Public to Accept Serfdom

Americans Have Been Turned Into Peasants – It’s Time to Fight Back

The Oligarch Recovery – U.S. Military Veterans are Selling Their Pensions in Order to Pay the Bills

The Oligarch Recovery – 30 Million Americans Have Tapped Retirement Savings Early in Last 12 Months

Another Tale from the Oligarch Recovery – How a $1,500 Sofa Costs $4,150 When You’re Poor

It’s way past the time to stop being suckers.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Adam Smith would think we are on the road to ruin.

“But the rate of profit does not, like rent and wages, rise with the prosperity and fall with the declension of the society. On the contrary, it is naturally low in rich and high in poor countries, and it is always highest in the countries which are going fastest to ruin.”

Exactly the opposite of today’s thinking, what does he mean?

When rates of profit are very high, capitalism is cannibalising itself by:

1) Not engaging in long term investment for the future

2) Paying insufficient wages to maintain demand for its products and services

Such a great quote I’m going to figure out a way to include it in the post.

As you have noticed everything is corrupted and nothing more than Adam Smith.

Adam Smith had much to say and is not the person he is portrayed to be today:

“The Labour and time of the poor is in civilised countries sacrificed to the maintaining of the rich in ease and luxury. The Landlord is maintained in idleness and luxury by the labour of his tenants. The moneyed man is supported by his extractions from the industrious merchant and the needy who are obliged to support him in ease by a return for the use of his money. But every savage has the full fruits of his own labours; there are no landlords, no usurers and no tax gatherers.”

Adam Smith saw landlords, usurers (bankers) and Government taxes as equally parasitic, all adding to the cost of doing business.

He sees the lazy people at the top living off “unearned” income from their land and capital.

He sees the trickle up of Capitalism:

1) Those with excess capital collect rent and interest.

2) Those with insufficient capital pay rent and interest.

He differentiates between “earned” and “unearned” income.

Adam Smith would not like today’s Mergers and Acquisitions.

“The interest of the dealers, however, in any particular branch of trade or manufactures, is always in some respects different from, and even opposite to, that of the public. To widen the market and to narrow the competition, is always the interest of the dealers. To widen the market may frequently be agreeable enough to the interest of the public; but to narrow the competition must always be against it, and can serve only to enable the dealers, by raising their profits above what they naturally would be, to levy, for their own benefit, an absurd tax upon the rest of their fellow-citizens.”

Could he be talking about the Hedge Fund acquired, single source drug companies?

Adam Smith on the businessmen you shouldn’t trust:

“The proposal of any new law or regulation of commerce which comes from this order ought always to be listened to with great precaution, and ought never to be adopted till after having been long and carefully examined, not only with the most scrupulous, but with the most suspicious attention. It comes from an order of men whose interest is never exactly the same with that of the public, who have generally an interest to deceive and even to oppress the public, and who accordingly have, upon many occasions, both deceived and oppressed it.”

He wouldn’t think much of today’s lobbyists.

Adam Smith was engaging in a scathing critique of mercantilism, as practised by the British government of his era, which was not too different from what we have today. The British government of the 18th century was an amalgam of strong central government, the Crown, and favored economic players, which should ring more than a few bells. These forces together chartered the inimitable British East India Company, later known solely as “The Company”, which became the driving force of later British imperialism.

The Parliament, under Oliver Cromwell, had commenced the original British imperial operation, in Ireland, but did not try to turn that into mercantile benefit immediately; that was not their stated purpose.

it only became so with the North American colonies, which were nearly contemporaneous, and originally received more white slaves, typically taken from areas of resistance in Ireland and elsewhere, than any other.

Most did not adapt well to the strain and climate, and died very early deaths.

Some history books refer to the latter as “indentured servants,” and of course, some actually did willingly indenture themselves; but they were still slaves, albeit slaves with a finite term, if they lived that long. Many, however, were picked up from the slums of various towns in Britain (especially children, and particularly in Ireland), and impressed into servitude. This was an early form of “eugenics”, as well as a very serious suppression of freedom of all sorts.

They have everybody right where they want them……

Students seeking sugar daddies for tuition, rent

Kashani believes such sites are a “great resource” for young women, but others say these arrangements smack of prostitution and take advantage of women in a vulnerable situation.

U.S. undergraduate students last year finished school with an average of $35,000 in student debt — a figure that has risen steadily every year, according to Mark Kantrowitz, a financial aid expert. The average graduate debt load is $75,000, and some longer programs force students into much deeper debt.

Many students say their loans don’t cover the cost of living, and with rent skyrocketing in most major cities, they are left scrambling to make up the difference.

One graduate student at Columbia University in New York had a scholarship that covered almost all of her tuition, but not her living expenses. She spoke on the condition of anonymity because of the potential impact on her job prospects. She tried to make do — sharing a room with a classmate and working a minimum wage job, plus any freelance work she could get. But still she struggled to pay her rent and utilities, and her grades suffered.

“That’s just not why I am here,” she said. “I wanted to find the most amount of money I could make for the least amount of effort.”

http://www.seattletimes.com/business/students-seeking-sugar-daddies-for-tuition-rent/

Barbara Snyder, vice president of human resources at Atlantic American Corp., said she didn’t want to get into the loan business.

Many of the 100 employees of the Atlanta insurance provider “live paycheck to paycheck,” she said, and were borrowing against their 401(k)s. After realizing the company wouldn’t be liable if employees defaulted, she signed up with Kashable about two years ago.”

.

A raise would have worked.

What they want me to ask is…Please sir may I purchase this fine sofa with a 300% annual loan…..What they don’t want me to say is …I will purchase this fine sofa on a 2% loan when banks are paying -2% on deposits otherwise the business end of a 7.62 will be inserted where the sun doesn’t shine.

Reminds me of a Tennessee Ernie Ford song, “You load sixteen tons, what do you get? Another day older and deeper in debt; Saint Peter don’t you call me ’cause I can’t go; I owe my soul to the company store.”

Such problems have to become wide spread before they are even noticed. The oligarchy is turning precarity into an everyday reality, people are made to work and repay loans, then retake loan and work again. What kind of economy is this?

This is just the outgrowth of the credit that was extended in lieu of wages beginning in the mid 70s and gathering steam from then until today. The owners of capitalism found that they could keep the money that would have given in increased wages, as unionism was attacked and collapsed, and then lend that money at interest to the working classes as they tried to maintain their standard of living. Of course shorting one section of the economy affects the supply demand vectors but to the wealthy what do they care if the economy takes on a second or even third world structure as this would make them even more in control…

http://www.nytimes.com/2016/06/02/us/politics/hillary-clinton-donald-trump-foreign-policy.html?_r=0

you must skewer the new york times which supports world war 3. hillary clinton is the ww3 candidate that is accusing donald trump of a dangerous foreign policy.

st. peter don’t you call me cause i can’t go, i owe my soul to the company store!