Irresponsible and dangerous lending practices in the U.S. automobile market have been flagged by many people for a long time, but nobody knows exactly when it will all come to a head and create real problems. Today, I want to flag the latest warning sign.

Bloomberg reports:

Subprime auto bonds issued in 2015 are by one key measure on track to become the worst performing in the history of car-loan securitizations, according to Fitch Ratings.

This group of securities is experiencing cumulative net losses at a rate projected to reach 15 percent, which is higher even than for bonds in the 2007, Fitch analysts Hylton Heard and John Bella Jr. wrote in a report Thursday.

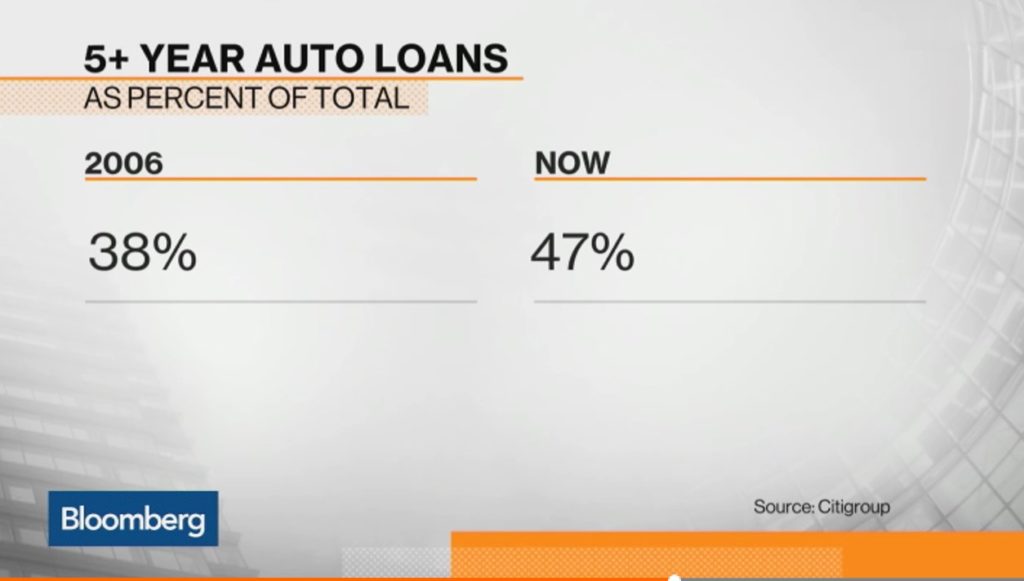

“The 2015 vintage has been prone to high loss severity from a weaker wholesale market and little-to-no equity in loan contracts at default due to extended-term lending, a trend which was not as apparent in the recessionary vintages,” said the analysts, referring to lenders’ stretching out repayment terms on subprime loans, sometimes to over six years, to lower borrowers’ monthly payment. That becomes riskier in the tail end of the loan, after the car has mostly depreciated and borrowers may be left owing large balances.

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.