This ridiculously condescending budget put out by McDonald’s in partnership with Visa has been making the rounds today. I’ll allow excerpts from the Gothamist article on it and their corresponding video do most of the explaining, but the key point I want to hammer into people is that food stamps are corporate welfare. They actually are not welfare for the workers themselves, who undoubtably don’t have wonderful lives. What ends up happening is that because the government comes in and supplements egregiously low wages with benefits like food stamps, the companies don’t have to pay living wages. So in effect, your tax money is being used to support corporate margins. Even better, many of these folks who get the food stamp benefits then turn around and spend them at the very companies which refuse to pay them decent wages. Who benefits? CEOs and shareholders. Who loses? Society.

I previously covered these topics in two popular posts:

Where Food Stamps Go to Die

The Stock Market: Food Stamps for the 1%

Guess what would happen if these companies failed to pay high enough wages and food stamps didn’t exist? There would be massive employee organizing and ultimately the companies would have to change tack. This of course doesn’t happen when the taxpayer makes up the difference, and that is exactly what they want. From Gawker:

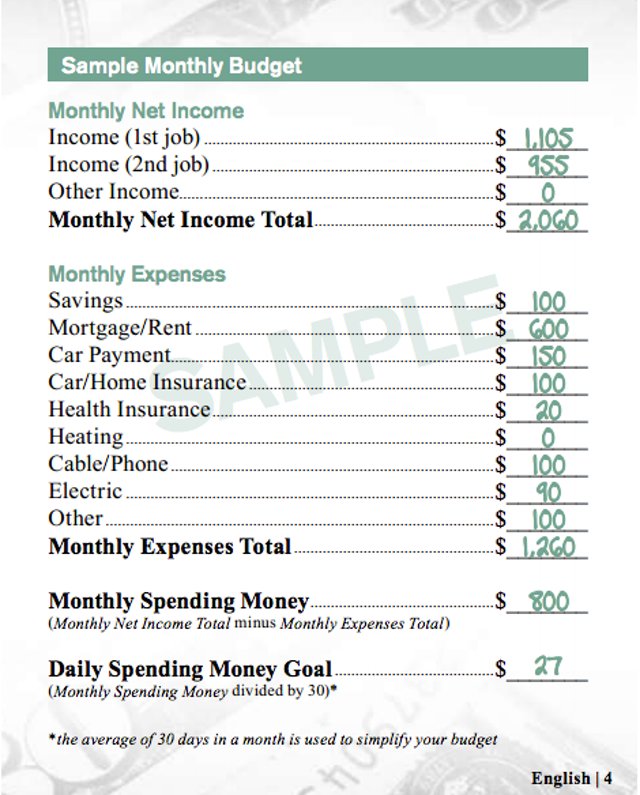

Just in case you weren’t already aware of how difficult it is to survive on minimum wage, allow McDonald’s to lay it all out for you. The fast food giant has partnered with Visa to release a just-shy-of-condescending “budget journal” to help their employees manage their finances. In a hilariously obtuse budget breakdown, the Big Mac purveyor’s first piece of advice to employees: get a second job. Yup, even McDonald’s knows that workers can’t survive on the pittance they make flipping patties and fighting off customers.

So tallying up all of these totally realistic expenses, a McDonald’s employee would need to net $2,060 per month to make this budget work. Broken down, that would mean working at least 40 hours per week and making at least $15 an hour pre-taxes to earn the necessary $12.86 an hour. Currently, McDonald’s workers earn an average of $8.25 per hour, barring any funny business.

For more on how ridiculous this is, watch this video. By the way, where can I sign up for $20 healthcare?

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

How the rich get a big real estate tax break

The rarefied few who can afford to shell out tens of millions of dollars for an apartment in one of the gleaming new condominiums being built across New York City may be searching for luxury, but in some cases they will find an unexpected perk: a break on real estate taxes that can mean tax bills as low as $96 a month.

At 56 Leonard Street, where a penthouse just went into contract for $47 million, the buyers are poised to receive a 76 percent break on their real estate taxes.

At 150 Charles Street, an ultraluxury development in the West Village, the tax break is 70 percent.

And at , the 90-story skyscraper in Midtown where asking prices top $10,500 a square foot, the tax break is an eye-popping 94 percent.

A recent review of the offering plans for some of the city’s most expensive new apartment buildings offers an interesting peak into the perquisites and disadvantages of a lavish lifestyle. There are the windfalls, like the generous tax breaks, but there are also oft-overlooked expenses, like mandatory health club and dining-room fees, that can add to a buyer’s bottom line.

The tax abatement, known as the 421A program, was established in the 1970s, during the depths of the city’s financial crisis, to spur residential construction. In the 1980s, as the economy improved, the program was modified, and affordable-housing requirements were added. In 2008 it was substantially scaled back, although some buildings, like 56 Leonard, made it just under the wire to get the abatements by starting construction before the stricter rules went into effect.

