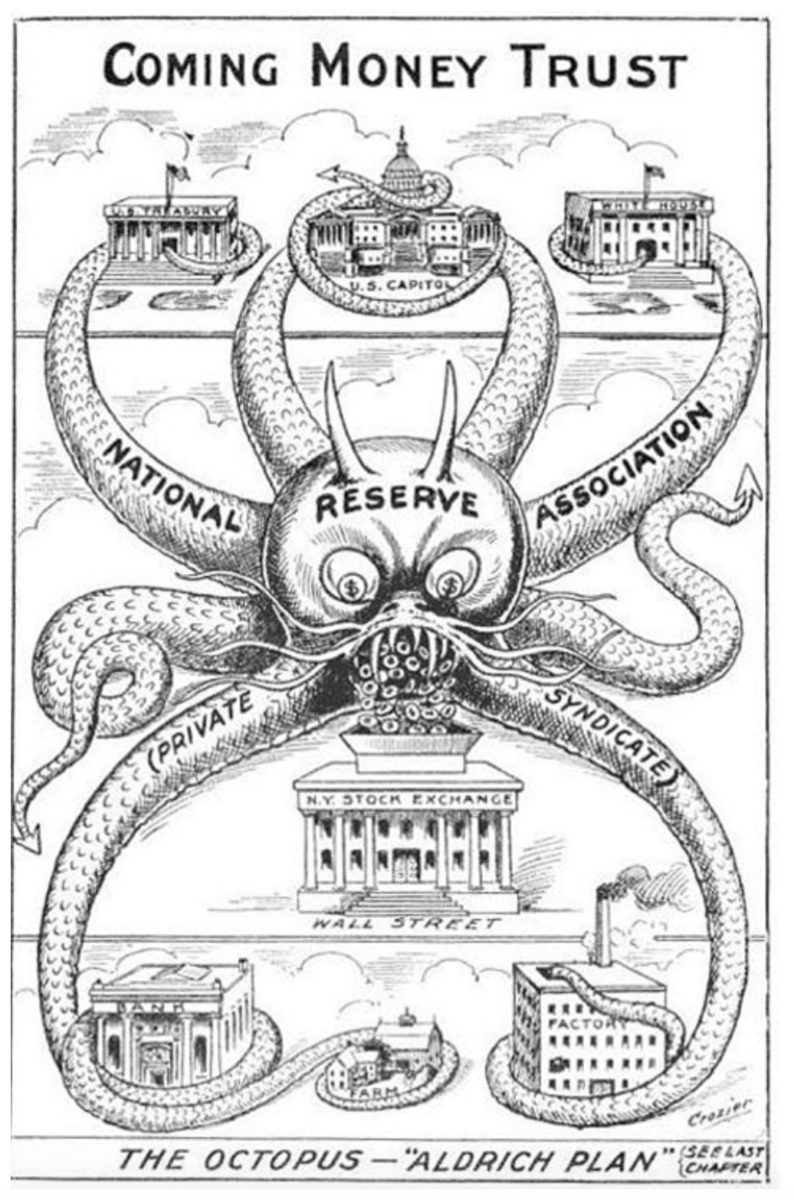

One of the most famous, and prescient, financial cartoons in American history is the above depiction of the Federal Reserve Bank as a giant octopus that would come to parasitically suck the life out of all U.S. institutions as well as free markets.

The image is taken from Alfred Owen Crozier’s U.S. Money Vs Corporation Currency, “Aldrich Plan,” Wall Street Confessions! Great Bank Combine, published in 1912, just a year before the creation of the Federal Reserve.

Last night, the current high priest of money printing, asset bubbles and inequality, Jerome Powell, appeared on 60 Minutes. Interviewer Scott Pelley mentioned the fact that such discussions are rare and noted the last time a Fed head appeared for such a chat was Ben Bernanke back in 2010.

As such, what I find most interesting about this event wasn’t Powell’s boilerplate, bureaucratic propaganda about how the economy’s doing fine and how much central bankers love average Americans, but why he and the institution he heads felt a need to do this now.

There’s no doubt something has the Fed spooked otherwise Powell never would have done this. One factor is they know the economic ground’s starting to shift beneath them, and they need to push a particular narrative ahead of time so central bankers can once again do as they please when “the time to act” arrives.

This is why Powell pushed the blame on the current economic slowdown on China and Europe. The Fed is no different than your average politician. It takes full credit when things go well, but endlessly deflects and blames outside forces when things fall apart.

Rule number 1 of the Federal Reserve: It’s never the Fed’s fault.

Rule number 2 of the Federal Reserve: It’s never the Fed’s fault.

Rule number 3 of the Federal Reserve…

You get the point. If central bankers accept blame, or admit they got anything over the past decade terribly wrong, then they can’t justify doing more of the same and worse in the future. And that’s exactly what they plan to do, by the way.

