This is the perfect post for Fed day, where once again America’s Banana Republic central planning statists were too petrified to raise interest rates. The Fed has now missed the entire economic cycle without raising rates once. All you can do now is sit back, relax and wait for all hell to break loose.

Recently released data from the Census Bureau is nothing short of devastating to anyone who has been pushing the absurd meme of a strong U.S. economy.

There is simply no way one can look at this data and not conclude that the last seven years has been nothing more than an upward redistribution of wealth crafted by the Federal Reserve. As I’ve said many, many times before, central bankers should be tried for crimes against humanity for what they have done.

From Bloomberg:

U.S. Census Bureau data out Wednesday underscore just how lousy the recovery has been if you aren’t rich.

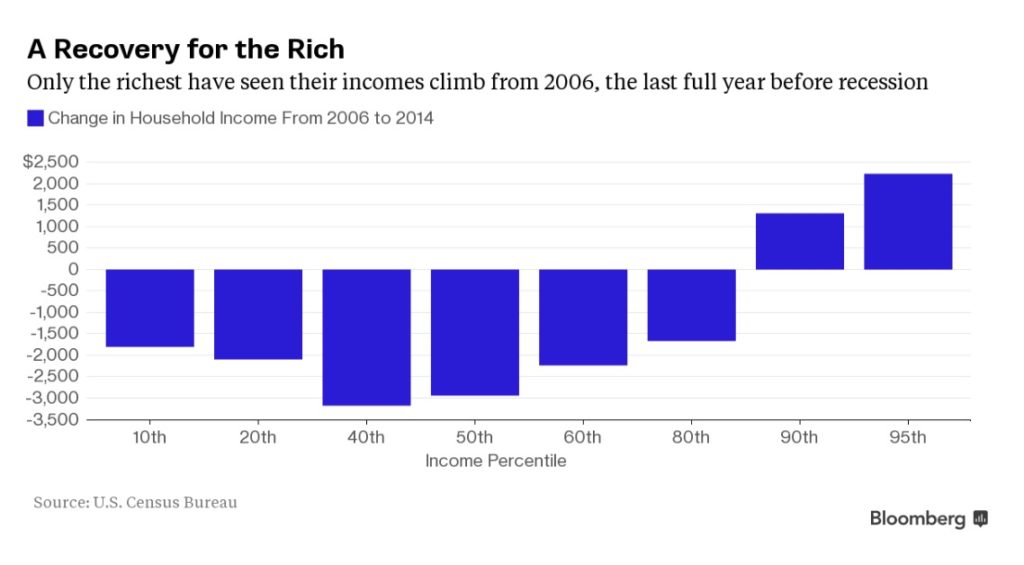

Looking at eight groups of household income selected by Census, only those whose incomes are already high to begin with have seen improvement since 2006, the last full year of expansion before the recession. Households at the 95th and 90th percentiles had larger earnings through 2014, the latest year for which data are available.

Want to see a chart of how bad this really is? Here you go:

Income for all others was below 2006 levels, indicating they’re still clawing their way out of the hole caused by the deepest recession in the post-World War II era.

Median household income is 6.5 percent lower than in 2007, the year the recession started.

So this is now what we call a “recovery”?

Overall, median income was $53,657 in 2014, not a statistically significant difference on an inflation-adjusted basis from 2013’s median of $54,462. It’s the third straight year that there’s been no significant change, after two consecutive years of annual declines.

That’s happened even though the labor market has posted steady progress.

Meanwhile, the official poverty rate was 14.8 percent, with some 46.7 million people in poverty—both little changed from 2013. The rate is 2.3 percentage points higher than it was in 2007.

If you believe this translates into an “economic recovery,” you will literally believe anything.

I haven’t been calling this the “Oligarch Recovery” for nothing. See:

Welcome to the Recovery – Two Out of Five American Children Experience Poverty

The Oligarch Recovery – Low Income Americans Can’t Afford to Live in Any Metro Area

The Oligarch Recovery – Renting in America is Most Expensive Ever

Another Tale from the Oligarch Recovery – How a $1,500 Sofa Costs $4,150 When You’re Poor

Shall I go on? And yes, I can.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

This proves that this is where our money went and how they stole it.

Trying to understand the data.

If 2006 was a cycle peak that had got way out of control, then you might not expect to get back to those levels – as an ultimate measure of whether there’s been any recovery or not?

the graph shows $change in incomes – if it was show in % terms instead the 95th would look flat (my guess – as they’re up very little compared to their income), and lower percentiles down a bit from those 2006 peaks.

In a strong economy the scarcity of lower percentile workers to keep up with the demand for their services from the economy would have pushed their pricing up? (not in a sustainable way).

Not saying bad things have not happened

Not saying the US is not an oligarchy (or that it hasn’t always been one)

But isn’t there a bit more to it than just “bad rich guys took from the poor”?

There is more. It’s actually mostly the 0.01% that has benefitted, which I explained in the post: Where Does the Real Problem Reside? Two Charts Showing the 0.01% vs. the 1%

http://libertyblitzkrieg.com/2014/03/31/where-does-the-real-problem-reside-two-charts-showing-the-0-01-vs-the-1/

That said, it’s not about 2006 anyway. For example, read: Portrait of the American Oligarchy – The Very Troubling Income and Wealth Trends Since 1989

http://libertyblitzkrieg.com/2015/04/10/portrait-of-the-american-oligarchy-the-very-troubling-income-and-wealth-trends-since-1989/

so you say everything is a powder keg and if it blows it will be worse than 1929 and then complain that the Fed didn’t push the detonator button. So does that mean you want it to explode and be worse than 1929? and if not, then why do you want the fed to lite the fuse?

I’m not complaining. I’m mocking them. If they were going to raise rates, they should have in 2013. It’s laughable that they missed the whole economic cycle. There are no good choices now, but yeah, they created this mess and they deserve to take the blame for it.

I wonder what those statistics would show if they used the real inflation rate at 10% more or less (shadowstats or chapwood).