Five years into a national economic recovery that has further strained the poor working class, an entire industry has grown around handing them a lifeline to the material rewards of middle-class life. Retailers in the post-Great Recession years have become even more likely to work with customers who don’t have the money upfront, instead offering a widening spectrum of payment plans that ultimately cost far more and add to the burdens of life on the economy’s fringes

In some ways, the business harkens back to the subprime boom of the early 2000s, when lenders handed out loans to low-income borrowers with little credit history. But while people in those days were charged perhaps an interest rate of 5 to 10 percent, at rental centers the poor find themselves paying effective annual interest rates of more than 100 percent. With business models such as “rent-to-own,” in which transactions are categorized as leases, stores like Buddy’s can avoid state usury laws and other regulations…

By the next day, the Abbotts had a remade living room, two companion pieces, both of the same blended material, 17 percent leather. The love seat and sofa retailed, together, for about $1,500. Abbott would pay for hers over two years, though she still had paying the option to pay monthly or weekly. The total price if paid weekly: $4,158.

“I’ve never seen a customer base or an economy like this,” Gazzo said in a telephone interview from the company’s headquarters in Tampa.

– From the Washington Post article: Rental America: Why the Poor Pay $4,150 for a $1,500 Sofa

When you bail out financial criminals and predators, you get a criminal and predatory economy. If there’s one clear lesson from the 2008 crisis and its aftermath, that should be it.

Earlier this week, I published an article titled, Land of the Debt Serf – How “Auto Title Loan” Companies are Ruthlessly Preying on America’s Growing Underclass. In it, we saw how efficiently the Fed’s 0% interest rate policy trickles down to the poor. In fact, preying on the poor for profits has been one America’s most vibrant business models since the “recovery” took hold. We learned that:

Short-term lenders, seeking a detour around newly toughened restrictions on payday and other small loans, are pushing Americans to borrow more money than they often need by using their debt-free autos as collateral.

Their hefty principal and high interest rates are creating another avenue that traps unwary consumers in a cycle of debt. For about 1 out of 9 borrowers, the loan ends with their vehicles being repossessed…

But Jordan said it wouldn’t make a loan that small. Instead, it would lend her $2,600 at what she later would learn was the equivalent of 153% annual interest — as long as she put up her 2005 Buick Rendezvous sport utility vehicle as collateral.

State law limits payday loans to $300, minus a maximum fee of $45. California also caps interest rates on consumer loans of less than $2,500 on a sliding scale that averages about 30%. Consumer loans above $2,500 have no interest rate limit.

For that reason, essentially all auto title loans in the state are above that level, according to the state’s business oversight department.

That article was a follow up to the piece published the week before, titled: Use of Alternative Financial Services, Such as Payday Loans, Continues to Increase Despite the “Recovery.”

In today’s piece, we examine the booming business of rent-to-own. This is where people too broke to buy things such as furniture and electronics, agree to buy these items via weekly payments. Of course, they typically never end up owning anything, as 75% of the time the items are repossessed or returned within weeks of the transaction. Those who do end up owning the items, pay multiples of the retail price.

Now, from the Washington Post:

CULLMAN, Ala. — The love seat and sofa that Jamie Abbott can’t quite afford ended up in her double-wide trailer because of the day earlier this year when she and her family walked into a new store called Buddy’s. Abbott had no access to credit, no bank account and little cash, but here was a place that catered to exactly those kinds of customers. Anything could be hers. The possibilities — and the prices — were dizzying.

Five years into a national economic recovery that has further strained the poor working class, an entire industry has grown around handing them a lifeline to the material rewards of middle-class life. Retailers in the post-Great Recession years have become even more likely to work with customers who don’t have the money upfront, instead offering a widening spectrum of payment plans that ultimately cost far more and add to the burdens of life on the economy’s fringes.

What national economic recovery? It is an oligarch recovery. Nothing more, nothing less.

The poor today can shop online, paying in installments, or walk into traditional retailers such as Kmart that now offer in-store leasing. The most striking change in the world of low-income commerce has been the proliferation of rent-to-own stores such as Buddy’s Home Furnishings, which has been opening a new store every week, largely in the South.

