Recently dismissed U.S. Attorney for the Southern District of New York, Preet Bharara, is suddenly being celebrated as an aggressive warrior in the fight against Wall Street corruption. Really? You could’ve fooled me. Perhaps I was in a coma when a string of big bank executives were arrested and sent to prison.

No, what actually happened is one of the most powerful attorneys in the nation came up with a mealy-mouthed, cowardly rationale for why he let these financial thieves off the hook.

Crain’s reports:

Bharara was nowhere to be found when it came to charging the top executives whose actions led to the collapse of Lehman Brothers, Merrill Lynch and AIG, and who made all manner of misleading statements to cover up how sick their firms were. Goldman Sachs executives sold institutional investors a mortgage-backed security that sales staffers described as “one shitty deal.” Where was Bharara when it mattered most?

We don’t have to wonder for too long because the prosecutor explained his actions—or lack thereof—at a Crain’s forum three years ago. Bharara said at the time that he didn’t think he could win a case against Wall Street top dogs because they had hired advisers assuring them what they were doing was legal.

“What you do have to prove is criminal intent,” he said. “And it’s very difficult if a bank president has in his hands a letter or opinion from a law firm or accountant saying, ‘If you do X, Y and Z when you sell these mortgage-backed securities, you’re good.’

“Now it may make you angry,” he told the audience. “But if you have the opinion, it is a very difficult thing [for a prosecutor] when they say, ‘I asked my lawyers to do the best they could to tell me what I’m supposed to do.'”

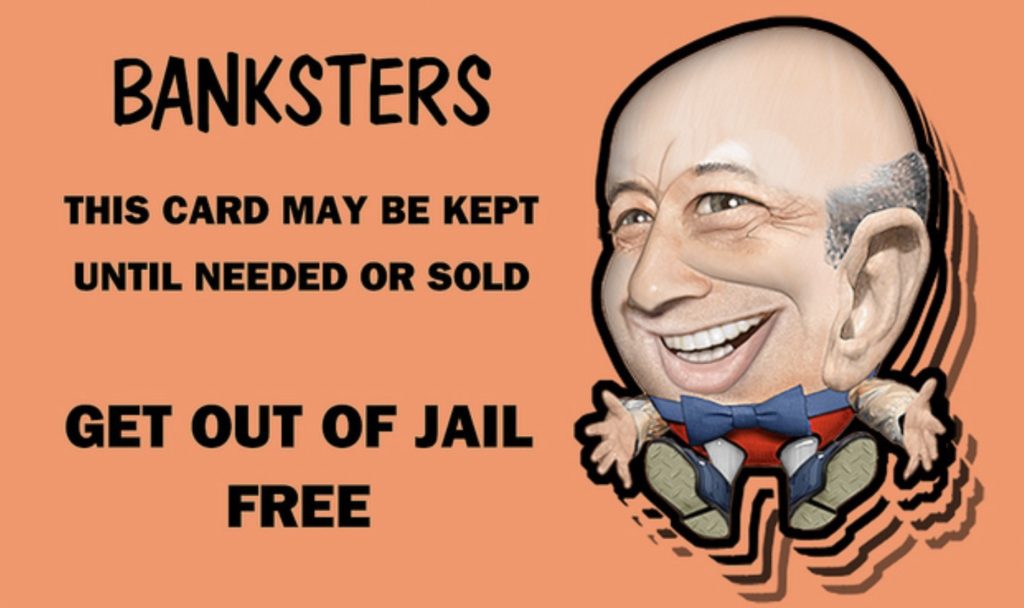

Read those statements again. The leading white-collar prosecutor in the country said that advice from the right lawyer or accountant is tantamount to a get-out-of-jail-free card.

Jesse Eisinger, a Pulitzer Prize–winning business reporter, will soon have a book out explaining how federal prosecutors lost their nerve to bring Wall Street leaders to justice. Its title is The Chickenshit Club.

Now that sounds like a book worth reading.

If you enjoyed this post, and want to contribute to genuine, independent media, consider visiting our Support Page.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

all of wall street should be in jail along with washington d.c. , lawyers, bankers and politicians are low life scum and should be treated as such . this nation would be better off for it .

While those of us with tender sensibilities may regret the coarsening of language that seems to be widespread in public discourse today, the truth is there has been way too much tsk tsking and not enough hell raising when it comes to the brazen asset striping these frauds allowed.

Sometimes you do have to be more direct and I can’t think of a more apt description of those whose job was to protect the investing public from the predator class…and soiled themselves in fear of what it would do to their future job prospects.

The Chickenshit Club? That’s a just a gentle rebuke.

