Wall Street has for some time attempted to put taxpayers on the hook for its derivatives trades. I highlighted this a year ago in the post: Citigroup Written Legislation Moves Through the House of Representatives. Here’s an excerpt:

Wall Street has for some time attempted to put taxpayers on the hook for its derivatives trades. I highlighted this a year ago in the post: Citigroup Written Legislation Moves Through the House of Representatives. Here’s an excerpt:

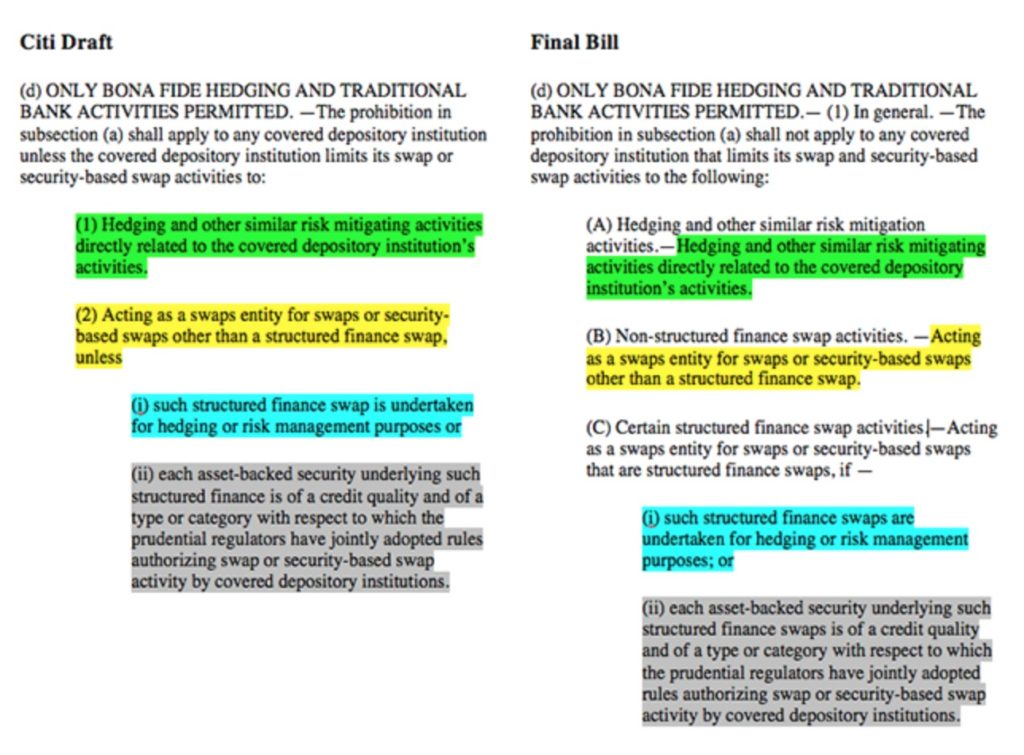

Five years after the Wall Street coup of 2008, it appears the U.S. House of Representatives is as bought and paid for as ever. We heard about the Citigroup crafted legislation currently being pushed through Congress back in May when Mother Jones reported on it. Fortunately, they included the following image in their article:

Unsurprisingly, the main backer of the bill is notorious Wall Street lackey Jim Himes (D-Conn.), a former Goldman Sachs employee who has discovered lobbyist payoffs can be just as lucrative as a career in financial services. The last time Mr. Himes made an appearance on these pages was in March 2013 in my piece: Congress Moves to DEREGULATE Wall Street.

Fortunately, that bill never made it to a vote on the Senate floor, but now Wall Street is trying to sneak it into a bill needed to keep the government running. You can’t make this stuff up. From the Huffington Post:

WASHINGTON — Wall Street lobbyists are trying to secure taxpayer backing for many derivatives trades as part of budget talks to avert a government shutdown.

According to multiple Democratic sources, banks are pushing hard to include the controversial provision in funding legislation that would keep the government operating after Dec. 11. Top negotiators in the House are taking the derivatives provision seriously, and may include it in the final bill, the sources said.

The bank perks are not a traditional budget item. They would allow financial institutions to trade certain financial derivatives from subsidiaries that are insured by the Federal Deposit Insurance Corp. — potentially putting taxpayers on the hook for losses caused by the risky contracts. Big Wall Street banks had typically traded derivatives from these FDIC-backed units, but the 2010 Dodd-Frank financial reform law required them to move many of the transactions to other subsidiaries that are not insured by taxpayers.

Last year, Rep. Jim Himes (D-Conn.) introduced the same provision under debate in the current budget talks. The legislative text was written by a Citigroup lobbyist, according to The New York Times. The bill passed the House by a vote of 292 to 122 in October 2013, 122 Democrats opposed, and 70 in favor. All but three House Republicans supported the bill.

It wasn’t clear whether the derivatives perk will survive negotiations in the House, or if the Senate will include it in its version of the bill. With Democrats voting nearly 2-to-1 against the bill in the House, Senate Majority Leader Harry Reid (D-Nev.) never brought the bill up for a vote in the Senate.

Remember what Wall Street wants, Wall Street gets. Have a great weekend chumps.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

The Bail-ins were discussed at the last G20 and new financial rules made:

http://www.globalresearch.ca/new-g20-financial-rules-cyprus-style-bail-ins-to-confiscate-bank-deposits-and-pension-funds/5417351

Thank You Mike and Kathryn ( Above Comments) for the great articles.

Goldman Sachs Networks in Germany

Hmmm

Instead of laying off their bad investments on the public why not pass a law that requires the officers of all these banks TO PERSONALLY BACK THE derivatives investments they are making on behalf of the bank. In fact the very first people to lose everything if these banks fail should be the bankers and any related family member which has reached money from them since they became employees of the bank. And of course this would have to include all offshore holdings of the bank officers as well. After that we should hold the stock holders responsible personally as well. And the level of responsibility would correlate to the percentage of stock they hold. After all this information is a matter of record and THEY ARE THE OWNERS OF THE BANK. Now after every single one of the owners has been suitably “taxed” then any and all remaining assets of the banks and all there holdings should be liquidated. At which point the bank would be declared legally “dead” and its charter would be permanently revoked. My solution would hold the people that have a legal fiduciary responsibility for the decisions made at the bank (the officers and board members) and the owners. The AMERICAN PEOPLE IN NO WAY SHAPE OR FORM HAVE ANY LEGAL, MORAL OR ETHICAL RESPONSIBILITY FOR THE STUPID DECISIONS OF THE MANAGEMENT AND THE OWNERS. And if Congress feels that strongly about bearing responsibility they can all put their personal holdings toward any loses of the banks. As for me not this time, and never again.

It is well past time for the American people to stand up and say NO! The Constitution specifically forbids this type of BS anyway.

Withdraw Your Consent: 25 Ways To Declare Your Independence

http://www.silverdoctors.com/withdraw-your-consent-25-ways-to-declare-your-independence/

50 Ways to Starve the Beast

http://www.theorganicprepper.ca/50-ways-to-starve-the-beast-04052013

Let’s Stop Fooling Ourselves: Americans Can’t Afford the Future

http://www.peakprosperity.com/blog/81190/lets-stop-fooling-ourselves-americans-cant-afford-future

BE SURE to read ALL comments in the ‘comments’ section which follows

each of the above articles, for many practical SOLUTIONS, that ANYONE

may put to use, starting today, to become more self-reliant, and counter

the predations of the predatory class (.001%)