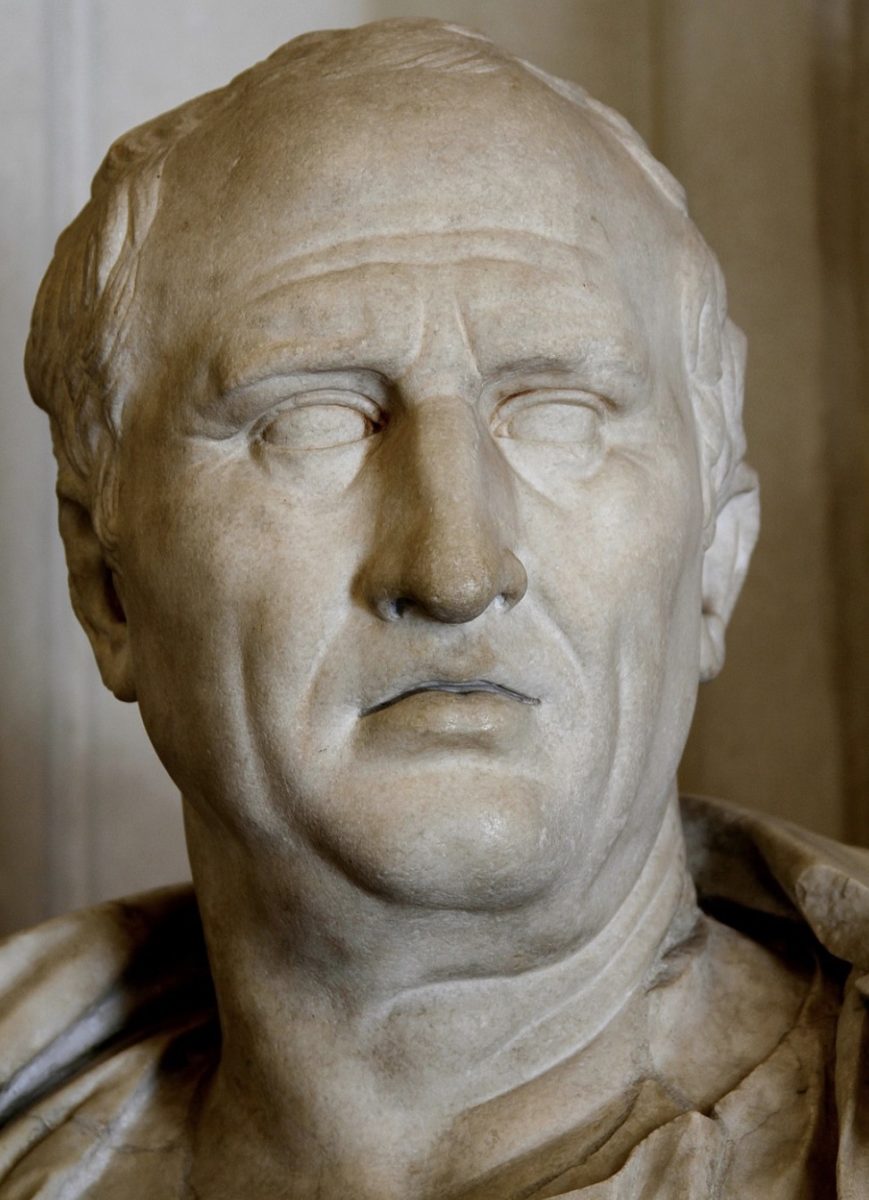

And we recently discovered, if it was not known before, that no amount of power can withstand the hatred of the many.

– Marcus Tullius Cicero

Although European leaders are talking a big game about keeping the Iran deal (JCPOA) alive following Trump’s unilateral withdrawal, there’s a good chance nations across the pond, especially the UK and France, will ultimately fold to U.S. demands. This is despite the fact these countries stand to lose far more economically than America. Acquiescing to U.S. imperial demands as submissive client states is simply what Europe does. On the other hand, China and Russia sense opportunity for major geopolitical gains and will not back down.

