The selling of U.S. green cards to foreigners, particularly the Chinese, has grown exponentially in 2014, and represents a significant public policy debate very few Americans are aware of. I covered the surging issuance of EB-5 immigrant visas a couple of weeks ago in the post: How the Pennsylvania Turnpike Commission is Selling Residency to Chinese “Investors” at $500k a Pop. Here’s an excerpt:

The selling of U.S. green cards to foreigners, particularly the Chinese, has grown exponentially in 2014, and represents a significant public policy debate very few Americans are aware of. I covered the surging issuance of EB-5 immigrant visas a couple of weeks ago in the post: How the Pennsylvania Turnpike Commission is Selling Residency to Chinese “Investors” at $500k a Pop. Here’s an excerpt:

A major theme here at Liberty Blitzkrieg over the past year has been the creative ways in which corrupt Chinese oligarchs and government officials are maneuvering their way into the United States. To be clear, I am not anti-immigration by any stretch of the imagination. My mother was an immigrant. This is about being against corrupt and morally compromised individuals being welcomed here with open arms just because they have cash. We have enough domestic criminal oligarchs as it stands. These people have collectively captured the American political and economic system and control it to their own ends. Do we really need to import more of these types from abroad?

Here’s what I’d like to know. Who are these investors and who vets them? It is a known fact that corrupt Chinese officials and businessmen are scrambling to get themselves and their money out of their homeland as the government cracks down on corruption. How many of them are going to use this program to get into the U.S., and what will be the long-term impact to our society? Important questions that must be asked, but most likely aren’t being taken seriously.

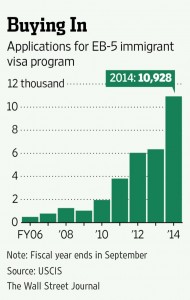

While that article focused on a turnpike in Pennsylvania and mentioned a few other projects, it didn’t clarify how widespread the use of these visas has become in 2014. Specifically, there were 10,928 applications for EB-5 visas in the fiscal year ending September 30, 2014. This was up a stunning 72% from fiscal year 2013. Even more shocking, the number of applications in 2006 was 486. So the 2014 figure is up 22x in less than 10 years. That’s not normal.

Moreover, 85% of the visas approved this past year were from China. So when you combine the explosive growth rate, as well as the apparent Chinese monopoly, it looks to be nothing more than corrupt Chinese officials and businessmen trying to escape before they end up in prison. As I said before, capital moves to where it is treated best and so does fraud.

Now here are some excerpts from the Wall Street Journal article explaining how the biggest project in New York City in a generation is being partly financed by selling green cards to the Chinese.

From the WSJ:

The giant trucks pumping concrete in Hudson Yards, New York’s biggest real-estate project in a generation, are being financed by an unlikely source: about 1,200 Chinese families in search of U.S. visas.

Developer Related Cos. says it has raised roughly $600 million from the families to build the foundation for three skyscrapers at the West Side project, a 17-million-square-foot colossus of office, retail and residential space set to open over the next decade.

To finance the concrete-steel platform, Related tapped a little-known and at times controversial federal visa program known as EB-5, which offers green cards to foreign families who invest at least $500,000 in U.S. projects that create at least 10 jobs per investor.

The amount brought in so far, which privately held Related hasn’t previously disclosed, is a record for the cash-for-visa program.

In San Francisco, home builder Lennar Corp. has raised about $200 million through the program for San Francisco projects that include more than 12,000 housing units on a former naval shipyard. Developer Forest City Ratner Cos. has taken in more than $475 million for the real-estate project connected to Brooklyn’s Barclays Center. In lower Manhattan, World Trade Center developer Larry Silverstein is trying to raise about $250 million for a 937-foot Four Seasons hotel and condominium going up.

In all, 10,928 foreign investors applied to invest through the program in the fiscal year ended Sept. 30, up from 6,346 a year earlier and 486 in 2006, according to U.S. Citizenship and Immigration Services, the program’s administrator. Most projects have been real-estate developments.