The case for One57 is slightly more complex. Its location on West 57th Street would prohibit the developer from applying for the abatement, but in January the state legislature passed a broad housing bill that included an exemption for the building. The legislation gave a similar pass to several others, including 99 Church Street, otherwise known as 30 Park Place, an ultraluxury condominium that the developer Larry Silverstein is building in Lower Manhattan, and to a site owned by the developer Joseph Sitt at 516 Fifth Avenue in Midtown.

The city has not yet signed off on the abatement, but if it does, a result will be an annual real estate tax bill of under $18,000 for the buyer of the penthouse at One57, assuming it sells for its $115 million list price. That tax bill would more typically apply to a $3 million apartment; for this penthouse, the typical bill would be nearly $300,0000, according to the offering plan. Similarly, the least expensive unit in the building, a 1,000-square-foot one-bedroom, has monthly taxes of just $96, which works out to $1,157 a year—versus $19,234 without the tax break.

http://www.cnbc.com/id/100887481

enough is never enough……

The video link is amazing. Heavy metal beating over

Fake fiat ironic but sad

Working at McDonalds was never intended to support a family of four. Its a job for high school kids. Its a shame that it has come to that, people working at McDonalds to make a living. Its not McDonald’s fault, really. Nobody should be eating that crap anyway.

I do hate that my tax dollars go to this, and to Walmart and all the other roach infested corporations that plague this nation, but there aren’t many alternatives. You can pay someone taking McDonald’s orders 40k a year, that’s stupid. You can yank the rug out of the food stamp program (see republicans), yes that hurts, but it accomplishes the same thing as you say in your article.

I agree with you that nobody should be eating that crap but unfortunately far too many do. Desperation in many cases. It’s real sad to see. No budget for health ($20???) and NO heating???

Excellent perspective!

Mass production—and its corollary minimal employment—is thought by many to be the inevitable progress of business…it is not. Mass production is artificially created by limiting liability, and allowing unlimited terms of debt. The path to mass employment and mass prosperity will require restoration of personal liability and short term limits on debt.

Nice budget figures, where are you living Fantacyland? Tell my friends in Nome Alaska their heating bill is 0 dollars per month, I can hear their Eskimo neighbors laughing. Most people have a dog, what about dog food and vet bills? Speaking of food, where’s the tab for your food bill? I see this budget has money for a car payment, what about the oil change every 3 months, what about gasoline $300 per month, and that mechanic bill $600 per year. As Rodney Dangerfield once said in the movie Back to School…”you left out a bunch of stuff”.

Just curious: “Broken down, that would mean working at least 40 hours per week.” How long are you suppose to be working now? Is McDonalds suppose to be a part time job or what?

@Joe: I agree on all the other costs but am not sure why you would change oil on the car every 3 months. Does you car run on oil? No offense intended just want to know weather cars are so much different in US. Unless you mean driving a 20 year old one in which case I’d say maybe 😀

There are a lot of expenses missing here but also you need to take into account that having a wage like that there are certain things you can’t and should not afford if you want to survive. No matter how harsh that sounds you need to cut expenses. Maybe you can’t even consider kids. That’s capitalism for you. Fantastic isn’t it.

Sorry, but the idea that food stamps are corporate welfare is idiotic.

http://bleedingheartlibertarians.com/2013/07/against-the-living-wagesubsidy-arguments/

Hardly idiotic and this article you pasted as some sort of closed case on why my argument is wrong does nothing to address my point, which is clearly lost on you. I’m not arguing any company is “required” to pay any of its employees a certain amount, nor am I saying that I know what that would even be. What I am saying is that the food stamp program is there to quell action or organizing on the part of employees who would be more engaged and active in getting whatever their labor is worth without the program (I’m not even suggesting ending food stamps, rather I am describing they help the companies more than the people). The people then become hapless serfs, brain dead on tv and able to survive while the corporations and shareholders laugh all the way to the bank as they don’t have to even deal with unrest or a real market since the government bastardized it so badly. Mike

Are you people aware that in the 60’s the minimum wage was about $1.25/hr. If this had been PROPERLY adjusted for inflation the minimum wage would now be over $21.00/hr and workers receiving same wouldn’t need food stamps? For that matter, what job could any CEO do that’s actually worth millions a year?

Here’s a better idea; how about denying any government benefits to any American Corporation that outsources labor? There’s no reason American Taxpayers should be forced to support companies who deliberately send their jobs abroad: no tax breaks, no government guaranteed loans, nothing.

We only have ourselves to blame…

Much of this comes about due to government intervention into the workplace…

This costs the corporation money, costs that can’t all be passed onto the customer…

Remember, we elected the government we apparently deserve…