Political leaders in China and Russia must be licking their chops at the short-sighted stupidity of Donald Trump’s decision to ditch the Iran deal. As mentioned in previous pieces, the Trump administration isn’t just saying the U.S. will sanction Iran from its end, but that it could leverage the global financial system and its dependency on the USD, to punish those who dare defy U.S. policy.

As discussed in the recent post, The Road to 2025 (Part 3) – USD Dominated Financial System Will Fall Apart, this unilateral move against Iran is likely to be a key catalyst in the planet transitioning away from a financial system completely and totally dominated by the USD into a more multi-polar currency world. Trump’s essentially willing to trade away U.S. global geopolitical and financial dominance because he’s obsessed with taking out the Iranian regime.

While Europe may not be willing to make a huge fuss about all this right now, its leaders, and more importantly its citizenry, know exactly what this means. As long as the global financial system is totally dominated and controlled from the U.S. via the USD, no country on earth can be truly sovereign, in terms of economic or foreign policy.

In case you still aren’t getting how serious this is, let me point you to a few comments recently made by Russian leader Vladimir Putin:

In comments to lawmakers on Tuesday after his inauguration for a record fourth term as president, Putin said a “break” from the U.S. currency is necessary to bolster Russia’s “economic sovereignty,” especially in light of recent penalties and what he called politically motivated restrictions on trade.

“The whole world can see that the dollar’s monopoly is precarious and dangerous for many,” he said. “Our gold and currency reserves are being diversified, and we’ll continue to do that further…”

Putin acknowledged this week that since oil trades in dollars, “we are thinking of what needs to be done to free ourselves from that burden.”

Every world leader understands this, Putin’s just unique since he’s willing to come out and say it. It’s not just Russia though. People across the world have had just about enough of U.S. bullying and recognize USD dominance in the global financial system represents the key obstacle to overcome if they wish to avoid being pushed around forever.

Chinese leaders tend to speak less bluntly, but actions speak louder than words and China clearly has no intention of leaving Iran. It understands that becoming more involved in the Iranian economy, not less, is where the huge geopolitical gains are to be found. As we learned from a recent fascinating Bloomberg article, Iran’s Door to the West Is Slamming Shut, and That Leaves China:

To develop its $430 billion economy, Iran is being forced to rely on political allies in the east.

Trade with China has more than doubled since 2006, to $28 billion. The biggest chunk of Iran’s oil exports go to China, about $11 billion a year at current prices…

China is “already the winner,’’ said Dina Esfandiary, a fellow at the Centre for Science and Security Studies at King’s College in London, and co-author of the forthcoming ‘Triple Axis: Iran’s Relations With Russia and China’.

“Iran has slowly abandoned the idea of being open to the West,’’ she said. “The Chinese have been in Iran for the past 30 years. They have the contacts, the guys on the ground, the links to the local banks.’’

And they’re more willing to defy U.S. pressure as Trump slaps sanctions back on…

Airbus Group SE’s contract for 100 jetliners, worth about $19 billion at list prices, was already held up amid financing problems, and Treasury Secretary Steven Mnuchin said Tuesday that the export license will be revoked (Russian manufacturers could be the beneficiaries). Total SA has a contract to develop the South Pars gas field together with China National Petroleum Corp., but has signaled that it would pull out if the U.S. re-imposes sanctions and it can’t win an exemption. In that event, Iran says, the Chinese partner would take over Total’s share…

The Chinese have some workarounds that Europeans lack. There are many more Chinese companies with zero exposure to the U.S. And, since many of the Chinese businesses working in Iran are state-run, it’s relatively easy to set up special-purpose vehicles for bypassing U.S. regulations. “All they have to do is create a subsidiary that’s separate from the original entity, and they’re good to go,” said Esfandiary.

Chinese businesses are also likely to be more flexible about how they’re paid, says Batmanghelidj, citing a transaction he’s aware of where the European company declined to be paid in bonds…

China — along with Russia — is America’s main strategic rival, with big geopolitical ambitions. Central to them is a plan to crisscross Eurasia with a web of transportation and infrastructure links. Persia was on the old Silk Road, and Iran is at the heart of President Xi Jinping’s plans for a new one.

