It’s hard for an article to be simultaneously disturbing and amusing, but this morning’s article in the UK Telegraph about Barclays’ new blood vein finger scanner does just that.

It’s hard for an article to be simultaneously disturbing and amusing, but this morning’s article in the UK Telegraph about Barclays’ new blood vein finger scanner does just that.

What’s truly incredible about the article is Ashok Vaswani’s (chief executive of Barclays personal and corporate banking) purported obsession with fighting criminality, when in reality there appear to be few bigger criminal enterprises on earth than Barclays itself.

We are told the following about Barclays’ ostensible commitment to the rule of law:

Protect your wealth – Buy Gold and Silver Bullion with Goldbroker.com

Mr Vaswani said Barclays was improving technology and security, but criminals were also getting more sophisticated.

“You can’t let these guys create a breach in the dam. You’ve got to constantly stay ahead of the game,” he told Reuters.

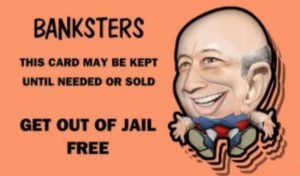

This guy sure talks a good game, yet it’s hard to find a bank more engaged in almost every single financial crime and market rigging practice imaginable, and yes I’ve tried.

Just this morning, I woke up to the following headline: Barclays, BofA, Citigroup Sued for ISDAfix Manipulation. But that’s nothing really. Let’s take a look at some of the greatest hits from Barclays’ wall of shame…

Gold Manipulation: Barclays Slapped with $44 Million Fine Over Gold Price Fix.

Foreign Exchange Rigging: Barclays Drawn into Foreign Exchange Scandal.

Energy Market Rigging: Barclays’ $453m Fine for U.S. Energy Market-Rigging Upheld.

LIBOR Manipulation: Barclays Settles U.K. Libor Case Weeks Before Start of Trial.

The rigging of LIBOR may be the most insidious of all, as I outlined in my 2012 post: My Two Cents on LIBOR-GATE.

Now for the Telegraph article. It’s incredible how shameless and full of shit these banksters are:

Barclays is launching a vein scanner for customers as it steps up use of biometric recognition technology to combat banking fraud.

Indeed, to “combat banking fraud.” Barclays doesn’t like competition.

The bank has teamed up with Japanese technology firm Hitachi to develop a biometric reader that scans a customer’s finger to access accounts, instead of using a password or PIN.

The biometric reader, which plugs into a customer’s computer at home, uses infrared lights to scan blood flow in a person’s finger. The user must then scan the same finger a second time to confirm a transaction. Each “vein profile” will be stored on a SIM card inside the device.

“Biometrics is the way to go in the future. We have no doubt about that, we are committed to it,” said Ashok Vaswani, chief executive of Barclays personal and corporate banking.

Mr Vaswani said Barclays was improving technology and security, but criminals were also getting more sophisticated.

We all know who the real criminals are. You aren’t fooling anybody.

“You can’t let these guys create a breach in the dam. You’ve got to constantly stay ahead of the game,” he told Reuters.

The bank was also exploring other opportunities, which could include using similar technology on mobile tablets, which is the fastest growing area for European banks, or at ATMs.

This is why you don’t bailout criminals. Especially banking criminals, the most dangerous kind.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Barclays should go back to enable people to do simple and plain banking like allowing pin numbers to enable customers to access their accounts and stop these stupid gimmicks to promote security. What a lost case. This a bank that is on the verge of going KAPUT!

Anyone who has not exited the megabanks and moved to a credit union should delay no longer.

Original story link pleas, or just hearsay guys

Along with valid proof and documentation, facts etc

@ Anonymous

“Original story link pleas, or just hearsay guys

Along with valid proof and documentation, facts etc”

What do you mean?

He cited the main article that he referenced in the first pargraph of the blog peice and also provides links throughout.

Did you read this before you posted you comments? Because , your comment seems kinda troll-ee.

If you are not merely causing trouble and if your are not a bott giving computer generated comments, then please be specific in your request for further information.

What particular items did you need original story proof/documentation/facts of or wha else was it that you found was lacking?

well, that leaves out Cheney. Just one advantage for beginners.