I see many economists and entrepreneurs as opponents even if that is not the intention of the economists. Academic economists are most needed by those who have power and want to keep it. Multinational corporations, banks, and governments. The last thing those entities want is disruption, their principal and interlocking goals are stabilization and optimization of the existing order. They have an incentive to “optimize” the current system and extract rents.

I would argue that hyper focus on optimization is the enemy of creative beings such as ourselves and makes us very unhappy and leads to blow-back from human beings. And rightfully so. But that blow back can get ugly.

– From the piece: Energy, Money, and the Destruction of Equilibrium

Earlier today, a reader named Brett Maverick Musser, who works in Operations at Airbitz sent me an article he published on Medium, which I thought was excellent.

With permission, I have reposted the entire piece below:

Energy flux is the driver of change in our galaxy. Nothing happens without a flow of energy. And what is energy? Energy is the ability to perform useful work. And in physics, what is useful work? Work is useful if it overcomes inertia or resistance in order to generate motion.

Energy not money makes the world go round. Energy is destiny.

A Failed Paradigm and Fake Prices

To paraphrase Paul Romer author of the scathing paper “The Trouble With Macro”, economics has had a ‘considerable observed regression since the 1970s’ yet hides behind mathematical elegance and authority that the public at large is not sophisticated enough to rebuke nor powerful enough to eschew. Never ending zero interest rate policies, negative interest rates and other forms of financial alchemy perpetuated by central banks all over the world are intellectual concessions that the existing paradigm of economic thought and authority is just flat wrong. No matter what the economic leaders say, these actions prove to me and many others that their mental models of the world have failed. The status quo has ventured into the shallow sea of un-reason just to keep the global socio-economic system afloat. They’re able to hide behind authority and academic vocabulary which if put in plain terms for the lay person could be described as theft, ponzi, tyrannical and moronic.

Many were shocked at how wrong the media was about the entire democratic mood and political conditions of not just the United States but much of the world. It is scary for me to know that they know orders of magnitude less about economics and even worse the people they run to for guidance have failed the world miserably. And a HUGE part of the media’s predictive incompetence and narrative without substance is their economic incompetence. Many with the right economic lens could see the Donald Trump and Brexit phenomena from a mile away but this was an embarrassingly tiny percentage of the professional talking class who are supposed to inform the public.

The United States and much of the Western World has been put to sleep by nice, well meaning leaders(Barack Obama, Angela Merkel, etc) and their bloviating media sycophants. Unfortunately most have barely noticed the emergency financial measures put in place after the 2008 financial crisis are still very much in place all over the world and have even intensified. If the world economy was doing so well why is it under constant central bank life support?

The narrative parroted by the Western propaganda agencies NYT, CNN, NBC, BBC etc have been one of economic recovery justified by a flurry of statistical measures that any close analysis would dispel any perception of a well functioning economy for everyone. If looked through the prism of the common man and woman, centralization of financial power, and the fiscal sustainability of nation states this “recovery” has been an abject failure. If looked through the prism of increasing returns on assets owned by the asset owning population and super rich, then it’s been an overwhelming success.

Stock indices have gone through the roof on embarrassingly anemic world wide growth and nearly all those returns go to a very small percentage of the global population.

Financial markets have morphed into state propaganda tools yielding no useful information about actual economic conditions but rather the primacy of central bank alchemy and the greater fool theory of investing. Fake prices are way more dangerous than fake news because fake prices are intimately tied to resource allocation leading to large market distortions, fraud, and inequality. Many get the false impression that information in the form of an Arabic number are just facts that can’t be disputed. The stock market is up! The economy must be good! Government statisticians say unemployment is at 5%! Things must be great! Facts! Science man!

Last year the Bank of Japan was the biggest buyer of Japanese ETF’s, the ECB hasn’t found a corporate bond it doesn’t like, and the Federal Reserve knows it can’t raise interest rates in any substantial way without popping huge fat bubbles in the bond, stock, real estate, and auto loan markets.

These popular movements all over the west are aiming to disrupt, deconstruct, and transform. They are not the problem but the symptom of a system that is bankrupt partly because the underlying intellectual foundations are bankrupt. The world is yelling and puking because it’s sick.

These poisons include government backed inflationary money, flawed economic theory, and an immature understanding of risk. All of these have worked in conjunction to produce a fragile global financial system full of populations finally waking up from their credit based consuming binge and media induced coma.