Chinese companies are building or funding railway lines to the eastern city of Mashhad and the Gulf port of Bushehr, under deals signed in the past year worth more than $2.2 billion. India was supposed to be developing the strategic port of Chabahar on the Arabian Sea., but repeated delays have prompted Iranian officials to turn to China in the hope of speeding up construction.

Much of Trump’s base supported him because they wanted the U.S. to focus on domestic issues as opposed to foreign adventurism. Ironically, he’s doing the exact opposite. Rather than tackling the country’s dilapidated infrastructure, continued theft by finance criminals and a completely rancid healthcare system, the national dialogue is now dominated by an embassy move to Jerusalem and heightened confrontation with Iran. I’m not sure what this is, but it’s certainly not “America First.”

Many Trump supporters like to say he’s playing “3D chess,” but in the case of Iran he isn’t playing chess at all — he’s playing checkers. His infatuation with Israel and Saudi Arabia, coupled with a deep-seated disdain for Iran is blinding him, and opening up a historic opportunity for China and Russia to make major geopolitical gains. Europe’s trying to hang out on the fence and see who comes out on top, but the outcome of such a game should not be in doubt. The results will be crystal clear by 2025.

Like all Presidents before him, the main campaign promises Trump's delivering on are the ones he made to oligarchs.

— Michael Krieger (@LibertyBlitz) May 14, 2018

I’ve written several detailed posts on this topic in recent weeks. Here are a few:

Trump Pulls Out of Iran Deal – U.S. Determined to Become a Rogue State

Part 1: The Road to 2025 – Prepare for a Multi-Polar World

Part 2: The Road to 2025 – Russia and China Have Had Enough

Part 3: The Road to 2025 –USD Dominated Financial System Will Fall Apart

Part 4: The Road to 2025 – A Very Bright Future If We Demand It

If you liked this article and enjoy my work, consider becoming a monthly Patron, or visit our Support Page to show your appreciation for independent content creators.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

i don’t think trump is obsessed with taking out iran, but rather just doing what putin tells him to do. http://www.citjourno.org/page-1

There is dim,and then there is your gormless comment D310.Lol

I’m starting to believe the “3D chess” motif of OJ’s presidency will soon be viewed as even more laughable than “Hope and change”, “WMDs”, and possibly even “Too big to fail”. Beating those whoppers is no small feat.

Though the results may be frightening, at least we’ll find out for sure before long. If the neocons really are holding Donald’s reins, they aren’t known for their patience, especially after watching the window close on GWB before they could get to Iran.

Trump may hasten the collapse of empire by doing, with enthusiasm, what Sheldon Adelson paid for, and clumsily, and rudely, and offensively…

Thing is – USD Empire crashes and burns if USA go further for truce with Iran

With killing JCPOA USD Empire rots and decays instead. Slowly and relatively peacefully.

http://cluborlov.blogspot.ru/2018/05/the-us-pulled-out-of-iran-nuclear-deal.html

So, Trump is making the choice from awful and catastrophic here

The notion that Trump and Putin are somehow dictating global monetary policy is quaint.

There has never been a truly fiat reserve currency, other than the USD.

It only rose to power because the US was the only developed economy left standing after two world wars… and it was coming off a war-time economy where it stepped up its manufacturing capacity to levels that dwarfed anything prior.

25 years later, we had the economic and military clout to convert to pure in 1971… we told the world we were dropping the gold standard and would be printing money in whatever amounts we deemed appropriate and if you don’t like it you can pound sand.

That is clout… and balls.

We basically centralized global economic policy.

Fiat requires centralization of authority. I don’t think the nations of the world are near a point that decentralization of monetary control is viable… and who else would you put in charge?

China does not offer the information security or judicial fidelity to play first fiddle in the global capital markets. Who wants to set up the financial market servers in China? Who considers China to be a good jurisdiction to seek remedy? Exactly…

Russia’s does not offer the economic diversity or the political stability necessary for the role… I shudder to speculate on a post-Putin Russia.

