Now regulators from Bern to Washington are examining evidence first reported by Bloomberg News in June that a small group of senior traders at big banks had something else on their screens: details of each other’s client orders. Sharing that information may have helped dealers at firms, including JPMorgan Chase & Co., Citigroup Inc., UBS AG and Barclays Plc, manipulate prices to maximize their own profits, according to five people with knowledge of the probes.

At the center of the inquiries are instant-message groups with names such as “The Cartel,” “The Bandits’ Club,” “One Team, One Dream” and “The Mafia,” in which dealers exchanged information on client orders and agreed how to trade at the fix, according to the people with knowledge of the investigations who asked not to be identified because the matter is pending. Some traders took part in multiple chat rooms, one of them said.

“Some of these problems developed over many years without anybody speaking up,” said Andrew Tyrie, chairman of Britain’s Commission on Banking Standards and Parliament’s Treasury Select Committee. “This is remarkable. It suggests something very wrong with the culture at these institutions.”

– From the 2013 post: Meet the “Bandits’ Club” – The TBTF Wall Street Cartel Rigging the FX Market

Serious question: Is there any illegal activity that someone at Barclays hasn’t been accused of engaging in?

Bloomberg reports:

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

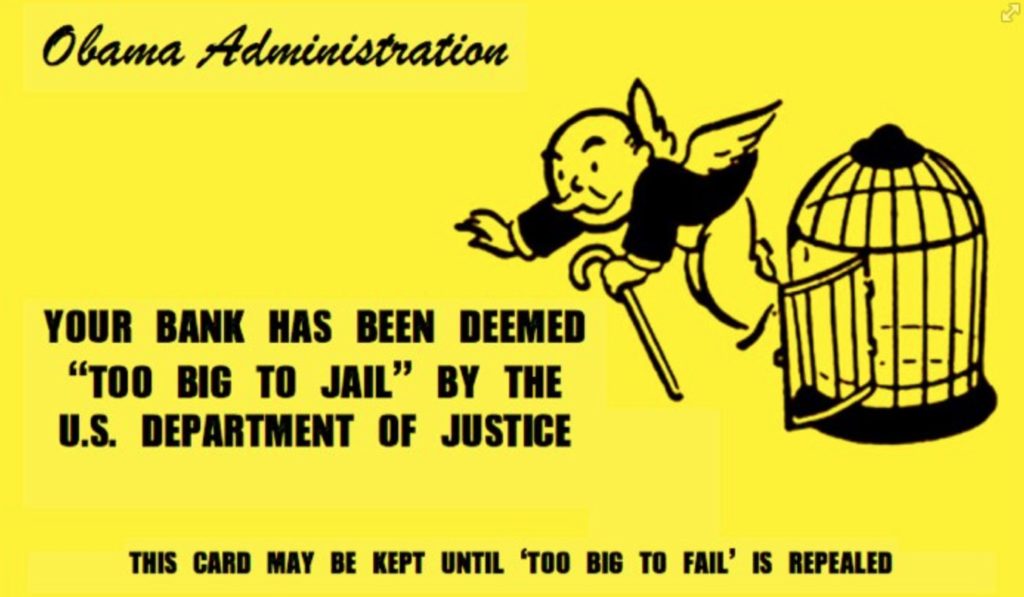

These agreements were created 100 years ago to give juvenile defendants and first-time offenders a chance to for rehabilitate themselves. Only in the last 20 years have DPAs migrated to the field of corporate criminals, treating them like kids who’ve just gone down a bad path in life.

These agreements were created 100 years ago to give juvenile defendants and first-time offenders a chance to for rehabilitate themselves. Only in the last 20 years have DPAs migrated to the field of corporate criminals, treating them like kids who’ve just gone down a bad path in life.