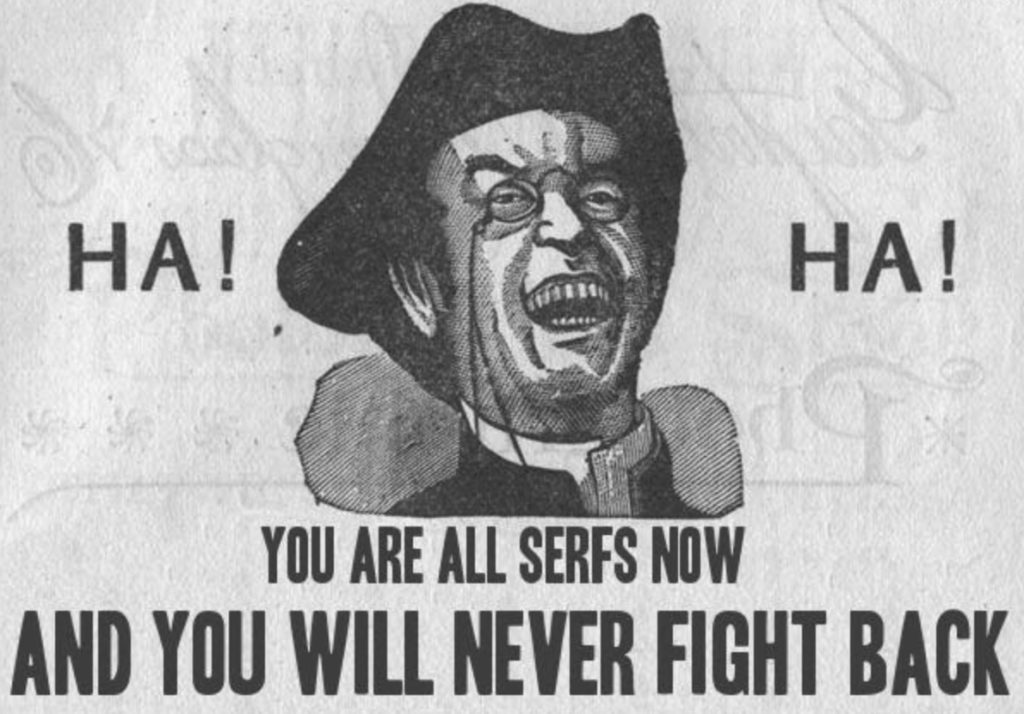

One of the key themes here at Liberty Blitzkrieg over the past couple of years, has been to highlight the fact that individuals or institutions with access to capital or cheap financing have been buying up properties across the U.S. in order to rent them to the same people foreclosed on during the financial crisis. This represents a primary driver in the transformation of the American economy into a neo-feual wasteland of broke debt serfs. The first article I ever wrote on the subject was titled, America Meet Your New Slumlord: Wall Street. Here’s an excerpt:

Well they aren’t really your “new” slumlord in the sense you have been debt slaves to the financials system for decades. What I really mean is that it is now becoming overt and literal. Literal because financiers are now the main players in the real estate market and are buying all the homes ordinary citizens were kicked out of over the past few years. Yep, we bailed out the financial system so that financiers with access to cheap credit can buy up all of America’s real estate so that they can then rent it back to you later.

Blackstone has spent more than more than $2.5 billion on 16,000 homes to manage as rentals, deploying capital from the $13.3 billion fund it raised last year, said Jonathan Gray, global head of real estate for the world’s largest private equity firm. That’s up from $1 billion of homes owned in October, when Blackstone Chairman Stephen Schwarzman said the company was spending $100 million a week on houses.

“While leverage is currently limited, potential financing options include secured credit lines, lending syndicates, high- yield debt, government sponsored enterprise-provided financing, and securitization,” Jade Rahmani, an analyst with Keefe, Bruyette & Woods Inc. in New York, wrote in a note yesterday.

One thing to note is that many of these early movers have since pulled back from the market, as prices became too high and rents started to get stretched. In other words, the easy money was made and the entire “trade” experienced yield compression.

Ultimately, this would lead to some sort of slowdown in the appreciation of real estate prices, but Congress is hard at work making sure this doesn’t happen. As such, Paul Ryan and his crony enablers have snuck into last week’s spending bill a repeal of a 35-year tax on foreign real estate investment known as FIRPTA.

Let’s just go ahead and put a nail in the coffin of the idea that American citizens will ever actually own their own homes again. Instead, you can rent from China’s sovereign wealth fund, or perhaps a Saudi prince…

From Bloomberg:

President Barack Obama signed into law a measure easing a 35-year-old tax on foreign investment in U.S. real estate, potentially opening the door to greater purchases by overseas investors, a major source of capital since the financial crisis.

Contained in the $1.1 trillion spending measure that was passed to avoid a government shutdown is a provision that treats foreign pension funds the same as their U.S. counterparts for real estate investments. The provision waives the tax imposed on such investors under the 1980 Foreign Investment in Real Property Tax Act, known as FIRPTA.

“FIRPTA has historically made direct investment in U.S. property a non-starter for trillions of dollars worth of foreign pensions,” said James Corl, a managing director at private equity firm Siguler Guff & Co. “This tax-law modification is a game changer” that could result in hundreds of billions of new capital flows into U.S. real estate.

Cross-border investment in U.S. real estate has totaled about $78.4 billion this year, or 16 percent of the total $483 billion investment in U.S. property, according to Real Capital Analytics Inc. Pension funds accounted for about $7.5 billion, or almost 10 percent, of the foreign total, according to the New York-based property research firm.

Foreign investment has surged from just $4.7 billion in 2009, according to Real Capital. Foreign buying this year as a percentage of total investment in U.S. real estate is about double the 8.1 percent average in the 10 years through 2012.

Under old rules, foreign majority sellers had to pay 10 percent of gross proceeds from the sale of U.S. real estate as well as additional federal, state and local levies that could increase the total tax burden to as much as 60 percent, according to the National Association of Real Estate Investment Trusts.

The change “is a huge deal,” said Jim Fetgatter, chief executive of the Association of Foreign Investors in Real Estate. “There’s no question” it will increase the amount of foreign investment in U.S. property, he said.

Naturally, Congress snuck this tax repeal into the treasonous abomination known as the $1.1 trillion omnibus spending bill. As reported last week, Congress also added a nightmarish surveillance bill into that legislation as well.

Just further proof that not only is the U.S. government not working for you, it is actively working against you.

For related articles, see:

Paul Ryan Sneaks Massive Surveillance Bill Into $1.1 Trillion Must Pass Spending Legislation

Chinese Purchases of U.S. Real Estate Jump 72% as The Bank of China Facilitates Money Laundering

Guardian Op-Ed – The City of London Has Turned Britain Into a “Civilized Mafia State”

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Can there be any doubt that Washington, DC is deliberately destroying America? I don’t think so!