The EU will never be a viable economic entity until the individual nations fully surrender sovereignty to Brussels… and even then, would the EU openly defy the Fed and BOE and throw it’s apples in the China/Russia cart, all while preventing civil unrest? Not likely.

So, that leaves a potential extra/multi-national monetary entity, like a WTO or BIS, consisting of the BRICs plus Iran and some quasi-colonies in SE Asia and Africa? Not gonna happen unless it’s backed by gold or some TRUE gamechanger manifests in the cryptospace (sorry, BTC ain’t it).

And all that assumes the US won’t use foreign policy (a.k.a., economic and military violence) to subvert all of those efforts, every step of the way, AND that the current financial institutions are not simply compelled into non-participation…

Nope… Not worried…

I think the ascendance of multipolar currency environment could only come as a result of a calamity in the US of such magnitude that our domestic stability collapses and our deep-moated economy is so dislocated that we are rendered ineligible to carry-on as a world financial center and completely incapable of projecting economic or military power overseas.

If that happens, we’ve all got bigger fish to fry.

https://youtu.be/0hUrcGCQV1g

I hope for your sake that you really like fried fish, Nightnthebox.

I tend to believe that preparing for a catastrophe is simply malinvestment.

Better to deploy all necessary resources towards gleaning the greatest possible return from the most probable chain of events.

Considering our short life expectancy, maintenance of the status quo is the most probable shake-out of systemic turbulance.

Every generation has assumed “the end is nigh” and that their generation would see the apocalypse…

But every single one has proven utterly incorrect… Except maybe the Meso-American cultures of the 16th century. They were pretty right.

“maintenance of the status quo is the most probable shake-out of systemic turbulance”

Spoken like many an Englishman on this continent in the early 1770’s.

The end is nigh, and like all things that end, there is then a beginning which was born out of the end of an old worn out system.

BTW, there are far more examples throughout the course of human history of “the end” actually being a reality than just the Meso-Americans.

You might also want to check on the complete definition of “apocalypse” (See: prophecy).

I’m well-“versed” in Revelations and the Christian concept of Armageddon and the like. Just as for many others, it truly fascinated me for a time and I spent waaay too many hours exploring it (along with the end-times traditions of many other cultures) only to divine the following revelation: Prophecy is pure nonsense.

I would look at the time I spent on it as pure malinvestment were it not for the insights it gave me into human psychology.

And as for those un-Enlightened Englishman: sure, Change is the only guaranteed outcome for any situation. It is the unwavering Truth of the universe and THE defining characteristic of Existence.

BUT, for every generation that experiences a major upheaval in the status quo, there were multiple generations immediately preceding and following that did not experience such an upheaval. Therefore, the most probable experience will be maintenance of the status quo and one should invest accordingly.

Those generations passing away these days are the last ones who lived part of their lifes when planetary scale destruction was unthinkable.

And then there is this AI singularity, which can go very fast if it gets going.

Things happen much faster now than before. Status quo is becoming exponentially more difficult to maintain.

I’m not talking about biblical end times. What I am talking about is the complete dissolution of the current status quo that you are so convinced will remain the same that you’re willing to “invest” accordingly.

Have at it, man.”See ya’ in the funny papers”.

Sigh…

I recommend everyone on the planet should read:

The Compleat Strategyst” by J.D. Williams

Copyright, The RAND Corporation 1966

The concept of Dominance, when appropriately presented, is not difficult to grasp for those with moderate mental horsepower.

@Nightnthebox You should consider that we appear to be reverting to the norm of human existence, where a tiny minority of oligarchs own almost everything. The anomaly came in the 20th century with the emergence of a large middle class, but that appears to be fading away.

I don’t see anything stopping this tidal wave of financial graft. The banksters have gained such a degree of control that only two outcomes are still possible. They either retain control and keep skimming everyone else dry, or the whole system collapses. Both of those futures are very ugly.

Tengen, I do not see us ‘reverting’ to anything.

I don’t think we’ve ever strayed from that norm to which you refer.

