Another day, another data point proving what anyone with two functioning braincells already knows. That for most citizens, the U.S. economy is a neo-feudal Banana Republic oligarch hellhole. The facts are indisputable at this point, and the trend goes back decades when it comes to the American male. All the way back to 1973, in fact, just two years after the U.S. defaulted on gold and the economy started its grotesque transformation into a Wall Street controlled, financialized gulag.

Just yesterday, I highlighted some very depressing data from the Census in the post:

Census Data Proves It – There Was No Economic Recovery Unless You Were Already Rich

Now we learn the following, from the Wall Street Journal:

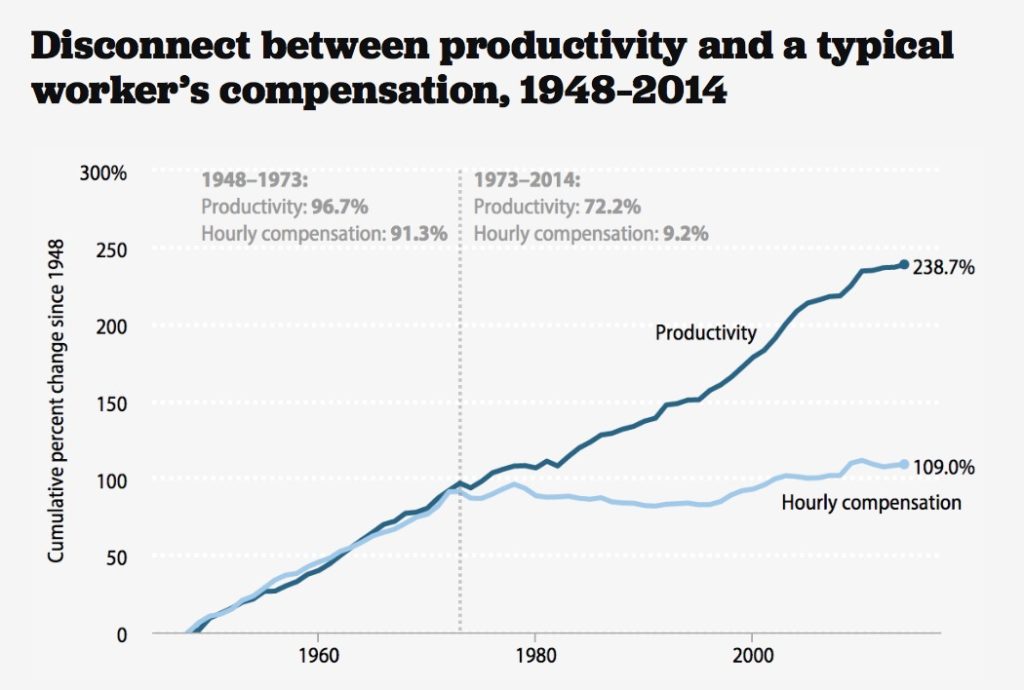

The typical man with a full-time job–the one at the statistical middle of the middle–earned $50,383 last year, the Census Bureau reported this week.

The typical man with a full-time job in 1973 earned $53,294, measured in 2014 dollars to adjust for inflation.

You read that right: The median male worker who was employed year-round and full time earned less in 2014 than a similarly situated worker earned four decades ago. And those are the ones who had jobs.

This one fact, tucked in Table A-4 of the Census Bureau’s annual report on income, is both a symptom of an economy that isn’t delivering for many ordinary Americans and at least one reason for the dissatisfaction, anger, and distrust that voters are displaying in the 2016 presidential campaign.

Now here’s a chart of the middle class death spiral:

On a related note, billionaire and CEO of “Too Big to Fail and Jail” JP Morgan, Jamie Dimon, decided to weigh in on income inequality earlier today. Here’s some of what he had to say courtesy of Yahoo.

JPMorgan CEO Jamie Dimon says it’s OK that chief executives get paid way more than their average employees — and that cutting down on executive compensation wouldn’t help eliminate income inequality.

“It is true that income inequality has kind of gotten worse,” Dimon said, but “you can take the compensation of every CEO in America and make it zero and it wouldn’t put a dent into it. What really matters is growth.”

How enlightened. Considering the U.S. has seen massive GDP growth since 1973, yet median wages for males haven’t budged, I wonder how growth is supposed to suddenly reverse the trend. Does he even think before speaking?

But he wasn’t done. Apparently, Mr. Dimon felt a need to double down on his remarkable disconnectedness with the following:

As for the middle class, Dimon reportedly said Thursday: “It’s not right to say we’re worse off … If you go back 20 years ago, cars were worse, the air was worse. People didn’t have iPhones.”

That’s what you get when you ask a billionaire executive from a taxpayer bailed out, unaccountable industry for his thoughts on income inequality.

For related articles, see:

Census Data Proves It – There Was No Economic Recovery Unless You Were Already Rich

Welcome to the Recovery – Two Out of Five American Children Experience Poverty

The Oligarch Recovery – Low Income Americans Can’t Afford to Live in Any Metro Area

The Oligarch Recovery – Renting in America is Most Expensive Ever

Another Tale from the Oligarch Recovery – How a $1,500 Sofa Costs $4,150 When You’re Poor

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

For those of us who don’t quite buy into the Official Government Inflation Statistics especially those of us who were actually employed full time in 1973 and might I suggest actually even BORN before 1973 unlike most people who write about this topic today let me suggest that maybe it’s just a touch worse then down 5%. Perhaps we could now just institute ‘Chained CPI’ and readjust that -5%% to a plus 2% or perhaps even better therefore enabling the government, in it’s continuing attempt, to put even more lipstick on a pig.(and oh yes a very special thank you to David Boskin for helping make this -5% a BS reality)

“Considering the U.S. has seen massive GDP growth since 1973, yet median wages for males haven’t budged”

You’re confusing GDP with income. GDP measures, everything, including TARP bailouts.

I’m not confusing anything. Dimon is confusing the two and I am pointing out the obvious lack of any link between “economic growth” and median incomes in the U.S.

In 1970 the minimum wage was $2.00/hour and a gallon of gas cost 20¢, steak cost $1.50/lb and hamburger as low as 15¢, a can of tuna fish cost 20¢, a comfortable pleasant 1 bedroom apartment in San Jose cost $70/ month. An hours work would buy ten gallons of gas; 35 hours would pay a month’s rent. Today the minimum wage has risen by a factor of four, the price of gas, beef, and tuna by more than ten times and the rent on that same apartment has risen by a factor of twenty and will now require 200 hours to pay, not 35. REAL inflation is many many many times higher than the “5%” stated by this article. This “5%” number is nothing but a fraud, a deceit, an attempt to minimize a collapse in the level of livelihood of nine in ten Americans over the past generation which is little short of a disaster. I expect better than this from this website. What happened? Why are you buying into and publicizing this outrageous LIE?

I think you missed the point of the article. I wasn’t stating that the government inflation rate as accurate, I was pointing out something that would be very disturbing to most people, which is that even using the government inflation rate, wages haven’t increased in over four decades.

That was the main point of the article. You added an additional point, which is great, but don’t expect me to cover everything in one article. I was trying to drive home a much bigger point.