A friend of mine and former fund manager has recently launched a blog, called LarryLarry, where he intends to write musings on the markets and finance, amongst other things. I greatly respect his thought process and I intend to republish some of his work going forward. This will serve as a great compliment to Liberty Blitzkrieg considering I no longer focus my attention on financial markets. So without further ado…

Read The Fine Print To Find The Bubble

by LarryLarry

Here are some snippets from the prospectus for the “Investment Grade Bond Fund” at one of the largest mutual fund complexes and buyers of credit in the country:

The Fund may invest up to 20% of its net assets (plus any borrowings for investment purposes) in any combination of non-investment grade instruments (commonly known as “high yield” or “junk” bonds)…… The Fund may invest in securities rated C and above or determined by the management team to be of comparable quality.

Who would have ever thought a vehicle marketed as investment grade could have up to 20% of its assets in junk? Probably not many people that own these funds.

There is a bubble in higher-risk credit. It is being missed by many because the wrong qualifications for what makes a bubble are being used. When there is debate about bubbles, it almost always centers on the price of an asset category. There is often no mention of the volume of assets in that category trading at that price.

For there to be a meaningful bubble there needs to be both:

-Absurd pricing within an asset category

-A lot of money in the absurdly priced assets

Determining whether or not there is a bubble always seems to be a controversial topic (even when asset categories have massively deviated from trendline) prior to that bubble bursting, at which point after it is too late it becomes generally recognized that the bubble existed and was gigantic.

Once again there is an enormous amount of focus on certain high-flying stocks and whether or not they are in bubble territory and if that means there is another bubble in general. One tech stock trading at 100x revenue when everything else is at 15x PE would not constitute a bubble in the equity market. When you get a lot of stocks trading at the beefy multiples, the conversation becomes more complex.

Regardless of what is going on in the equity market, I believe the larger potential bubble is in credit, specifically higher-risk credit. The Greenwood-Hanson model is now predicting negative excess returns on risky bonds (article and charts to follow). I believe the model is being generous and reality will turn out much worse for the current vintage of risky credit.

Officials at the Fed clearly disagree with me. This is a recent quote from Federal Reserve Bank of San Francisco President John Williams “the central bank should avoid encouraging excessive financial risk-taking as it pursues its goals of full employment and stable prices… The San Francisco Fed chief said he doesn’t see the currently “very narrow spreads” in some corners of the credit market such as junk bonds and leveraged loans as “a big risk” to the economy or the financial system. Even so, “that is an issue, and that’s an issue that we need to keep watching.”

By focusing on spreads, Williams is fundamentally talking about pricing in the bond market. He is also talking solely about relative prices as opposed to absolute prices. And most importantly he is ignoring the volume side of the equation. This is the big mistake he and many others always seem to make. Although when it comes to bubbles, I shouldn’t be surprised anyone associated with the Fed is making a mistake about what constitutes a bubble and whether or not one currently exists.

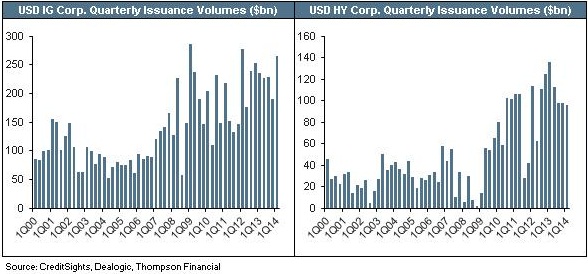

The following charts are alarming:

The following charts are alarming:

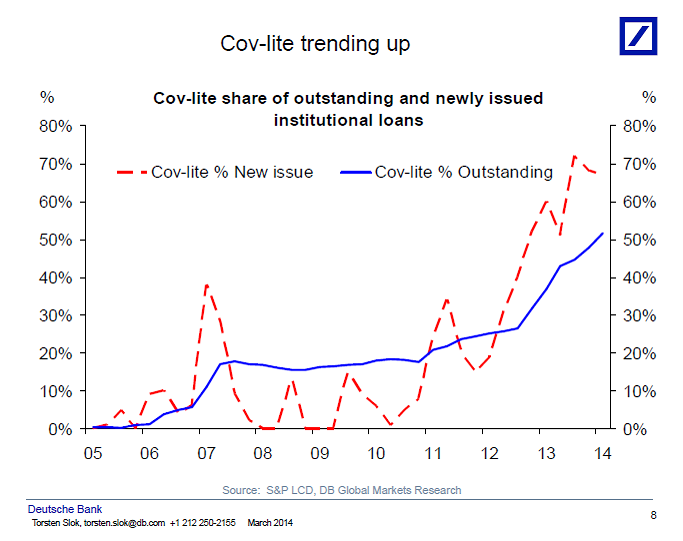

The dollar volume of high-yield credit being issued is through the roof. It is in the range of two to three times what it was in the period leading up to the housing bubble. There is also an enormous amount of other risky credit that is being extended that these charts do not capture. It could be multiples of this – risky consumer loans, auto loans, student loans, commercial and residential property loans. And all this stuff is still getting spliced, diced, re-packaged and re-levered in all sorts of exotic vehicles. For all I know it could all be percolating throughout the shadow banking system again.

Risky credit of all forms meets my definition of a bubble – both the pricing and volume are there.

While no model is ever perfect (none the Fed has ever seem to work) the Greenwood-Hanson model is now predicting negative excess returns on risky bonds. As I understand it, they smartly focus on volume as opposed to just price. But their model uses high yield issuance relative to investment grade issuance, which has also gone way up. So the model does not capture the fact that in absolute volume terms high-yield issuance is 2 to 3 times greater than it ever has been. Also their model does not account for the underlying state of corporate margins being as good as they can be, the fact that we are years into a theoretical economic recovery, and monetary conditions are as easy as they can be. And their model is still predicting negative excess returns for high-yield. I think for this vintage of risky credit that negative excess returns is a very conservative description of what will happen.

When there is so much credit being issued in certain categories relative to their own history the odds of that credit being money good at historical averages is very slim. In this category history has not been stupid either. There was not a free-lunch that all the sudden is being efficiently eaten by the additional volume.

For example if you lent to the best 100 people throughout history and that only got you a market-return, and then decided to lend multiples more money to the next 200 people on the list while charging them less interest for doing so, and you thought persons 200-399 would generate the same returns per person as persons 1-100, that wouldn’t seem so bright. Or assume there was a game that you had a 50% chance of winning and it paid even-odds. Then the rules of the game were changed where you still had a 50% chance of winning, but you needed to win 80% of the time to break-even. Then you decided you are still going to play the game and bet multiples more money than you ever have, that wouldn’t seem so bright either would it?

There is not much question about why institutions (companies, investment banks, individuals, etc.) want to sell this debt. That is a pretty simple answer. The age old rhetorical question pretty much sums it up, “Why does a dog……?”

As to why there is so much demand for this paper, the common notion is that so much risky credit is being absorbed because investors are stretching for yield. That is true. But it is also happening because just like in the tech-bubble, those making the investments do not care about the asset they are buying as much as they care about their fund’s performing as well as the ones in their peer group so they don’t lose their jobs (this also probably includes pension funds and other institutional pools of capital).

The fine print from the prospectus for the aforementioned Investment Grade Bond Fund helps to illustrate my point. In this case, I have no idea what the portfolio manager is actually doing, but by reading the fine print I know what the portfolio manager can do. To repeat up to 20% of a fund branded as “Investment Grade” can be invested in Junk, including C rated credit. This is not unique. This sort of leeway exists in funds of all types, credit and equity. I would not be surprised if there are equity funds branded as “Stabile Dividend and Income” that own Tesla, Netflix and Facebook.

From the prospectus:

Principal Investment Strategies of the Fund

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in investment grade bonds and investments that are the economic equivalent of investment grade bonds. For purposes of the Fund’s 80% policy, these include, but are not limited to, corporate bonds, commercial and residential mortgage-backed securities, asset-backed securities, collateralized mortgage obligations (“CMOs”),municipal securities, preferred securities, pass-throughs, U.S. Treasuries and agency securities, securities issued or guaranteed by foreign governments, their agencies or instrumentalities, and derivative instruments with similar economic characteristics.

The Fund invests primarily in fixed-income securities that are rated in the four highest rating categories by at least one of the recognized rating agencies (Baa or better by Moody’s Investor Service, Inc. (“Moody’s”) or BBB or better by Standard & Poor’s (“S&P”) or Fitch Ratings (“Fitch”)) or are determined by the management team to be of similar quality. Securities rated in any of the four highest rating categories are known as “investment grade” securities. The Fund maintains an average portfolio duration that is between 0 and 10 years. The Fund may invest without limitation in investment grade U.S. dollar-denominated instruments of issuers in each of U.S. and non-U.S. markets.