Follow the Money

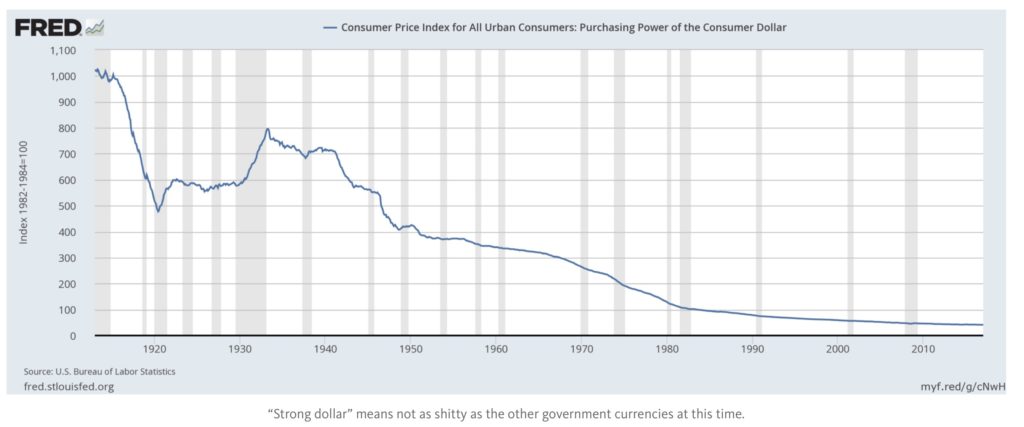

Inflationary money is the scourge of the common person and a boon to those who have privileged access to money. The longer one holds a dollar the less and less it buys overtime without fail. This is done on purpose and is a deliberate policy tool used by governments for various reasons and backed up with economic academic authority. No matter what the theories purport to aim for, in practice inflationary money allows for maximum purchasing power by those who first receive the newly minted currency and cheapens their liabilities i.e banks, governments, and multinationals. Once that dollar trickles down to the bottom of the social ladder it buys a fraction of the goods and services it used to buy. And whatever savings the bottom of the population has is eventually inflated away in the name of bank bailouts and never ending government deficits to fuel more demand.

The young working poor and working middle exist mostly on a cash economy, they don’t have real estate but if they do have real estate its just an over leveraged structure they work hard to get the privilege of sleeping in at night. Of course only after work. They don’t have well diversified portfolios, they don’t have tax advisors, and they don’t own businesses. They usually hold unsophisticated forms of cash. And you might not see the inflation per se in consumer goods or technology which is deflationary but you’ll see inflation in asset prices which disproportionately favor the old and rich while keeping the young and poor out of assets they might otherwise afford if their money kept its purchasing power over time.

This rapid asset inflation coupled with insignificant economic growth makes it hard for those at the bottom to dependably build wealth and become independent, self-sustaining citizens over time. Independent, self determined human beings are the lynch pin of a free, self governing society. Instead we have a nation of debt serfs who move up in the world by being allowed to borrow more i.e. credit cards, pay day loans, student loans, auto loans, mortgages, etc.

Inflationary money also encourages spending/consuming behavior instead of saving behavior which is the only way to increase wealth overtime and the hall mark of a sustainable long term society. Inflationary money transforms a society of prudent savers into a society of mindless consumers, hell bent on shortermism which we can see manifest itself not only in our transactional lives but also in our culture and government. Why hold on to something when it becomes worth-less over time?

One of the key attributes of money is the preservation of value. This is especially true for those that depend on money. Gold for this very reason has stood the test of time in the free market of money for thousands of years partly because it’s an element that is resistant to entropic forces, meaning it lasts overtime and everything else doesn’t. Everyone could trust that their labor value could be stored for very long periods of time and not decay in anyway, a powerful concept early in man’s history. And naturally when you have something that doesn’t decay or inflate away you want to store it and hold on to it and only trade it for something else when necessary.

Inflationary money punishes you for holding on to it for too long.

Its the Energy Stupid

Contrary to popular belief; energy, not money makes the world go round.

Printing more and more money will not make your economy better, it’ll weaken it, distort it, and eventually infect the culture. Money is the common unit of trust that bonds everyone together. There is nothing that is truly common throughout the 50 states more than our belief in and use of the US dollar for economic calculation, value storage, and economic transactions.

The slow measured desecration of the one thing that actually holds us all together will lead to and has led to a breakdown in trust between people, groups and institutions. This trend will continue as long as our financial alchemy continues.

