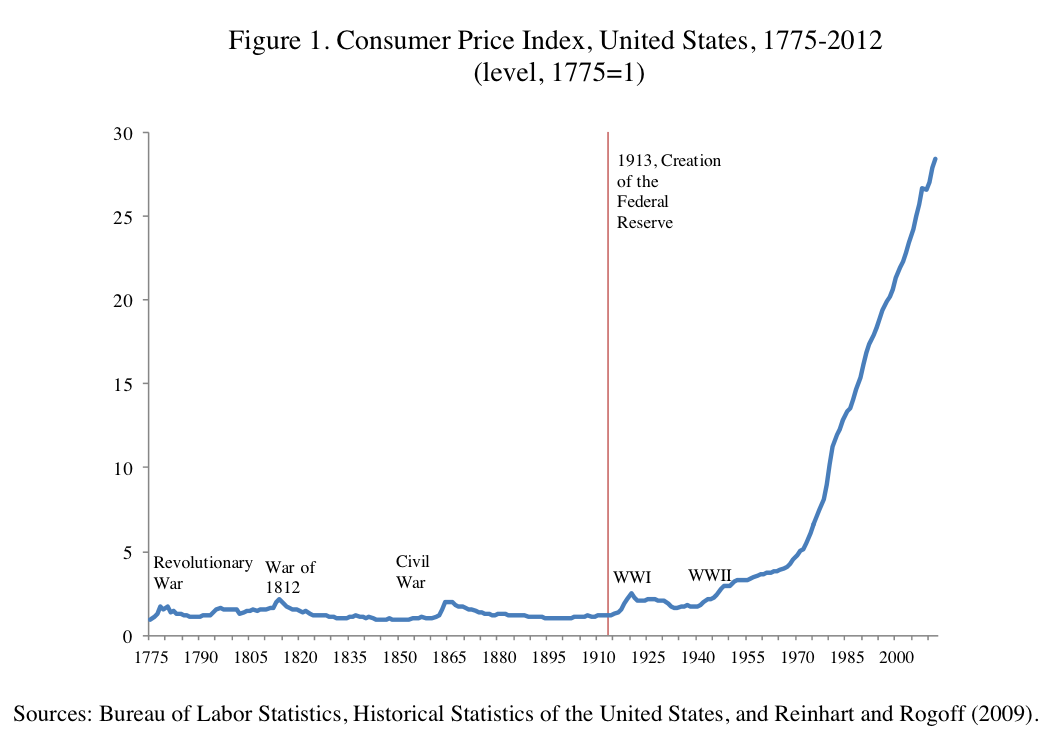

As is clear by this chart, inflation was virtually unheard of until the Creature from Jekyll Island (the Federal Reserve) took over. However, more importantly, things didn’t really start to get bad until the 1970’s right after Nixon took the nation off the gold standard in 1971. Since that time, America has seen a period of non-existent real wage growth and a huge gap grow between the rich and the poor. Nothing like livin’ the debt slave dream!

Like this post?

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Chart illustrates the converging of multiple events—widespread introduction of birth control, emergence of the two-income family, and passage of the Equal Credit Opportunity Act to mandate credit expansion based on two-incomes. Add to all this Nixon’s removal from the gold standard.

The allusion to the double-income family, mentioned in two of your four events, is a little vague.

The second spouse joined the workforce BECAUSE real wages were falling, that is to say, BECAUSE inflation was eroding the buying power of first spouse’s paycheck. Please don’t tell me you’re suggesting the second spouse got a job for personal fulfillment and that price inflation resulted from her second paycheck bidding up of the cost of goods.

The birth-control reference is obscure to me, as it affects currency valuation.

Birth control facilitated married women entering the workforce en masse. Banks previously resisted lending to married couples with two-incomes because of risk aversion. The Equal Credit Opportunity Act of 1974 barred lending institutions from this practice. Married couples then bid up the price of housing, autos, etc., due to increased credit.

Thank you.

Personally, I’d love to see some volumes on the effect of the ECOA of 1974 on credit expansion. Is it really going to create the near-hockeystick I’m seeing?

Also, while family planning made the second paycheck possible, does that make it a cause? Or was it the peak in real wages in 1972 that caused spouses to seek a second paycheck, even before there were laws like the ECOA to encourage it?

All our money is debt, meaning an increase in its supply reflects a loosening of credit or credit expansion, and I am certainly seeing that. But I’m not buying the bidding up of prices creating more money.

Good questions. Price inflation is only possible in an environment of rising income or increased access to credit. You will never see milk go to $20/gallon unless people have and are willing to pay the price. Thus house prices are rising now in general. It is because artificial low interest rates are giving desirous house buyers the increased money for the same payment.

And obviously there are no other correlations. Nope.

I hope no-one is really this stupid but you never know. The concept made it this far.

They will never allow a return to the gold standard it would decimate the paper currencies and reduce the amount of worthless money floating around the system, and stop governments printing money when they needed it. It would also mean that people would need to have proper wages paid and not live from credit anymore, which would also see a return to saving, everything that the banksters and their like, do not want, they need the wage and credit slaves!

So get rid of the Fed and go back on the gold standard.

But a return to the gold standard would surely affect the governments ability to just print money to would self finance, also there wouldn’t be credit available anymore, people would therefore have to be paid proper wages, instead of relying on credit to survive, the basis of the modern Anglo-Saxon economy would be eliminated i.e. cheap credit, lots of worthless paper money, and low wages! Surely this although not unwelcome from my point of view, would cause chaos?

There is no argument with your point that decoupling the dollar from a fixed exchnge rate had an inflationary impact. But there was a major event that launched the inflationary spiral which was far more jarring to economies the world over: OPEc first embargoed the shipment of petroleum and the quadrupled the price of oil almost overnight in October 1973.As a result of negotiations of Kissinger and West Germany’s Witteveen with OPEC, the quadrupling of the cost of energy was absorbed by the world’s economies over the ensuing years, which effectively quadrupled the cost of everything as a result. In the immediate aftermath of the Vietnam War (which weakened our national resolve to fight for our way of life), and the relentless assault on Richard Nixon by the Democrats (which weakened our political leadership), The United States was in no position to do otherwise.

Was the doubling of energy the result of the Arabs suddenly realizing that we were serious about devaluing our money…thereby making those dollars we were sending them worth less?

I was in a position at the time to have access to weekly CIA reports. Fear of inflation was never mentioned in any of the analysis. But motivations based upon anti-colonialism, anti-zionism, and just plain extortion (Local leaders wanted to make more money.) ran throughout the reports.

Well, this tells me the Gold Standard could never return in any form because it would mean the END of this ridiculous asset Ponzi scheme.

It is clear there is a strong correlation between a private fiat money banking system, inflation and hyperinflation, the boom and bust cycle, poverty and wealth confiscation; and even the assassination and assassination attempts of US Presidents who tried to defend US sovereignty and the US citizen.

American revolution, my ass…

All you are a traitors of yours kings

stupids invaders racists,

Shouldn’t the chart be on a log scale? The linear scale is deceptive and serves to help promote the narrative.