In some ways, the business harkens back to the subprime boom of the early 2000s, when lenders handed out loans to low-income borrowers with little credit history. But while people in those days were charged perhaps an interest rate of 5 to 10 percent, at rental centers the poor find themselves paying effective annual interest rates of more than 100 percent. With business models such as “rent-to-own,” in which transactions are categorized as leases, stores like Buddy’s can avoid state usury laws and other regulations.

And yet low-income Americans increasingly have few other places to turn. “Congratulations, You are Pre-Approved,” Buddy’s says on its Web site, and the message plays to America’s bottom 40 percent. This is a group that makes less money than it did 20 years ago, a group increasingly likely to string together paychecks by holding multiple part-time jobs with variable hours.

“Basically, the market pulled back from all low-income borrowers instead of trying to figure out how to serve them,” said Michael Barr, a University of Michigan law professor and author of “No Slack: The Financial Lives of Low-Income Americans.”

Let’s see. How do I make this abundantly clear.

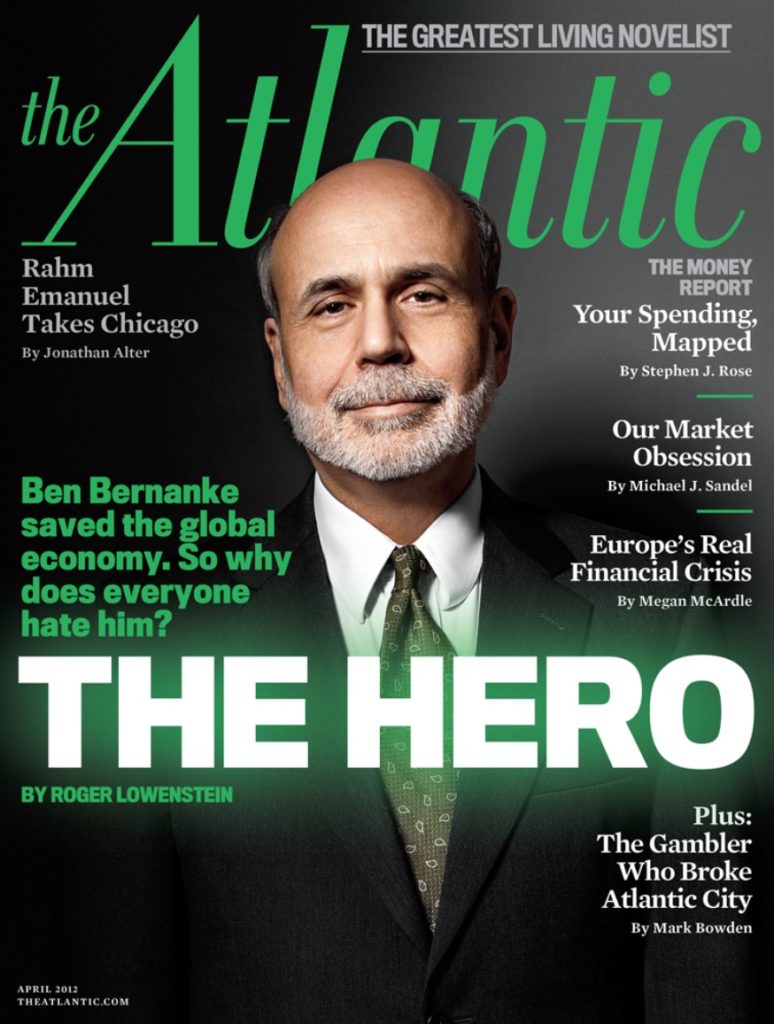

Bernanke and the Federal Reserve are nothing but criminal butlers for the oligarchy. The proof is undeniable at this point. While this unaccountable banking cartel promised us that 0% rates would help the economy, America’s growing underclasses are paying 100% rates for loans to buy sofas and pay for food, more than five years into this so-called “recovery. Meanwhile, the only segment of society with access to low interest rates are the very wealthy financial oligarchs who leverage this cheap money to speculate on financial assets and real estate. So yes, the Fed (Central Banking in general) is completely to blame for the world’s growing inequality, as are their submissive, compliant defenders in academia, “journalism” and within the halls of power in Washington D.C.