Physicists and those of the historical sense posit over and over again that energy is everything. I call for an economic system that is intellectually and practically rooted in energy and is focused on the transformation of energy towards useful work not one sustained by financial engineering.

Unfortunately our collective productivity or ability to perform useful work has been declining ever since moving off an energy intensive money system to one that is managed by international banks and their nation state offshoots.

We’ve descended into an agrarian-like economic growth environment.

When the cost of money creation is basically nothing and its a good that can be exchanged for anything else, it makes sense that so many of the wealthiest come from the financial industry. They get a declining asset first, and it always gets replenished with no energy cost to them. Its no wonder we’ve become less productive as our financial system has taken over our means of production and has effectively turned the global economic system into a giant private equity LBO where money is debt, profits are private, losses are socialized, workers are commoditized , and the world with all of its complexity and ambiguity reduced to an impressive excel spread sheet.

Parasitic finance disguised as free markets, free trade, globalization, and inclusiveness. Creation and transformation is not the prerogative but a successful financial exit. A transactional society not a meaningful society.

Energeia

Darwinian evolution itself can be characterized as increasing energy consumption and efficiency at the individual and species level. The key to biological evolution is to become better and better at capturing external energy supplies. The same goes for economic “evolution” if we think of the economy as an evolving organic system full of complex human beings.

The agricultural revolution allowed the human population to overcome the limitations of hunter gatherer energy cultivation. As a consequence of agriculture’s ability to fuel more and more human beings and free up human energy for more sophisticated tasks, the complexity and consciousness of our individuals and our collectives went up an evolutionary notch.

Likewise, coal was the basis on which the first industrial revolution was born and the ability to use petroleum birthed the second industrial revolution and has made our modern world possible.

Fossil fuels are cheap, abundant resources but we have yet to find a viable, scalable, and affordable alternative that can handle the sheer amount of energy demand modern societies need to function and are incentivized to consume. Remember, there is never enough consumption. There is never enough demand for those of the Krugman School.

Both coal and petroleum spawned all types of new products, industries, and social relations that are directly related and attributable to that specific resource. A huge economic leap forward will only be possible through cultivation of another energy source, more knowledge about our current sources, and a reorganization of our collective human energy.

Geo-politics is hyper focused on energy resources for a reason. Without it, we wouldn’t be able to defend ourselves, our societies would literally stagnate and billions would starve.

We can only imagine what new types of products, organizations, and social relations emerge from a new energy source.

Equilibrium? Wait…Whut?

Energy flux(change) is so fundamental to how our universe operates, yet a large amount of economic analysis depends on the incorrect idea that economies are in equilibrium or want to be in that state. The concept of equilibrium in physics or economics means a state in which essentially nothing happens. Unfortunately as Heraclitus and other ancient luminaries have often reminded us, change is the only constant.

We clamor for economic growth yet our experts’ models depend on the concept of equilibrium which is almost oxymoronic if our goal is growth. There is no growth or change in a state of equilibrium.

We want an economic system that is dynamic and changes with the changing social and physical reality not one that tries to keep its current “equilibrium”. Unsurprisingly almost all large economic models are based on equilibrium conditions and are always looking to “stabilize” or “optimize” the economy in its current state especially when its in a crisis.

Optimization of a system maximizes the effectiveness of a certain model of operation. This is perfect for incumbents who want to lock in their place in the world and maximize their profit potential. However to evolve consciously as a species we need to leave room for experimentation, iterations, chaos i.e. “mistakes”. This isn’t optimal within an existing system but allows for a new model to emerge and replace the existing system. A systemic self-overcoming. An unfolding of sorts.Truly creative destruction.