Which brings me to the purpose of this piece. The reason I’ve started writing about such topics again after a multi-year hiatus is because the chickens are finally coming home to roost. The recent global slowdown and concurrent central banker panic is proof we’ve arrived at a very important inflection point. The central bankers hope they can prolong this already historic and obscene financial asset bubble a little longer via manipulation and propaganda, but they also understand it may be the end of the road for this cycle.

As such, every person in the world needs to understand what the Fed and other central banks did during the last crisis, and what they plan on doing the next time around (more of the same and worse). If you judge an economy based on stock market performance and aggregate GDP, you might think the Fed did a great job over the past decade, but if you judge it based how we’ve turned an entire generation of young people into debt slaves, arrived at levels of inequality unseen since just before the Great Depression and catalyzed an explosion of populist politics throughout the western world, you might be ready to grab a pitchfork.

What central banks have achieved over the past decade is a surreptitious transfer of risk and cost away from elites and onto the general public. They sent benchmark interest rates down to zero, but only the corporate and financial class really benefits from such distortions. They’re the ones who bought up all the foreclosed upon real estate (hello Blackstone) only to rent it right back to those who were evicted. They’re the ones who can issue debt on the cheap to buyback shares in order to dump their personal holdings to their own corporations. At the same time, credit card interest rates for the average person are at record highs of 17.64%. So who really benefits from the Fed’s record low rates?

Powell: Not everyone is experiencing this widespread prosperity we have.

No contradiction there or anything.

— Michael Krieger (@LibertyBlitz) March 11, 2019

What I also think has the Fed spooked is the fact the public is slowly but surely catching on to its scam. The increased popularity of MMT in the public conversation is proof of this. People are starting to wonder why the central bank can print money and buy assets to save the portfolios of baby boomers, yet the public can’t simply print money for stuff like healthcare, education and roads. The Fed intentionally obfuscates what it does (money printing) with terms like “quantitative easing,” but people are starting to get the joke. The Fed doesn’t want people thinking about such things.

Another sign that non-financial types are starting to pay more attention to such topics was made clear when I saw Michael Hudson interviewed on the Jimmy Dore show. If you haven’t seen it, take a watch.

The monetary system is slowly being exposed for the scam that it is. It’s merely an opaque and unaccountable mechanism to bail-out and entrench the wealthiest and most powerful segments of society at the expense of the general public. This is one reason the Fed is currently panicking and so desperate to craft and promulgate an alternative narrative.

The Fed will try to do what it did ten years ago (and then some) the next time the economy craters. They already transferred trillions from future generations and society at large to financial industry elites once in the past decade. Will we let them do it again?

Liberty Blitzkrieg is now 100% ad free. As such, there’s no monetization for this site other than reader support. To make this a successful, sustainable thing I ask you to consider the following options.

You can become a Patron.

You can visit the Support Page to donate via PayPal, Bitcoin or send cash/check in the mail.

Thank you,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

This is a “warning” of some type. Be afraid….

Good post. And in my opinion (for what that’s worth) every bit of it is correct. Unfortunately.

Even though more people than ever are catching on to the scam it’s still the only game in town. It will take nothing short of catastrophic bank failure to get out from under this– if ever.

UNRELATED

FACEBOOK BANNED ZEROHEDGE

What on earth is going on ??? Really ??

Dr Michael Hudson is great. I’m sure he understands the difficulty of “freeing” slaves, be they wage slaves, debt slaves, or physical slaves. – They don’t really want the responsibility or the risks of freedom, until the “protection” disappears (their pensions, savings, services etc.)

They’ll lower interest rates below zero and they’ll purchase stocks & ETF’s just like Japan, with the same effect. We’re screwed unless we elect people that will stop them.

I wish we had the same future as Japan. We’re both screwed economically, but they have a far more stable and amicable society so they have a real chance of working together to weather any storm. Meanwhile in the US, we’ll be so busy settling scores with each other that there’s no realistic chance we’ll come together.

Great post. Keep up the good work.

Economy is so great our High Economic Council needs to cheerlead it on national television.

Another way to know they only care about boomer portfolios is that they go on 60 minutes. Who the hell watches that?

If we want to elect people who will stop this, I think we start will correctly labeling what we’ve become.

We no longer have a capitalist system. We are clearly under fascist rule. This is a combination of government and corporate rule. We are dictated to by a government that has no regard for our unalienable rights. They license just about everything, which precludes a free society from building new enterprise by the hands of small business. You can’t move a muscle without paying a fee for something.

Government should not be involved in any aspect of economics. There is absolutely no reason why any government “official” should lay claim to prosperity.