In 2013, Credit Susie estimated that 3.2 billion people (2/3s of the global adult population) had a net worth of less than 10,000 USD. It wasn’t any different previously.

Admittedly, post WW2 there was a greater concentration of wealth in the middle class than previously experienced, attributable to many factors, but most importantly the easing of credit and excess Money creation. The world needed rebuilding and the potential wealth of the whole world was basically up for grabs again, with financing guaranteed by the US government and its ability to deficit spend at will. No one benefited more than US citizens.

But that middle class wealth condition was only anomoylous relative to the top 0.1%. The average brokeass peasant that makes up the vast majority of the global populations was still, and always will be, a brokeass peasant.

And that’s ok… I do not believe in wealth equality. I firmly believe that if you evenly divided up all global wealth amongst every household, within 2 generations we would see a similar level of wealth inequality because some people are more adept at accumulating and retaining wealth than others whether it be due to greater intelligence, greater acumen or greater industry. In fact, I think the whole concept of wealth redistribution and welfare efforts is simply a lie that oligarchs use to convince idiots to elect them, thereby giving them license to legitimize the hierarchal structure.

That could be remedied by stripping voting rights from the left hand side of the intelligence bell curve. If you can’t think critically, you have no business engaging in the political process. An intelligent and honorable electorate would require intelligent and honorable candidates. An electorate of imbeciles does the opposite.

Shocking notion, I know.

I am way up there on the worldwide wealth scale. But I am not in the creme de la creme… yet… nor would anyone consider me an oligarch… except a brokeass peasant. But they don’t know shit.

As members of the developed economic world, we should embrace the glorious system built for our benefit and honor it by learning to work it well.

Single best thing you can do to better your life is to grow your net worth without destroying your family. You do that by playing the odds and refusing to buy into the bullshit.

When people look at elections, they said Trump couldn’t win, becuase of his high unfavorablity. However, once he had actual opponents (Republican priamry cahllengers and Clinton), things changed. Simirlarly, it easy to say that the USD won’t hold its place as the global reserve currency until you look at the alterantives.

@Nightnthebox has done that (with the same arguements I have made in the past), and no one actually disputed his/her points. Sure, you might have some **bilateral** trades in foreign currencies, but do you think China will pay Euros for Iranian oil? Or will Russia accept the Yuan as payment from Europe for natural gas? Or maybe Germany will take Rubles when it exports machinery to China? All ridiculous scenarios.

There is one long-term (15+ years) economic scenario that could dethrone the USD: the fact that China is taking over from the US (which took over from Europe) as the leading lender/invetor to third world countries could be a game changer if those third world economies develope signifcant econmic strength. Currently, USD-denominated loans saddle countries with no choice but to obtain dollars to repay those loans. It is ironic that the poorest countries in the world may provide the key for China to end USD domination.

The only other scenario that would cause a major world-wide economic dominace shuffle is another World War. However, the isolation of the US realtive to other militaries (not to mention it’s abnormally large defense force) would give the US a major advantage, just as it did in the past. The one weakness of the US is also it’s major strength: its high dependance on techonology. While I’m sure that the cyber-weapons of the US are second to none, there are far too many vulnerabilities in its cyber-defense. This same scenario would also increase the relative econmic power of third world countries: even if they suffered the same scale of cyber-destruction, the ciitzens of poor countries would be much more able to go about their daily lives.

I concur.

“The only other scenario that would cause a major world-wide economic dominace shuffle is another World War.”

There’s a third scenario typically referred to as a “Black Swan”. But what if there were multiple Black Swans combined with your China/USD and world war scenarios?

Nightinthebox fancies himself a critical thinker, and that may be true to an extent. What we are going to see will blow the limits of that extent to places that very few people can imagine at this particular point in time.

He thinks he’s a “pretty astute observer of the human scene”. That’ll change dramatically when he meets his personal version of Big Dan Teague.

https://www.youtube.com/watch?v=RP0oDhYnUSQ

I love me some Big Dan Teague! We share the Gift of the Gab.