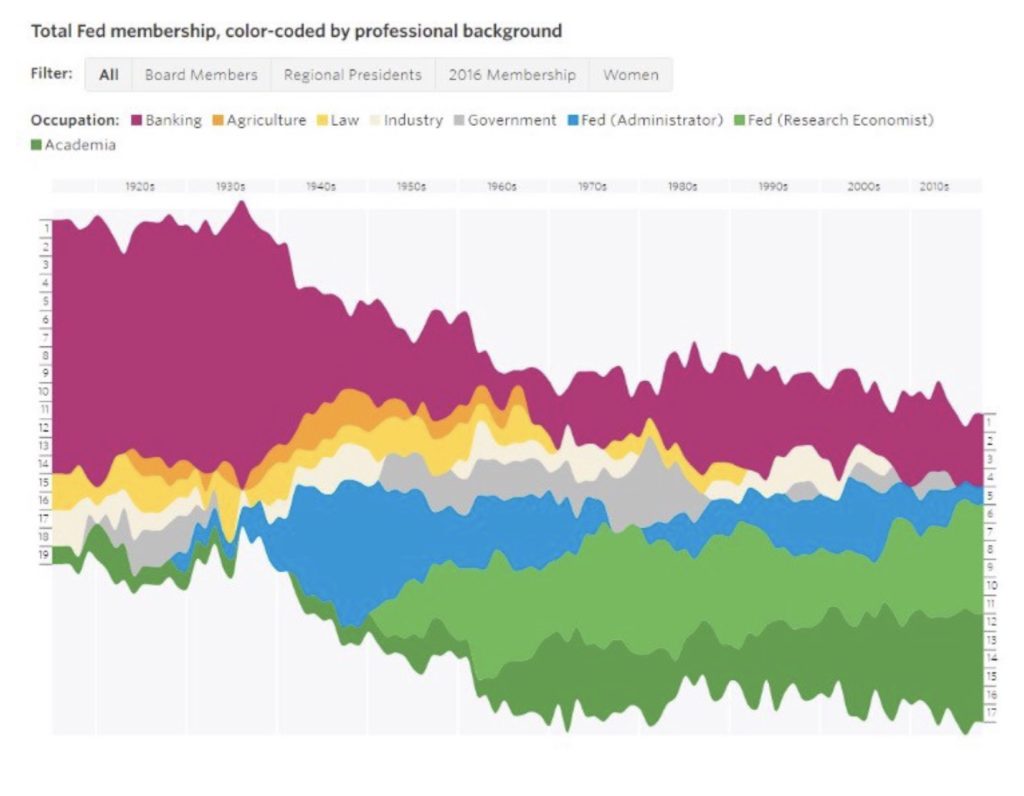

I see many economists and entrepreneurs as opponents even if that is not the intention of the economists. Academic economists are most needed by those who have power and want to keep it. Multinational corporations, banks, and governments. The last thing those entities want is disruption, their principal and interlocking goals are stabilization and optimization of the existing order. They have an incentive to “optimize” the current system and extract rents.

I would argue that hyper focus on optimization is the enemy of creative beings such as ourselves and makes us very unhappy and leads to blow-back from human beings. And rightfully so. But that blow back can get ugly.

Embrace the Chaos

“It is no different with the faith with which so many materialistic scientists rest content nowadays, the faith in a world that is supposed to have its equivalent and its measure in human thought and human valuations- a ‘world of truth’ that can be mastered completely and forever with the aid of our square little reason. What? Do we really want to permit existence to be degraded for us like this — reduced to a mere exercise for a calculator and an indoor diversion for mathematicians? Above all one should not wish to divest existence of its rich ambiguity: that is a dictate of good taste, gentleman, the taste for reverence for everything that lies beyond your horizon. That the only justifiable interpretation of the world should be one in which you are justified because one can continue to work and do research scientifically in your sense (you really mean mechanistically?)-an interpretation that permits counting, calculating, weighing, seeing, and touching, and nothing more- that is a crudity and naïveté, assuming that is not a mental illness, an idiocy.” — Friedrich Nietzsche

If you’ve ever taken a standard economics class the concept of equilibrium will undoubtedly be a part of the curriculum, probably in the form of a supply and demand graph. Unfortunately there is no proof that the equilibrium described even exists in an economic context or that an evolving complex system wants to be in a state of equilibrium.

If economics is going to be treated as a science it should have assumptions that are empirically derived from actual observations. Empirically derived assumptions allow for a coherent set of theorems to emerge that coincide with economic reality. There’s lots of literature debunking “equilibrium” as a useful assumption yet it is still used in economic models and taught in our elite universities and trickles down from there.

