Unsurprisingly, the Republican tax plan moving forward in the U.S. Congress and championed by Donald “Drain the Swamp” Trump, is very swampy. Today’s post will highlight a few examples.

First, let’s hear some of what billionaire fund manager Jeffrey Gundlach had to say. Via Bloomberg:

Jeffrey Gundlach, chief investment officer of DoubleLine Capital, said the congressional tax plan would expand the federal deficit and help a small fraction of the U.S. population, including hedge fund managers.

“I’m very disappointed incidentally about the shape of this tax cut that is being proposed,” Gundlach told a gathering of industry participants at the Drake Hotel in Chicago on Wednesday. “I am just appalled that we are going to continue to have a carried-interest scheme for hedge funds.”

The House bill set to be voted on Thursday keeps the carried-interest tax treatment that benefits private-equity managers, venture capitalists, hedge-fund managers and certain real estate investors. During last year’s campaign, President Donald Trump had vowed to get rid of the loophole. White House top economic adviser Gary Cohn has said Trump is committed to ending the tax break.

“After I saw that tax bill, I lost hope with the drain the swamp concept,” Gundlach said. “The swamp keeps getting bigger.”

Carried interest is the portion of a fund’s profit — usually a 20 percent share — that’s paid to managers. Currently, tax authorities treat that income as capital gains, making it eligible for a rate as low as 20 percent. The top tax rate for ordinary income is 39.6 percent.

He called the tax plan “a cosmetic tax decrease for the middle class that will go away over time.”

Of course, none of this is really surprising. Donald Trump’s been a Wall Street bootlicker ever since he came into office, just like Barack Obama before him.

But there’s much more swampiness to be had. For example, there’s the fact that the corporate tax rate cut is permanent, while the individual cut is temporary. From the Los Angeles Times:

A gambit by Senate Republicans to make a large corporate tax cut permanent by having benefits for individuals expire at the end of 2025 created new problems for the legislation Wednesday as lawmakers were still grappling with the controversial decision to add the repeal of a key Obamacare provision.

The decision by Republican leaders to double down on risky maneuvers to overcome budgetary hurdles with their tax overhaul threatened to put the entire effort in jeopardy.

Sen. Ron Johnson (R-Wis.) declared he would not support the bill because it treats large corporations differently than many small businesses, which pay taxes through the individual code.

“If they can pass it without me, let them,” Johnson told the Wall Street Journal. “I’m not going to vote for this tax package.”

He later said he hoped “to address the disparity so I can support the final version.”

Here’s some more on what Ron Johnson’s complaining about, via CNBC:

Johnson said he’s been working for months behind the scenes to make changes, but he added that he’s not going to let his “version of perfect” sink tax reform. “I want to get this thing fixed, and vote for pro-growth tax reform that makes all American businesses competitive globally,” he said. “I care deeply about this country, I care deeply about this deficit.”

As a former small business owner, Johnson said he’s particularly concerned about the so-called pass-through rate, in which the profits and losses of sole proprietorships, partnerships, and S-corporations “pass through” to their owners who are then taxed at individual income-tax rates, currently as high as 39.6 percent.

“We can’t leave anybody behind, which is why they came up with the 25 rate for pass throughs,” he said. “The problem is, neither the House or the Senate version really honored that commitment to pass-through businesses, which I argue are a huge engine of economic growth.”

“I don’t have the information on how much it would cost, how many pass-through businesses are being left behind that do compete globally. I can’t get the information. I’ve been asking. They don’t give it to me,” said Johnson, chairman of the Senate Homeland Security Committee.

Moving on, if you’re still in denial that this “tax reform” was written for oligarchs and mega corps, take a look at the reaction of former Goldman Sachs executive and Trump’s White House Economic Council director, Gary Cohn, when his audience of corporate executives were asked a simple question.

As Zerohedge perfectly summarized:

The eagerness to shift incentives away from buybacks to capex is also the basis for much of Trump’s economic policy as designed over the past year by his top economic advisor, former Goldman COO Gary Cohn who is the White House Economic Council director. In fact, the motive behind the administration’s entire push for tax reform (cutting corporate tax rates) and offshore cash repatriation, is to the funds domestically, though not on buybacks and M&A (which also leads to “synergies” and other headcount reductions), but on reinvesting the funds in growing one’s business and hiring.

Which is why we were amused to observe the following brief interchange yesterday between Gary Cohn and an audience made up of executives, where in the span of a few seconds Gary Cohn realized that his entire economic policy had been a disaster.

During an event for the Wall Street Journal’s CEO Council, an editor at The Wall Street Journal asked the room: “If the tax reform bill goes through, do you plan to increase investment — your company’s investment, capital investment?” He asked for a show of hands.

Alas, as the camera revealed, virtually nobody raised their hand.