The Fund may invest up to 20% of its net assets (plus any borrowings for investment purposes) in any combination of non-investment grade instruments (commonly known as “high yield” or “junk” bonds) and non-U.S. dollar-denominated instruments. The Fund’s investment in non-U.S. dollar-denominated instruments maybe on a currency hedged or unhedged basis. Non-investment grade instruments are instruments that, at the time of acquisition, are rated in the lower rating categories of the major rating agencies (BB or lower by S&P or Fitch or Ba or lower by Moody’s) or are determined by the management team to be of similar quality. The Fund may invest in securities rated C and above or determined by the management team to be of comparable quality. Split rated

instruments will be considered to have the higher credit rating. Split rated instruments are instruments that receive different ratings from two or more rating agencies.

The Fund may buy or sell options or futures on a security or an index of securities, or enter into credit default swaps and interest rate or foreign currency transactions, including swaps (collectively, commonly known as derivatives). The Fund may seek to obtain market exposure to the securities in which it primarily invests by entering into a series of purchase and sale contracts or by using other investment techniques (such as repurchase agreements, reverse repurchase agreements or dollar rolls).

The Fund may engage in active and frequent trading of portfolio securities to achieve its primary investment strategies.

This leeway that exists in nearly every fund allows portfolio managers try to add return and look better than their peers by taking more risk instead of being a more skilled investor. They stretch into riskier assets or asset classes. Or they just add riskier paper within a category. Risk gets used to boost return as opposed to skill.

A few PMs do it, then others follow to catch up. And a vicious performance-chasing cycle begins, every PM trying to keep up with every other PM regardless of the risk. It’s not their money, but it’s their jobs. And their job depends on keeping up with their peers so they don’t lose assets. It does not matter if they end up ultimately being down 50% as long as everyone else is. The same thing happened in the equity stock bubble. And when the phenomena starts, it tends to accelerate until it pops.

There is an enormous amount of money that can find its way into high yield and other risky forms of credit. Take every investment vehicle out there in the world, and do the math on how much dollar volume of this stuff could be absorbed if the fine print was fully taken advantage of by every fund?

Add that to the already large pool of dollars chasing yield and importantly chasing each other. It is a lot of dough willing to take a lot of risk.

This is also another way the savings class is getting punished. Besides finding it hard to earn income on their savings, I think a lot of the savings class has no idea about the risk it is taking with respect to what it is invested in to find yield. You think the average person buying an “Investment Grade Institutional Bond Fund” realizes up to 20% of it is in junk rated securities including C credits? And who knows, one of these PMs maybe even snuck a few shares of Tesla in there.

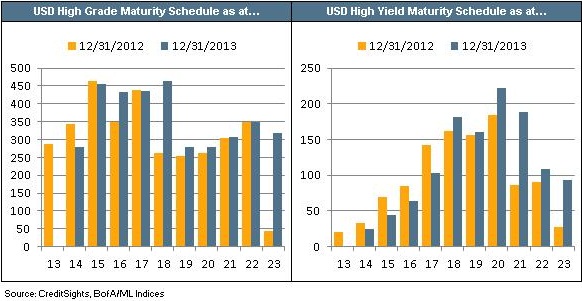

I look at the maturity schedule for this bolus or paper (above), and also wonder what will happen when the rat works its way through the snake and it comes time to re-finance or pay the piper in 3 to 4 years from now? Will these companies be able to do it? At what rates? If my suspicion is right, in addition to savings being destroyed, jobs will be lost and the economy damaged when borrowers of all types (individuals and businesses) end up over levered. And capital will yet again be destroyed. This includes not only individuals, but institutional capital (pension funds, endowments, etc.) as well.

So this time around look at the credit market. And focus on more than just spreads. Look at the amount of issuance and ask if it is possible that this credit is money good at anything near historical averages.

The first goal of lending is to get paid back!

To read more from the author above, check out the LarryLarry blog.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Wow, very enlightening stuff. I’m not a finance guy and had never thought of this new angle of menace.

There are signs everywhere. In addition to the stuff you mentioned, take a look at the sovereign market. GREECE just borrowed 3 billion Euros at under 5% with 5 year bonds. This is a country that needs to extend the bailout loans indefinitely (from 30 years to 50) just to pretend to be solvent. No sane person would loan them a dime. Basically speculators are betting that Germany will pick up the tab but they’re getting paid very little to make that bet.