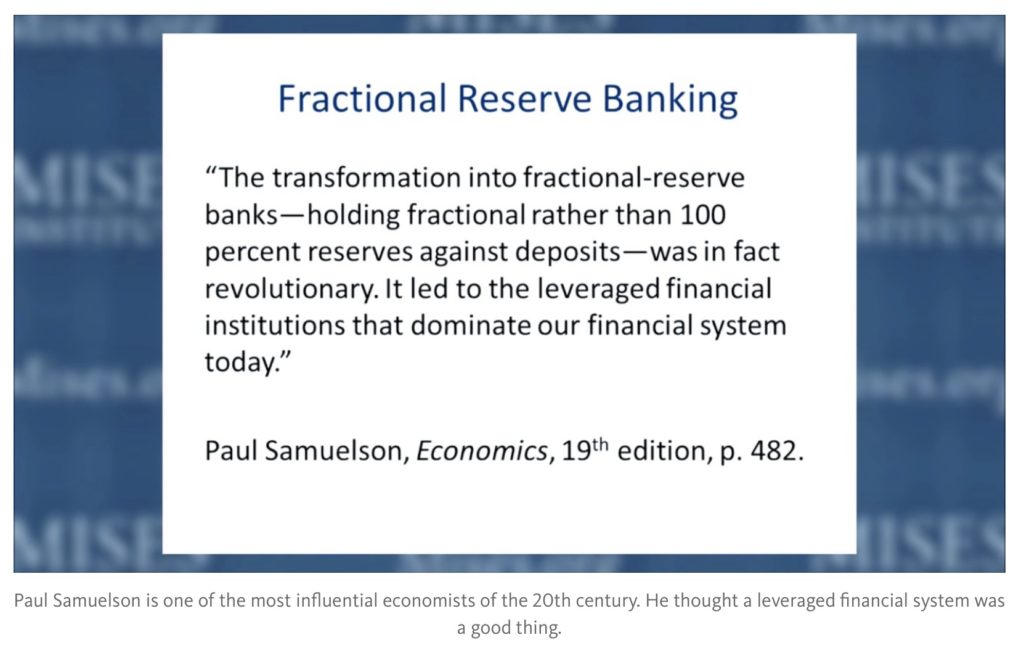

The taking down of the concept of “general equilibrium” strikes at the very foundation of mainstream economic thought. Economists are very intelligent men and women, but naturally a profession with a core assumption of equilibrium they are going to be employed and funded by people who want the existing equilibrium to perpetuate and optimize it to its highest efficiency. The bankers and government leaders essentially hired the economists to perpetuate a certain paradigm.

This is not to say that everything economists say, think, or recommend is bogus, far from it but the intellectual foundation of their thinking and our system is fundamentally flawed. Any builder would know that a shaky foundation will cause the collapse of any structure no matter how sophisticated the engineering on top of it happens to be. Unfortunately, their mathematical elegance is worthless if the starting assumptions are not empirically derived from actual observations in the universe! What a thought!

The new academic generation needs to tear down the concept of general equilibrium. Their forbearers went off on a flawed intellectual tangent and there needs to be a rehashing of some old debates that are philosophical in nature and value driven. The economic intelligentsia need to re-evaluate old assumptions and build from the ground up a respectable economic discipline that has a firm epistemological foundation.

Rooted in Energy, Not Faith In Confiscation

The first order of business from a practical perspective is to fix our international monetary system which is built upon our collective faith in the US dollar. The faith in the US dollar is really built on the domestic and international belief that the United States government will tax its citizens the appropriate amount at the right time and they can afford it. Put in more harsh language its the belief that the United States government can confiscate wealth from its electorate when appropriate. This puts the feds in a predatory financial relationship with the electorate even though many in the government may be well intentioned. The positioning matters.

What we need is money or monies that are rooted in energy not the extraction of wealth from the citizens of a nation state. Both gold and bitcoin are monies that are rooted in the transformation of energy. Bitcoin has its Proof of Work algorithm and gold has the physical mining process. The creation of state money is controlled by the minds of technocrats who are heavily immersed and heavily incentivized to perpetuate a system of equilibrium not one of transformation. It takes very little energy for central banks to create more and more currency to keep their shareholders afloat.

In contrast, bitcoin and gold are heavily energy intensive and require a massive amount of energy to produce and maintain. There are large costs to “mining” bitcoin or gold. The producers of them take huge risks. They have skin in the game, they are subject to organic market pressures, and there are physical limits to their efforts. And lets remember both have a rare supply.

Both bitcoin and gold are rooted in the laws of thermodynamics while the current economic theory and practice is openly inconsistent with those laws. The question becomes do you want a monetary system actively stabilized by the minds of persons with flawed models or one that is rooted in physical laws? I’ll take the latter.

Energy, not money makes the world go round. Energy is destiny.

