In an apparent attempt to advise investors on how they can take advantage of America’s transformation into a neo-feudal oligarchy in a 50 page research report, Morgan Stanley has put together some very interesting charts that were highlighted earlier today by MarketWatch.

In an apparent attempt to advise investors on how they can take advantage of America’s transformation into a neo-feudal oligarchy in a 50 page research report, Morgan Stanley has put together some very interesting charts that were highlighted earlier today by MarketWatch.

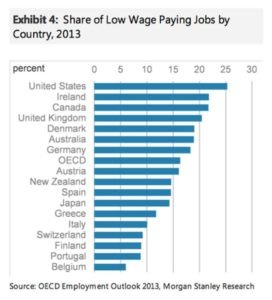

While I suggest taking a look through all of the charts, none of them is more telling and depressing than the one that shows how the U.S. leads the developed world in the share of low wage jobs. See below:

Of course, this shouldn’t come as any surprise to readers. I have covered the death of America’s middle-class for many years now, most notably in the post from last summer: How Does America’s Middle Class Rank Globally? #27.

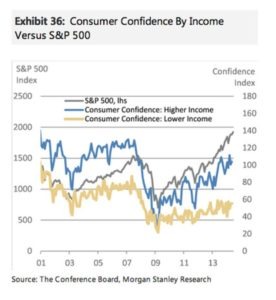

As the middle-class has been destroyed, and the poor placated temporarily by various government benefits, the oligarchy has had free reign to thieve and expand its wealth at a dizzying pace. The Federal Reserve fueled stock market has been a key tool in the process of keeping the 1% silent, as the chart below demonstrates:

While I can’t say the above is surprising, it certainly seems to confirm my prior contention that the stock market is merely: Food Stamps for the 1%.

U.S. policy is all about keeping the 99.9% quiet and distracted, while the oligarchs strip-mine the nation. Unfortunately, that strategy is working.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

The stock market is near its most extreme valuations in the last 100 years. The valuation is higher now that just before the 1929 crash, the 1972 crash, and the 2008 crash. The year 2000 was the only year it was more extreme and not by much if you looked at the median P/E ratios and market cap/GDP ratios.

So the foods stamps for the 1%, the stock market bounce and the housing bounce, isn’t going to last much longer now that QE3 is ending.

It will be very very interesting to see how U.S. citizens and the rest of the world is going to respond when QE4 has to get implemented. The stock market and housing bounce is about all they can show for the 9 trillion in new debt since 2008, the ZIRP policy, and nearly 4 trillion in Fed printing.

When that comes unglued, what will we really have accomplished over the last 5 years?

That would be the destruction of the middle class and a dependent society. It started much sooner than 5 years ago though. Start in earnest with NAFTA and most favored trade status to China.

P.S. There is a historic 100 year battle taking place right now on the Dow/Gold ratio. It is really interesting to watch it pay out.

How do I get the 50 page report

Alternative Currencies are providing a fall-back option. They are proof that people aren’t just standing around with their Dong in their hands (like some of my Vietnamese friends ;-).

Even things like airline miles and barter qualify, as people seek value in more stable forms of money than Fed IOUs.

“U.S. policy is all about keeping the 99.9% quiet and distracted, while the oligarchs strip-mine the nation. Unfortunately, that strategy is working.”

In the 1889 book The Great Red Dragon: Foreign Money Power in the United States, it points out that the world is the target for stripmining, not just the U.S. The Imperialism of Capital knows no national boundaries.

“The Imperialism of Capital ”

What is that supposed to mean?

Capital RUNS AWAY from empire all the time, and for a reason.

The government schools have done a bang up job in numbing, dumbing down, distracting, and misdirecting our youth.

iCrap, selfies, social media, sports, building billion $ sports stadiums, twerking, gay marriage are what’s important to them.

I don’t know if or when they will wake up.