Is it any wonder why they want the guns out of the hands of the American people, who first, are recognized in the Constitution as the only authority “to execute the Laws of the Union”.

Thanks, Michael, for keeping this topic alive. Though the establishment would have us believe that their strategy has succeeded and the danger has passed, it’s all lies!!

When I planned my retirement in 2007 and factored in the worst-case financial scenario, it didn’t include the unheard-of phenomenon of negative interest rates (ZIRP plus high inflation). I now understand why some people choose to become enemies of the state; and I wasn’t screwed nearly as bad as the millennials, who have little hope of acquiring any wealth to speak of.

When the next crisis hits the legislation is already in place to suck money right out of our accounts in order to bail out the banks once again. Nothing short of revolution will change the status quo.

The international banking cartel is calling all the shots and its members are legally untouchable:

All the Plenary’s Men – https://www.youtube.com/watch?v=2gK3s5j7PgA

Good post. The Fed may be able to keep the markets from crashing longer than many of us expected, but they cannot prevent the fallout of the rampant inequality their policies produce. Millennials are screwed as a generation and I feel badly for them, even though my Gen X isn’t much better off.

Seems clear now that unrest won’t kick off because of red numbers on the ticker, but rather what’s happening in the streets.

“Survival of the Richest” – Nomi Prins

https://consortiumnews.com/2019/02/27/survival-of-the-richest/

“The rich are only getting richer and it’s happening at a historic rate. Worse yet, over the past decade, there was an extra perk for the truly wealthy. They could bulk up on assets that had been devalued due to the financial crisis, while so many of their peers on the other side of that great wall of wealth were economically decimated by the 2007-2008 meltdown and have yet to fully recover.

What we’ve seen ever since is how money just keeps flowing upward through banks and massive speculation, while the economic lives of those not at the top of the financial food chain have largely remained stagnant or worse. The result is, of course, sweeping inequality of a kind that, in much of the last century, might have seemed inconceivable……….this can’t end well.”

I agree with everything except “this can’t end well”. It can end well for the underclass and will eventually.

However, it will not end well for the Federal Reserve and the banksters.

—

In the meantime, don’t fly on a Boeing 737 Max 8. And maybe we’ll all make it.

….Americans, it seems to me, want it both ways. They want a capitalist society — not anything else, they can’t stomach it, after all, socialism is the devil and “communism” is something to fight wars against — yet they also don’t want everything to be for sale. Bzzzt!! Sorry. Both those things cannot be true.

You can’t have it both ways — have a capitalist society, and also not live in a place where more or less everything’s for sale, where there are sane and healthy boundaries to what is a commodity and what isn’t. Yet it’s pretty obvious Americans want things both ways, not just because they’re horrified to find out things like college admissions are for sale — because they’re perpetually, constantly, endlessly surprised to…find out that everything’s for sale in a capitalist society. Whether it’s their data, their lives, their sanity — there’s this constant pulse of shock and outrage, isn’t there? “Oh my God, I can’t believe that capitalist is selling my data! That one’s selling my longevity!! That one’s raiding my pension and selling it off!!” But what do you expect? What happens — inescapably, inevitably, predictably — in a capitalist society is that everything is for sale.

And by everything, I mean everything. Yes, really……

https://eand.co/in-a-capitalist-society-everythings-for-sale-23b9fb3e1193

Prepare for negative interest rates! Theft by the banks! (- 3% would mean your $100 in the bank would be worth $97 in one year. This has been done in other countries already. More vicious yet: banks might create a 2 tier money system to phase out cash infavor of “e-money”; a closed sytem of bank controlled electronic credits. See the IMF’s website, their blog section, for an article explaining what they are considering. Max Keiser, on RT’s Keiser Report, also had an episode a few days ago on negative rates.

The poor has been dealing with negative interests on bank accounts for quite some time. Calculate the effective interest rate on an account with a $60 annual fee and $500 average daily balance

Fantastic article! Great sanity check. I think there are relatively few who have caught onto the Fed’s debacle, let alone how it will drastically impact their lives in the near future. They would rather drink the media’s Kool-Aid than see the truth. I was a Naval Intel officer. My eyes were opened after analyzing credible sources, which helped me connect the dots. I’ve tried to warn my family and friends, but not only do they understand, they don’t want to understand! I’ve given up trying as I’m now known among family and friends as a deranged, overly obsessive kook.

Thank you!

How is the Fed used to embezzle money from government for the benefit of Wall Street bankers ?

Answer: https://thedailycoin.org/2018/08/16/a-look-at-the-federal-reserve-through-a-different-lens/.

How is the embezzled money used to bring chaos and oppression throughout the world ?

Answer: https://thedailycoin.org/2019/07/10/looking-at-the-imf-and-world-bank-through-the-eyes-of-a-wall-street-economist/.