When physical systems get pushed “far from equilibrium,” they escape this chaos by leaping into a higher-level state of organized order — as when water that is chaotically rushing down the drain suddenly leaps into a perfect downward swirling whirlpool — referred to simply as “order out of chaos.” If nonliving matter inherently possesses this drive to self-organization and order out of chaos, living systems certainly do — and that definitely includes evolution — a drive that philosophers often call “Eros,” an inherent dynamic toward greater and greater wholeness, unity, complexity, and consciousness. — Ken Wilber

Source: Energy, Money, and the Destruction of Equilibrium.

If you appreciate our work, and want to contribute to genuine, independent media, consider visiting our Support Page.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Energy flux is the rate of transfer of energy through a surface. Certainly in my experience trying to optimize in certain situations has caused me screw everything up.

Interesting read. Of course everything built by civilization requires energy to build it, from the food and water the population ingests to what they produce.Of course allowing the money creation business to be dominated by private for profit corporations and its preferred share owners dominating an entourage of productive corporations and government corporations is sure folly that human kind has foisted upon itself. And of course the author has it dead nuts right that those at the apex want to keep the status quo with them as masters of all they see in place.

View this for an honest critique of today’s mainstream economic and economists: https://www.youtube.com/watch?v=KIaXVntqlUE

I really don’t agree with this energy, bitcoin, gold connection, and neccessity for effortful CPU frazzling, or physical mining money, the ‘mining’ in bitcoin is intellectually regressive, it’s a waste of energy..

Ok it may be necessary according to the current paradigm to underpin the whole thing, or protect ourselves from ourselves, but a pretty convoluted

the most intelligent system of all would be a zero energy money system, without arbritary limits, or needless energy consumption

.. ie simply the direction of imagination, will, choice, positivity, and facilitation and direction of real world energy, people, materials, ideas..

That sounds a lot like frictionless fiat money..

But humanity cant seem to get its act together, so if we have to use regressive high energy cost money with artificial limits.. that is sad I guess, (and another case of the tail wagging the dog)

the choice to decide ‘mining’ is worth something is an idea, an agreement, and therefore there is no money objectively worth something due to being mined..

We may aswell use our ideas to stop wasting energy, and collectively agree something less arbritary..

Why is neo-liberalism going so wrong?

Underlying it is 1920s neo-classical economics leading to a 1920s world and progressing from there.

1920s/2000s – high inequality, high banker pay, low regulation, low taxes for the wealthy, robber barons (CEOs), reckless bankers, globalisation phase

1929/2008 – Wall Street crash

1930s/2010s – Global recession, currency wars, rising nationalism and extremism

How did this failed economics re-surface?

To give neoclassical economics credibility it was called scientific and a “Nobel” prize was created.

“The economics prize is a bit different. It was created by Sweden’s Central Bank in 1969, nearly 75 years later. The award’s real name is the “Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel.” It was not established by Nobel, but supposedly in memory of Nobel.”

The “Nobel” prizes helped to give the refurbished neoclassical economics credibility and allow it to push out the old Keynesian ideas (goodbye equality).

Under-lying neo-liberalism was a massive confidence trick to get an old failed economics back that generates 1920s levels of inequality.

How do you get the rich and powerful on board?

Appeal to their vanity by telling them they are special and they are at the top because they deserve it, they deserve their rewards. The rewards appeal to their wallets too, they are going to love it.

well i have not had time to read the full article but it is obvious from your opening statement that you have a strong economical bias. the two basics of the universe are energy and information. information being the function of energy. energy being the substance of information. not useful work, who gets to define useful? the polluted human mind full of discriminatory opinions, rhetoric and habit. promise to read full article cheers G.

another self deluded false prophet, hiding behind semantics and self righteousness.

With regards to the “Rooted in Energy, Not Faith In Confiscation“ section about the government’s ability to confiscate its citizens wealth. This ability would be greatly diminished if those citizens knew weather they were state citizens or federal citizens and acted accordingly.

“The United States government is a foreign corporation with respect to a state.” [Merriam’s Estate, 36 N.E. 505, 141 N.Y. 479, affirmed U.S. v. Perkins, 16 S.Ct. 1073, 163 U.S. 625, 41 L.Ed 287] [19 C.J.S. 883]

“There is a distinction between citizenship of the United States and citizenship of a particular state, and a person may be the former without being the latter. [Alla v. Kornfeld, 84 F.Supp. 823] [(1949)]

More info here:

http://famguardian.org/Subjects/Taxes/taxes.htm#CITIZENSHIP

If you want things biased in your favour, bias the economics that everything runs on.

