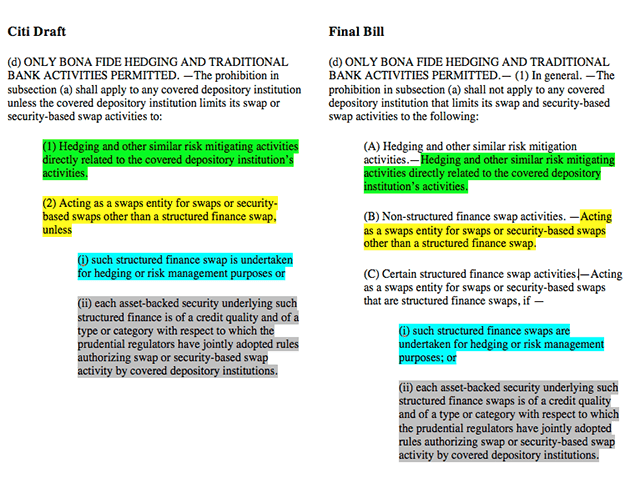

Five years after the Wall Street coup of 2008, it appears the U.S. House of Representatives is as bought and paid for as ever. We heard about the Citigroup crafted legislation currently being pushed through Congress back in May when Mother Jones reported on it. Fortunately, they included the following image in their article:

Unsurprisingly, the main backer of the bill is notorious Wall Street lackey Jim Himes (D-Conn.), a former Goldman Sachs employee who has discovered lobbyist payoffs can be just as lucrative as a career in financial services. The last time Mr. Himes made an appearance on these pages was in March 2013 in my piece: Congress Moves to DEREGULATE Wall Street.

More from the New York Times:

The House is scheduled to vote on two bills this week that would undercut new financial regulations and hand Wall Street a victory. The legislation has garnered broad bipartisan support in the House, even after lawmakers learned that Citigroup lobbyists helped write one of the bills, which would exempt a wide array of derivatives trading from new regulation.

Remember what George Carlin observed:

“Bipartisan usually means some larger-than-usual deception is being carried out.”

The bills are part of a broader campaign in the House, among Republicans and business-friendly Democrats, to roll back elements of the 2010 Dodd-Frank Act, the most comprehensive regulatory overhaul since the Depression. Of 10 recent bills that alter Dodd-Frank or other financial regulation, six have passed the House this year. This week, if the House approves Citigroup’s legislation and another bill that would delay heightened standards for firms that offer investment advice to retirees, the tally would rise to eight.

But simply voting on the bills generates benefits for both House lawmakers and Wall Street lobbyists, critics say. For lawmakers, it comes in the form of hundreds of thousands of dollars in campaign contributions. The banks, meanwhile, welcome the bills as a warning to regulatory agencies that they should tread carefully when drawing up new rules.

“The House is the odd man out in terms of doing Wall Street’s bidding,” said Marcus Stanley, policy director of Americans for Financial Reform, a nonprofit group critical of the financial industry. “They’re letting Wall Street write the law to its own benefit in ways that harm the public.”

Wall Street’s support from the House extends beyond favorable votes. When bank executives are called to testify before Congress, industry lobbyists distribute proposed questions to lawmakers and their staff, seeking to exert some control over the debate, according to emails written by staff members on the House Financial Services Committee that were reviewed by The Times.

The legislation, Mr. Himes said in an interview, poses no financial risk to the country. And while he is the second-largest recipient among House Democrats of financial sector donations, that is not what is compelling his vote, he said.

Of course not. What are you a conspiracy theorist?

“It hardly determines, thank goodness, how legislators think about these issues,” said Mr. Himes, a former Goldman Sachs executive.

“After inflicting so much pain and suffering on the American people, now is not the time to let the largest banks back into the casino,” Representative Maxine Waters, the ranking Democrat on the House Financial Services Committee, said in a statement.

Sorry ma’m you’re just a little late.

Some House bills have the explicit purpose of delaying new regulation. One bill scheduled for a vote this week could temporarily restrain the Labor Department from imposing a new rule requiring some financial advisers to take on a fiduciary duty to clients when providing retirement investment advice. Such a duty would demand that the advisers act in the best interest of the client.

The bill that Citigroup helped draft takes aim at one of the more contentious provisions in Dodd Frank, a requirement that banks “push out” some derivatives trading into separate units that are not backed by the government’s insurance fund. The goal was to isolate this risky trading and to prevent government bailouts.

How contentious! This is America after all.

Full article here.

In Liberty,

Mike

Follow me on Twitter!

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

CONTROLLING OTHER PEOPLE’S QUICK CAPITAL

The goose that lays golden eggs has been considered a most valuable possession. But even more profitable is the privilege of taking the golden eggs laid by somebody else’s goose. The investment bankers and their associates now enjoy that privilege. They control the people through the people’s own money. If the bankers’ power were commensurate only with their wealth, they would have relatively little influence on American business. Vast fortunes like those of the Astors are no doubt regrettable.

They are inconsistent with democracy. They are unsocial. And they seem peculiarly unjust when they represent largely unearned increment. But the wealth of the Astors does not endanger political or industrial liberty. It is insignificant in amount as compared with the aggregate wealth of America, or even of New York City. It lacks significance largely because its owners have only the income from their own wealth. The Astor wealth is static. The wealth of the Morgan associates is dynamic.

The power and the growth of power of our financial oligarchs comes from wielding the savings and quick capital of others. The fetters which bind the people are forged from the people’s own gold.

“The men who through their control over the funds of our companies are able to direct where such funds shall be kept and thus to create these great reservoirs of the people’s money, are the ones who are in position to tap those reservoirs for the ventures in which they are interested and to prevent their being tapped for purposes of which they do not approve. The latter is quite as important a factor as the former.

http://www.law.louisville.edu/library/collections/brandeis/node/192

But they supplied all the BLUE CITI bikes in NYC. That’s

Kind of cool…seem like good dudes