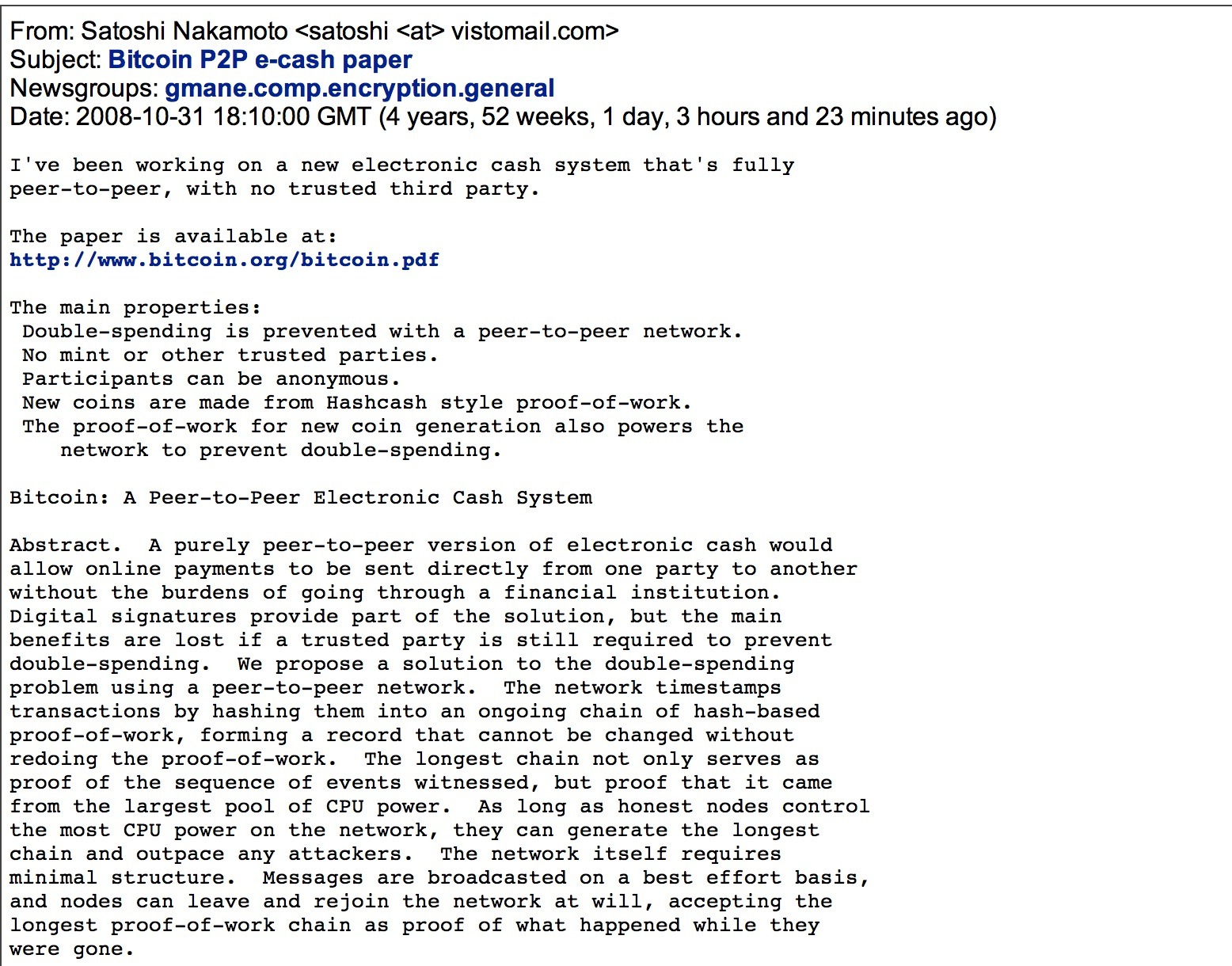

As all of my readers know, I am a huge supporter of Bitcoin for many reasons. What you may not know, is that five years ago today a still unknown individual(s) known by the pseudonym Satoshi Nakamoto released a white paper titled: Bitcoin: A Peer-to-Peer Electronic Cash System. The paper announced the Bitcoin concept to the world, and described how the network would deal with the wide variety of problems that might be encountered within the context of such an ambitious project.

Here is a screen shot of the original email:

I just read through the entirety of the white paper and it is quite fascinating to observe the creator(s) thought process. Below are some of the excerpts I found most intriguing:

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments…While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model.

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.

The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes.

If a majority of CPU power is controlled by honest nodes, the honest chain will grow the fastest and outpace any competing chains. To modify a past block, an attacker would have to redo the proof-of-work of the block and all blocks after it and then catch up with and surpass the work of the honest nodes. We will show later that the probability of a slower attacker catching up diminishes exponentially as subsequent blocks are added.

On Incentives…

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.