The Classical Economists looked out on a world of small state, basic capitalism in the 18th and 19th Centuries and observed it. It is nothing like our expectations today because they are just made up.

Adam Smith in the 18th century:

“The Labour and time of the poor is in civilised countries sacrificed to the maintaining of the rich in ease and luxury. The Landlord is maintained in idleness and luxury by the labour of his tenants. The moneyed man is supported by his extractions from the industrious merchant and the needy who are obliged to support him in ease by a return for the use of his money.”

We still have a UK aristocracy that is maintained in luxury and leisure and can see associates of the Royal Family that are maintained in luxury and leisure by trust funds. As these people are doing nothing productive, nothing can be trickling down, the system is trickling up to maintain them.

Adam Smith in the 18th century:

“But the rate of profit does not, like rent and wages, rise with the prosperity and fall with the declension of the society. On the contrary, it is naturally low in rich and high in poor countries, and it is always highest in the countries which are going fastest to ruin.”

Exactly the opposite of today’s thinking, what does he mean?

When rates of profit are high, capitalism is cannibalising itself by:

1) Not engaging in long term investment for the future

2) Paying insufficient wages to maintain demand for its products and services

Today’s problems with growth and demand.

The Classical Economists direct observations come to some very unpleasant conclusions for the ruling class; they are parasites on the economic system using their land and capital to collect rent and interest to maintain themselves in luxury and ease (Adam Smith above).

What can these vested interests do to maintain their life of privilege that stretches back millennia?

Promote a bottom-up economics that has carefully crafted assumptions that hide their parasitic nature. It’s called neoclassical economics and it’s what we use today.

The distinction between “earned” and “unearned” income disappears and the once separate areas of “capital” and “land” are conflated. The landowners, landlords and usurers are now just productive members of society and not parasites riding on the back of other people’s hard work.

Unearned income is so easy, it’s the UK favourite today.

Most of the UK now dreams of giving up work and living off the “unearned” income from a BTL portfolio, extracting the “earned” income of generation rent.

The UK dream is to be like the idle rich, rentier, living off “unearned” income and doing nothing productive.

Powerful vested interests come up with neoclassical economics so that it works in their favour and only bottom-up economics can be easily corrupted. Top-down economics is based on real world observation.

Their neoclassical economics blows up in 1929 due to its own internal flaws but the powerful vested interests still love it as they designed it.

Keynes comes up with new ideas that herald the New Deal and a way out of the Great Depression.

The powerful vested interests don’t want to lose their beloved neoclassical economics and fuse it with Keynes ideas to roll out after the war. This gives them the opportunity to get rid of some of Keynes’s more unpleasant conclusions, generally tone it down and remove all the really obvious conflicts with their neoclassical economics. The only real Keynesian economics was in the New Deal.

When the Keynesian synthesis fails in the 1970s, they seize the opportunity to bring back their really biased neoclassical economics.

It still doesn’t work of course.

It’s reliance on debt based consumption and debt based speculation, tend to end in debt deflation, e.g. the Great Depression, today’s secular stagnation.

Today’s secular stagnation is only being achieved by the Central banker’s pumping in their trillions and there are plenty of asset bubbles still to burst.

Te article points out a lot of valid point on the energy usage of technology in society. The most energy efficient society are hunter-gathers. Agriculture required a massive increase in use to support it and the infrastructure. As we applied more technology the greater amount of energy has been required to support it. The major misconception on economists is that productivity increases equates to less energy consumption. This comes form the concept of reduce labor costs (less people working) is major cost of any production. An example, one farm worker can now work a 1000 acres of corn. So you use less people, but how much energy is require to build the machines, run the machines etc, is over looked all they see is the labor cost.

II agree with Mathhew: Bitcoin “mining” is a huge waste of resources. Just because something is hard, labor-intensive, resource-intensive, etc. should not make it valuable in itself. Using gold as money runs into the same problem or perhaps worse, because it would be more difficult to change the rate of currency creation (as compared to Bitcoins).

As noted in the article, ideally currency is a store of value. That is how it was initially developed. So of course stability in value should be the benchmark, yet economists have convinced the public that “2% inflation” is ideal and that any deflation would be catasatrophic. It’s not surprsing that this was accepted, considering the golden rule: he who has the gold (or the fiat dollars) makes the rules.

For price stability, the money supply should grow at approximately the same rate as GDP.