The essay below is courtesy of Doug Rudisch, a friend and former fund manager, who I have known and respected since my days on Wall Street. I am extremely grateful that he took the time and effort to so insightfully write on some of the greatest issues facing our nation today and to provide this content to my readers. What follows below are some of the most powerful passages from his piece and the entire thing is embedded at the end. The whole thing is simply excellent.

What I can say with absolute certainty is that I have lost a lot of faith and trust in the system. And I am not the only one. This sentiment is running at all-time highs amongst business leaders (their collective in-actions prove it) and guys on the street. It is both sides of the barbell and middle that are upset. Often it’s one or the other, but not all three. This time it’s not at an external state, it’s directed inwards. That is a tough problem to solve. Jingoism is not the answer either as we already tried that.

If there is no faith in the system, it has a really hard time working. And I mean real underlying faith and trust in the system, as opposed to the confidence born from economic steroid injections or entitlements. These are valid notions, but as a point of clarity I am talking about a something different. There also is a subtle but important distinction between faith and trust versus confidence. Faith and trust are longer term and more powerful concepts.

There is more going on than a temporary lull in animal spirits that current fiscal and monetary policy will cure. If that was the case, it would be working already.

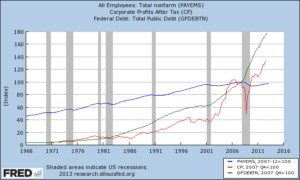

However as the above chart shows, things clearly changed in the 2003 and 2009 profit cycles as corporate profits surged while employment did not. My explanations:

Starting with the 2009 cycle first. In the 2008 downturn companies eliminated a lot of jobs. The depth of the downturn forced them to make the tough decision. Normally that kills consumer spend due to wage loss. But the government plugged the revenue gap with transfer payments and direct investment. See the green line go nearly vertical and it is fascinating how profit growth has mirrored the trajectory of debt growth. The consumer has started to dis-save again as well. Thus corporations kept the revenue, lost the labor, and voila record margins. You could argue unemployment is being subsidized. Like anything else, when something is subsidized, you tend to get a lot of it.

For example, see the recent new investor activity in single family homes and farmland of all things, including equity hedge funds who apparently think homes are like stocks. Maybe it’s a sign that other asset categories (equities and credit) are getting toppy or inflation expectations are increasing when hedge funds begin to foray into the single family housing market and farmland (some having little or no prior experience in these markets). At any rate, it seems odd and not good to me when policy results in hedge funds buying single family homes and farms.

Sorry Mr. Greenspan we have seen where valuing assets solely on the basis of current rates got us. If we should do that, baseball cards and chewing gum would also be great investments today. My suspicion is from here baseball cards and chewing gum will hold their value over time better than the typical company trading at 15x earnings derived from profit margins that are twice its average levels. And in point of fact according to the CPI the price of candy and chewing gum increased 31% between the years 2000-2012, while the S&P index including this year’s rip is only up 6% since 2000. Yes it matters what the price is that one pays for an asset!

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.