Genaro, you make my point excellently, sir, though I suspect that may not have been your intention.

You say “what we are going to see will blow the limits of that extent to places that very few people can imagine.”

So basically, your contention is that ‘it’s gonna be major and you’ll never see it coming’… sound about right?

Well, sir, I agree with you completely: At some point in time, shit will happen.

Furthermore, when that shit does happen, probability indicates it will NOT manifest as one of the “pre-chosen forms” (mad-kudos to anyone who can give me that movie reference) and the resulting post-shit environment may be best described as ‘alien’.

Full agreement.

But when will it happen? Ever trade options?

My point: if you can reliably predict neither WHAT will happen, NOR WHEN, then your only viable strategy is to act as if nothing major will happen in the allotted time frame.

Analogy time:

Imagine you are forced to play some random sport, at some point in the future, and if you don’t win, your family dies.

How do you train if you don’t know the sport?

It could be tennis… it could be baseball… it could be the bobsled… it could be judo… it could be hockey or curling or skiing…

You’d probably train differently for each sport, right?

But if you don’t what the sport will be, then what?

Well, a prudent person would try to train broadly, lots of cardio and cross-training, trying to build up your general strength, stamina, and flexibility, focusing on skills shared by as many different sports as possible… and hope for the best come gametime, right?

What you DON’T do is assume the sport will be something soooo different that none of the usual skills will be of any use…

If you don’t know WHEN the game will be played, you don’t assume it will be hockey and spend all your time learning to ice skate, a skill that doesn’t crossover well.

And you CERTAINLY DON’T assume the sport is going to be the bobsled and move to the mountains, buy a bobsled and build a track…

Building your net worth is the cardio and general cross-training of finance.

Chances are net worth today will be convertible into some amount buying power at some point in the future, regardless of what happens.

And if nothing major happens, you’ve grown your net worth. Cha-ching

Best way to build net worth is to play the game AS IT IS RIGHT NOW, assuming it will be of value later, versus bitching about it not being fair and scaring everyone else into thinking they need to buy a bobsled.

Hey Krieger as a long-time reader (2011) I was aghast seeing you on a panel with known paid shills like “Vortex” and Hoffman and whatever the chubby guy’s name is, Thomas Hunt I think, and hear you use the derogatory term “Bcash.”

I’m aghast because you understand markets and the Core devs approach to managing the currency is about as central planning as possible by creating artificial blockspace scarcity to fix prices higher. This is basic stuff man and a guy like you should know better. Pity to see someone I admire go to the dark side.

The bottom line is that even at 1MB Satoshi set the temporary cap 100x higher than utilized capacity because he DID understand the market idiocy of creating artificial scarcity.

I hope you didn’t sell your Bcash out of the gate Mike because the 85% of big-block SHA 256 miners have yet to speak and they will NOT allow users to flee to ETH the next time BTC fees spike. They will be forced to chose a winner and they will choose BCH for two basic reasons: 1) More users = more revenue is the scaling roadmap they signed up for, and 2) They’ve hoarded over 500k BCH in two addresses alone which will rise 10x on a flippening, far outweighing any short term revenue boost from higher BTC fees. https://bitinfocharts.com/top-100-richest-bitcoin%20cash-addresses.html

Remember this when Blockstream investor Trace Mayer and others start screaming “Jihan!”: Satoshi’s genius was to turn greed against itself to protect wealth instead of steal it. The miners’ profits secure the network. Blockstream/Core are attacking the miners’ economic incentive therefore they are attacking the security of bitcoin. You should expect the system to rebalance itself by the miners following their self interest as per Satoshi’s design.

In point you just don’t understand that bitcoin is a self-regulated system driven by economic incentives. In spite of all of your past insightful work on markets you have gone full central planning Mike. And you don’t even know it.

“and the resulting post-shit environment may be best described as ‘alien’.”

You’re getting warmer….

Reeaaalllyyy…. wow… and here I thought there was a tacit agreement to stay in the realm of the semi-rational.

I’m out.

Crypto zealots make themselves a touch too east to spot, don’t they?