More than four-fifths of applicants typically win approval and become eligible for a temporary visa, the data show, suggesting the investors who applied this year would fund nearly $4 billion in investment if all of the projects go forward.

The growing popularity has made for lengthy processing times for investors and developers. But Related successfully urged the federal government to declare the development a project of such national importance that it deserved expedited approval.

Wow, so now private real estate projects are matters of “national importance.” This country has morphed into a sad joke.

But he expects the $40 million to $50 million the firm is raising each month in EB-5 money to continue to play a major role. The company recently won broker-dealer status in the U.S., helping it to maintain this pace.

Related appears to be positioning itself as a systemically important real estate company, worthy of future bailouts.

Chinese nationals are the biggest source of EB-5 funds, making up more than 85% of visas approved in the 12 months ended in September. Many are investing for their children rather than for themselves, said Kenneth Li, a Houston real-estate broker who has offered advice to Chinese investing in EB-5 projects.

If you want to see what Chinese “investing for their children” looks like, watch this: Video of the Day: Ferraris, Maseratis & More – How the Children of Chinese Oligarchs Live it Up in SoCal.

Congress created the EB-5 program in 1990 to spur job creation through foreign investment. It was used infrequently for years. Administrators in 2009 clarified a rule to allow temporary construction jobs to be counted toward the 10-job-per-investor requirement, sparking more activity.

This is what more activity looks like:

Developers are embracing the program largely because it provides low-cost capital. Money borrowed through the EB-5 program carries much lower interest rates, sometimes half of what companies typically pay, executives said. That is because investors are primarily seeking green cards, not a profit, and generally are willing to accept low returns, EB-5 advisers said.

Precisely. This isn’t about investment, it is about selling access to America. Who benefits? Extremely wealthy developers who pay a lower interest rate. How is this good public policy?

Earlier this year, Durst executives flew to China to pitch their projects to investors. On a flight to Beijing and then again in the lobby of a Shanghai office tower, they ran into a Related executive who runs the Hudson Yards project.

“I thought China was a pretty big place,” said Jordan Barowitz, a Durst spokesman, who was on the trip. “Apparently not.”

Back in 2006, at least Americans were capable of blowing a housing bubble on their own. Now they need to sell green cards to the Chinese so they can do the honors.

At least NYC will get what it really needs. A Four Seasons hotel built by Larry Silverstein. Simple pathetic.

As I noted previously, we should just get it over with an change the words on the base of the Statue of Liberty. I propose:

Give me your corrupt, your crony, your oligarch masses yearning to launder money free,

The criminal masterminds of your destroyed environment and police state.

Send these, the pampered, the private jet setter to me, I open my hands to your golden yuan.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

“corrupt Chinese officials and businessmen are scrambling to get themselves and their money out of their homeland as the government cracks down on corruption. How many of them are going to use this program to get into the U.S., and what will be the long-term impact to our society?”

As per “Time Will Run Back,” by Henry Hazlitt, one very real possibility is that a lot of these corrupt officials know exactly what’s fucking up their society and will come here and try to stay free of or even fight against the ideological corruption that made them into slaves in their homeland.

The US has a long track-record of converting would-be usurpers into the most vigilant and resolved True Americans allied against the collectivists.

Everything in this story of Chinese defections leans that way, and humanity has a long track-record of doing exactly the right thing for the completely wrong reason. The back-handed opportunities for success hiding inside this story about Chinese defectors isn’t surprising to me at all.

Have you read “Spiral Road” about the de facto retreat from communist economics in China, as long ago as 1986? People know slavery doesn’t work, in addition to how shitty it is.

Why do you think those defectors want to come here? To work for their masters OUTSIDE of the walls?

Michael, just in case you haven’t read it, it’s free from Mises in pdf:

http://mises.org/library/time-will-run-back

This is the American Way! Our new Senate leader is married to a Chinese Oligarch’s daughter who served as Labor Secretary for a GOP President.

Further, it was Chinese funds that financed the development of our West when Eastern interests tried to control all expenditures and keep them Eastern USA.