Preet knows he is a scumbag. His “I was fired” tweet was simple PR spin. He is a big boy. HE IS NOT STUPID. Preet knows Obama fired 92 Attorneys. Thanks for this piece. Shines light on #chickenshit

My major recollection of this arrogant douchebag was when he issued a subpoena for Reason’s blog commentators after they had posted harsh rebukes of the Federal judge who put Ross Ulbricht (the alleged Dread Pirate Roberts of the Silk Road dark web) in prison for life w/o the the possibility of parole.

http://reason.com/blog/2015/06/19/government-stifles-speech

Then, after issuing the subpoena, he issued a gag order prohibiting Reason from even discussing the matter. What First Amendment?

And yet the Wall St. criminals got to skate — the ultimate legacy of the Obama DOJ.

(A great doco on the Ulbricht kangaroo trial is “Deep Web”. Two of the Federal investigators who helped prosecute him were later arrested and charged with breaking any manner of laws.)

then why didn’t he charge the lawyers? this is just b.s.

this guy is a politician, pure and simple.

“But if you have the opinion, it is a very difficult thing [for a prosecutor] when they say, ‘I asked my lawyers to do the best they could to tell me what I’m supposed to do.”

“Very difficult?” Welcome to life. If you don’t even try, then it becomes even harder for the guy after you.

Charge them under the RICO act. Many financial crimes fit under this act.

Then Simply…Arrest the Lawyers and Accountants…..lolol

I found out what the problem is… but while it may not really be newsworthy to readers here, It may be news to those on a steady diet of mainstream media People working deep in the networks, who know the truth are beginning to open up to Wikileaks and anonymous about the imbalance. Look at this Joda meme More… http://www.GroupsStartup.net/

It’s called discovery and if he had charged them discovery of government approval would be forced into the public square.

A Bit off the topic, but you remember the movie Absence of Malice where a DOJ attorney leaked ‘fake news” to a reporter about an innocent man. When the reporter and editor consulted the paper’s attorney, he sneered and said:

I’m telling you, madam, that as a matter of law, the truth of your story is irrelevant. We have no knowledge that the story is false, therefore we’re absent malice, we’ve been both reasonable and prudent, therefore we’re not negligent. We may say whatever we like to say about Mr. Gallagher, and he is powerless to do us harm. Democracy is served.

Reprinted from Caribbean News Now!

caribbeannewsnow.com

Breaking News: The $70 billion Puerto Rico bond fraud

Published on April 6, 2017

By Richard Lawless

Senator Jeff Sessions apparently participated in a $70 billion Wall Street bond fraud and is now using his position as attorney general to squash all criminal investigations.

Richard Lawless is a former senior banker who has specialized in evaluating and granting debt for over 25 years. He has a Master’s Degree in Finance from the University of San Diego and Bachelor’s Degree from Pepperdine University. He sits on several corporate boards and actively writes for several finance publications. Reference material is available at http://www.wallstfraud.com .

In April through June of last year, Senator Sessions’ office was provided with Securities and Exchange Commission (SEC) financial audits and legal documents reflecting widespread criminal behavior by Wall Street executives. This activity resulted in the issue of $70 billion in fraudulent Puerto Rico municipal bonds.

Aware of this activity, the senator moved forward to vote for the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) legislation in June, revoking all the legal rights of the innocent bond holders and confiscating the remainder of their money. PROMESA even prevented any of the victims from suing. The senator was handsomely rewarded with political contributions from those who benefited and possibly the attorney general position.

As attorney general, Sessions has used his authority to kill any investigations by the FBI or any prosecution by the US Attorney’s office.

According to the SEC, 69 percent of these bonds were purchased by retail investors (individuals) to supplement their retirement income. To date, $34 billion has been stolen and the rest is under the control of those that committed the crimes.

There are thousands of cases of documented wire fraud and mail fraud related to this criminal enterprise. There are civil rights issues and endless Dodd-Frank securities violations. Several private parties, desperate for justice, have filed Racketeer Influenced and Corrupt Organizations (RICO) Act lawsuits.

A few months ago, six senators wrote to the SEC and FBI requesting they investigate this further. The Department of Justice has ignored all the requests. The SEC will not comment.

Tuesday, June 14, 2016

WASHINGTON, DC – On the day Mary Jo White, Chair of the Securities and Exchange Commission (SEC), appeared before the Senate Banking Committee, U.S. Senator Bob Menendez (D-N.J.) led a letter to her calling on the agency to investigate potential fraud and illegal conduct, which may have contributed to Puerto Rico’s debt crisis. Sens. Elizabeth Warren (D-Mass.), Chuck Schumer (D-N.Y.), Kirsten Gillibrand (D-N.Y.), Bernie Sanders (D-Vt.), Jeff Merkley (D-Ore.) and Richard Blumenthal (D-Conn.) co-signed the letter.

This is a case that redefines political corruption and our legislators need to vote for a special prosecutor to get to the bottom of this.

Victims TV Commercial

https://www.youtube.com/watch?v=gfEh14S58jY&feature=youtu.be

60 Minute Press Conference Recapping FBI testimony