Poverty demoralizes. A man in debt is so far a slave; and Wall-street thinks it easy for a millionaire to be a man of his word, a man of honor, but, that, in failing circumstances, no man can be relied on to keep his integrity.

– Ralph Waldo Emerson, Wealth

Most of you will be aware that it’s almost impossible to discharge of student loan debt once you have it. It stays with you for the rest of your life almost no matter what, even if you file for personal bankruptcy.

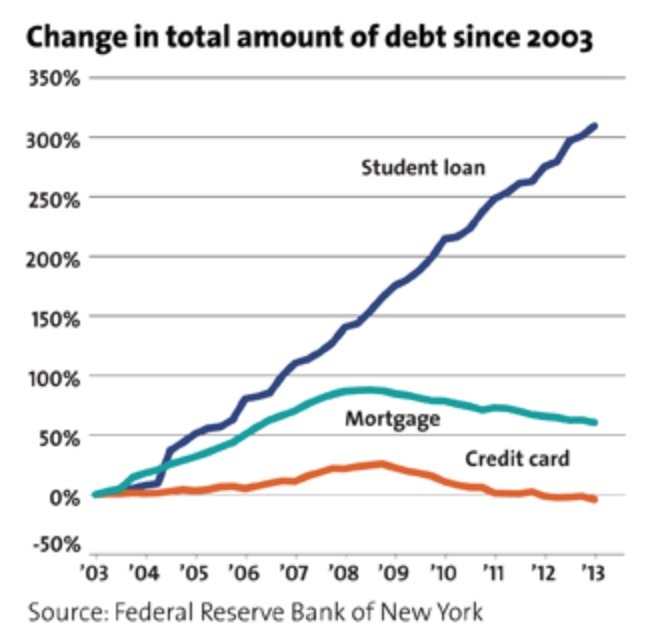

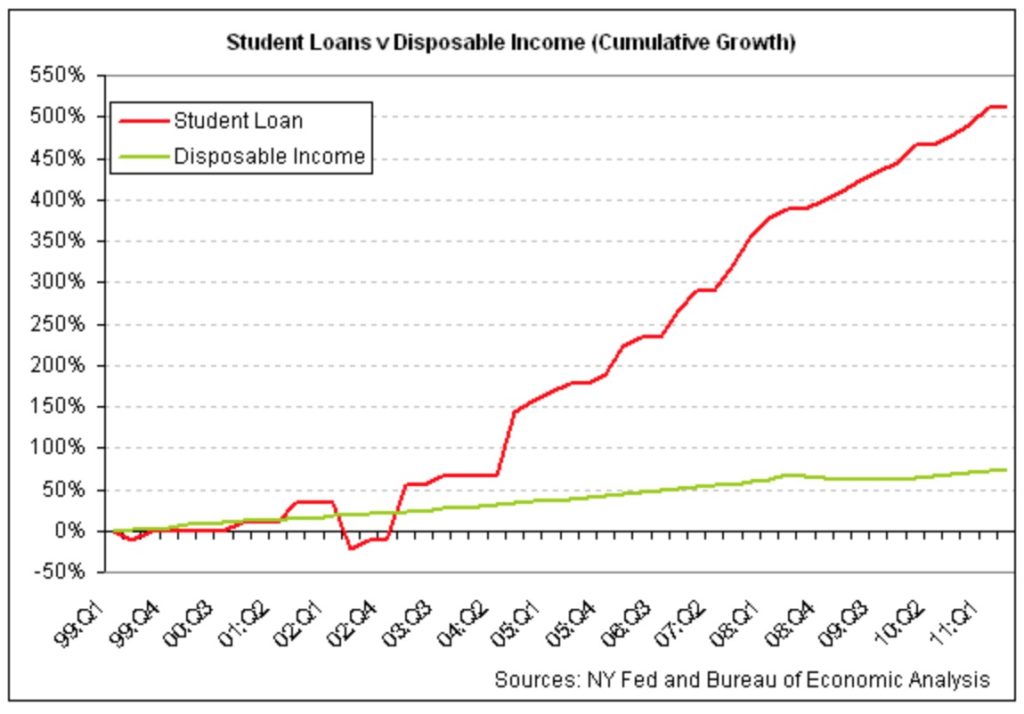

Why does this matter? Well, we’ve all seen charts depicting the disturbing surge in student loans outstanding over the past decade or so. Charts such as these:

So what do you produce when you encourage an explosion of debt that can never be repaid and can never be defaulted on? Debt serfs. Millions upon millions of hopeless debt serfs.

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.