Responding to this “unexpected” lack of enthusiasm to invest in growth, Cohn had one question: “Why aren’t the other hands up?”

Ironically, Cohn’s epiphany took place just as tax reform is approaching the final stretch in Congress and it increasingly appears that at least some form of corporate tax cut will be enacted. We say ironically, because the only thing Trump’s reform will achieve is to dramatically accelerate recently slowing buybacks, which in turn will push stocks to new all time highs as price-indescriminate CFOs and Tresurers tells their favorite VWAP trading desk to just “wave it in.” Which means that the White House paper suggesting corporate tax cuts will boost household income is correct… if it focuses only on the incomes of the richest 1% of households.

Don’t despair, I promise there’s something in there for the average joe. For instance, after years of repression, owners of private jets will finally get that tax break they desperately need.

The Hill reports:

The latest version of the Senate Republican tax reform bill includes a break for companies that manage private jets.

A measure in the Tax Cuts and Jobs Act would lower taxes on some of the payments made by owners of private aircraft to management companies that help maintain, store and staff those planes for owners.

The language would exempt owners or leasers of private aircraft from paying taxes on certain costs related to the upkeep and maintenance of the jets, according to a description from the Joint Committee on Taxation.

I know, Congress sells out to special interests pretty cheaply. Fortunately, Rep. Joe Barton of Texas is looking out for the plebs.

Texas Rep. happy about tax bill because he gets to build a new colosseum. pic.twitter.com/eeq88tLJB5

— Michael Krieger (@LibertyBlitz) November 16, 2017

Meanwhile, a recent Quinnipiac showed that this oligarch giveaway isn’t particularly popular. How surprising.

The WSJ reported:

In a new Quinnipiac poll, 25% of American voters approve of the Republican tax plan, compared with 52% who disapprove.

Among Republicans, support was 60%.

President Donald Trump has cast the tax plan as a boon to middle-class households. Nearly 60% of American voters in the Quinnipiac poll believe the Republican plan favors the rich at the expense of the middle class.

About 24% of American voters say the middle class will mainly benefit from the tax plan, while 61% say the wealthy would be the primary beneficiaries.

About 36% of voters believe the tax plan will propel economic growth, while 52% don’t believe it will.