Inside Buddy’s, Abbott walked over to a brown Ashley Furniture model, something she and her husband agreed would fit the colors of their Buccaneer trailer. The love seat had a cup-holder console in the middle and the cushions were plush, and when they took turns testing the feel, they realized it could pivot like a rocking chair.

By the next day, the Abbotts had a remade living room, two companion pieces, both of the same blended material, 17 percent leather. The love seat and sofa retailed, together, for about $1,500. Abbott would pay for hers over two years, though she still had paying the option to pay monthly or weekly. The total price if paid weekly: $4,158.

Most falter. At the Buddy’s in Cullman, some 75 percent of items are returned or repossessed within weeks of the transaction, store manager Angela Shutt says. And nationally, the percentage of returns has been gradually ticking upward — a sign of growing struggles for lower-income workers, said Joe Gazzo, the president of Buddy’s.

“I’ve never seen a customer base or an economy like this,” Gazzo said in a telephone interview from the company’s headquarters in Tampa. “You may have five people open an account in a day, but five people return in a day. You almost become like a Blockbuster.”

The Cullman store is one of Buddy’s best performers, and the five employees there empathize with their customers. Derek Bland, who drives around the county repossessing items from derelict renters, just left a job at Papa John’s. Brandy Day, one of the saleswomen, winces when talking about the jewelry that Buddy’s keeps near the register. “Take away a 42-inch TV from somebody, that’s one thing,” Day says. “But a wedding ring?”

In 2008, Buddy’s had 80 stores. Now it has 204. By 2017 it wants to have 500. Gazzo said that company revenue is rising at double-digit levels annually, even as it contends with a new wave of rent-to-own Web sites.

Totally normal that businesses which specialize on increased destitution would be booming half a decade into an economic recovery.

“The industry as a whole is in the biggest fight we’ve had, because we have to compete with everybody,” Gazzo said. “And the customer doesn’t have as much money as they used to.”

I don’t call it the “oligarch recovery” for nothing.

“We’ve always talked about the benefits and costs,” she said on the drive home. “Because with a family you can’t just say, ‘I want this, I’m going to get it.’ But growing up having the chair, the recliner, the love seat, the couch and everything, you just get used to the normal stuff. Sometimes it’s hard to break from the normal stuff and get to reality.”

As mentioned in an interview from last year, Serfdom is the New Normal. Don’t forget to send out your thank you notes:

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

PEU Reps at Bilderberg

Private equity underwriters (PEU) join government, business and media representatives this week for the annual gathering of global tamperers, otherwise known as Bilderberg. PEU invitees are surprisingly consistent when compared to the 2011 list. Bob Rubin will be the underground PEU as there is no mention of his work for Centerview Partners.

Bloomberg, The Economist, FT, Google and Google’s DeepMind will attend but not write one story about the event. Palantir’s CEO Alex Karp will attend and likely provide high tech security for the fort like event. Bilderbergers will discuss how the West created ISIS through its over reliance on violence as means to solve problems and its longstanding pattern of pitting oppressed groups against one another.

http://peureport.blogspot.com/2015/06/peu-reps-at-bilderberg.html

One thing you have to keep in mind is that you can get yourself out of poverty, but you can never get yourself out of stupid. Some of the people that take the pay day loans may be in desperate straights and I sympathize with them on that account. But the people leasing 40 inch TV and expensive furniture at usurious rates are just stupid and there’s no cure for that.

+1. “How a poor person gets a $1500 sofa with a tiny stain for $10 and a phone call to a friend with a truck.”, “How a poor person buys art at $5 and gets a piece that sold in a gallery 20 years ago for $2500”. Not poor for long.

“Five years into a national economic recovery that has further strained the poor working class” how can someone even keep a straight face while writing a sentence like that?

“They’re coming for your money, and they’re going to get it! And they’re going to get it all”! George Carlin

Why,if they live in a TRAILER are they even buying fancy furniture at any price?

I live within my means,never bought a new piece of furniture in my life.if i need something replaced i wait til bulk waste pick up day in a rich area & take their old furniture off the curb.its usually in brand new condition anyways & much nicer than anything in those stores.