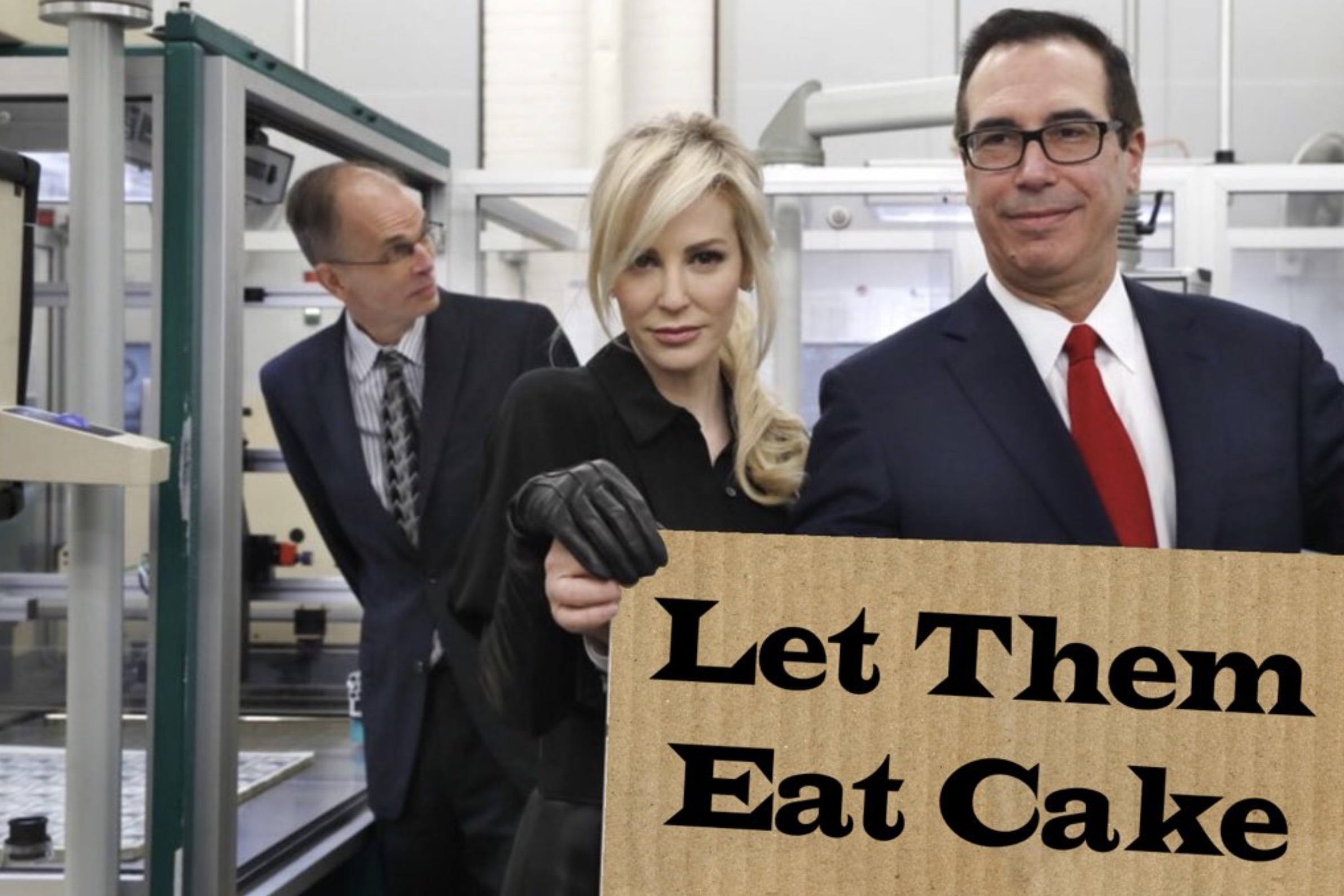

But here’s the best part. Former Goldman Sachs partner, Steven “Let them Eat Cake” Mnuchin, doesn’t want to hear it.

Asked whether Senate Republicans have 51 votes to pass the bill as it stands, Mr. Mnuchin said, “I am confident we are going to get this passed in the Senate.”

Mr. Mnuchin brushed aside suggestions that the bill is unpopular, refusing to comment on a Quinnipiac poll showing 16% of voters believe the bill will reduce taxes.

He also said “virtually everybody in the middle class will get a tax cut,” and that only “people who are making more than $1 million in high-tax states who will be making more.” Even people in high-tax states would reap the benefits of a lower corporate tax rate and other changes meant to help businesses that will boost economic activity, he said.

Guess he missed the recent video of his buddy Gary Cohn.

The more people learn about this monstrosity, the less they like it. Unfortunately, by that point it’ll be too late.

You lose again America. Make Wall Street Great Again.

If you liked this article and enjoy my work, consider becoming a monthly Patron, or visit our Support Page to show your appreciation for independent content creators.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Lighten up, Mike. They’re just keeping us safe.

If this goes through then without being able to deduct state income tax and property tax from the federal income, itemizing for me goes out the window. For me charitable donations will then not be part of the deductions. I will be looking at a $2,000-$3000 increase in federal taxes. I am willing in our pluralistic distribution type economy to pay my fair share. However…

Also, they are taking the Estate tax out, another HUGE beneift to the top 1%. Simple illustration:

Without the estate tax

Bob buys stock for $10M. He dies when the stock is worth $100M and deeds it to his son. The stock goes up to $1.B, when the grand son gets its. It then goes up to $1.1B when the grandson sells it all.

Most people think the grandson will thne have to pay capital gains tax on $1,090M. However, the tax on the Grandfather’s and Father’s cpaital gains is not deferred – it is **erased**. The grandosn **cost basis** i s $1B, so that’s $990M of tax free capital gains without an Estate Tax. I would be find if the Estate tax disappeared as long as Cap Gains was paid be the Estate **prior** to the transfer to the heirs.

Just keep in mind that multi-billionaires hide hundreds of millions in multiple “charitable foundations” that never get taxed because they are tax exempt entities. So the estate tax is basically a non-factor for their immediate and extended family.

Which is why Forbes wealthiest people list is a joke. Just the Rockefeller’s alone could buy and sell Warren Buffet and Bill Gates a hundred times over.

The late Congressman Larry McDonald used to point this out whenever he was given the opportunity. Which is why he’s dead.

Genaro,

The solution is not to kill the Estate Tax. The solution is to kill the loopholes.

Btn, I agree 100%. Wasn’t proposing that the estate tax be eliminated.

What needs to be eliminated are the massive loopholes available to the super wealthy through charitable trusts and foundations that only exist to serve as a tax dodge.

As to the proposed cuts in the corporate tax rate, the Zero Hedge article and Cohn video Michael excerpted above, covers that bullshit canard quite well.

Why anyone thought that a guy who made millions playing the swamp game would want to “drain the swamp” that made him wealthy is just further proof that PT Barnum was right.

As if we needed any further proof of that after 8 years of the Mulatto Messiah inside the big white house selling his Hope and Change snake oil on a daily basis. It had to be followed by another con man selling red MAGA hats who will do nothing to make America great for the poor schmucks who voted for him.

The 2020 election is going to make the 2016 election look normal.