Vinny Lingham’s latest post published at Medium, is yet another must read for anyone interested in the Bitcoin price.

Enjoy:

Given that the Brexit is still fresh in our minds — the big question of “how will the global financial elite diversify their assets” is one that every money manager and their clients are discussing this weekend. Great timing for a Bitcoin post!

I sent a tweet out earlier this morning (followed by a tweet storm!) and there was a lot of activity around it and I felt compelled to explain it in more detail.

Overlooked fact: The OTC market for Bitcoin is bigger than the exchange market. Exchanges set the price but large trades don’t happen there.

— Vinny Lingham (@VinnyLingham) June 26, 2016

One of the key themes of a prior post I wrote in 2014, was that the Bitcoin exchange infrastructure for the ordinary man on the street was not yet in place, and that this fact would be partially responsible for the subsequent sideways/downward trading in Bitcoin that eventually occurred as predicted.

To recap a quote from that post (dated March 31st 2014), entitled Finding Equilibrium:

Lack of trust with exchanges and limited ability to purchase

Consumers are spooked right now. MtGox ran away with $500m+ in Bitcoins and is bankrupt. No one really trusts any of the exchanges — even some smaller exchanges went under the past 3 months. The only “safe” place to buy Bitcoin in the USA is via Coinbase and they are not an exchange.

The US does not have a single licensed Bitcoin exchange and the rest of the world is reeling from MtGox. Bitstamp is proving to be the new global exchange of choice but the media has done a great job of keeping new potential Bitcoin users at bay with the usual inflammatory headlines whenever something negative happens in the Bitcoin space.

Most people I know who want to buy and sell Bitcoin are doing it “off-book” — which means the transactions are going instead via trusted networks. This will take buyers out of the marketplace and will ultimately mask the true supply/demand curve for Bitcoin. Anyone who doesn’t know a buyer will sell their coins via an exchange or via a merchant accepting Bitcoin which will put sell side pressure on the BTC price.

So instead of “buy side” money winding up in the exchanges which would be used to drive up the price, it’s sitting on the sidelines which has the impact of lowering the demand side of the equation within the marketplaces where Bitcoin is priced.

In my subsequent post 2 months ago, entitled Bitcoin 2016, I referenced the changes since the prior post:

There is a strong trust in exchanges and platforms for purchasing Bitcoin, such as Bitstamp, which recently got EU regulatory approval, Coinbase, Kraken, Circle, BitX and others.

What I didn’t cover in this post is what happened to the OTC (Over The Counter) market.

Over-the-counter (OTC) is a security traded in some context other than on a formal exchange such as the NYSE, TSX, AMEX, etc. The phrase “over-the-counter” can be used to refer to stocks that trade via a dealer network as opposed to on a centralized exchange. — Investopedia

The OTC market has continued to grow, and there are an estimated 10–15 formal OTC brokers out there for Bitcoin with any real volume, and maybe 3–4 who are more well known and trusted, such as Harry Yeh of Binary Financial and a few more referenced by Wong Joon Ian in his Coindesk post, (which is well worth reading) on OTC Bitcoin trading. In the case of LocalBitcoins, they deal with smaller transactions but many exchanges also facilitate larger trades, off-book.

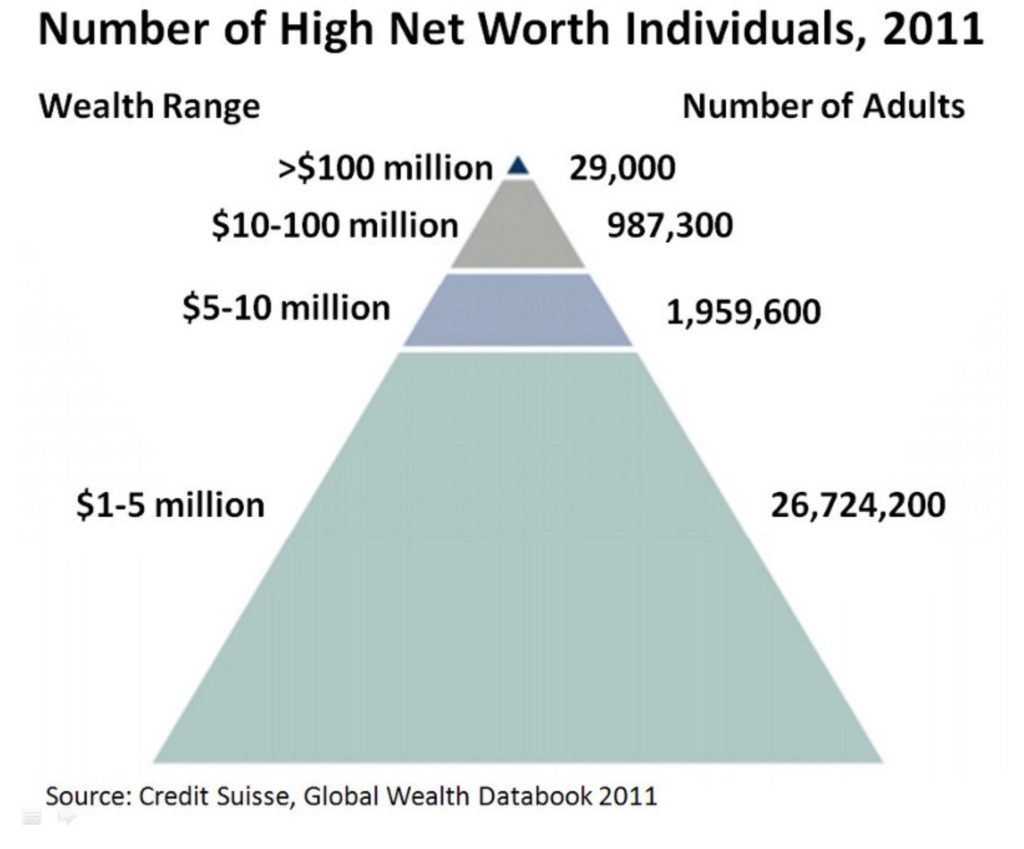

Many of the very wealthy individuals that I know who are looking to get into Bitcoin are not going to the exchanges. The limits are not significant enough for them. If a High Net-Worth Individual (HNI) has a net worth of $100m and wanted to place just $1m of that into Bitcoin as a hedge against market disruption, it would be imprudent of him to place that order on the open market. That is a single trade of over 1,000 BTC and it would push his price up (called slippage) significantly. Instead, he would call a broker, agree on a price (typically a few dollars above market spot price), and then perform the trade outside the market. The broker would match buyers and sellers and the exchange volume would not reflect the buying or selling activity for that trade. Now, imagine if a billionaire wanted to allocate 0.5% of his or her assets to Bitcoin. That is simply not possible on exchanges.

In doing some background research for this blog post, I spoke to a couple of OTC traders that I know and gathered the following data points:

The largest purchase I was able to uncover is around $50m on the OTC market and regular 8 figure purchases are now common. Given the scale of purchases this size, an order like this has to be filled using tranches. Brokers typically fill and price orders like this in 6,000–8,000 BTC tranches to prevent the market from pushing the price up and therefore it’s a combination of matching sellers and buyers, and then backfilling the balance from the exchanges (!! — nb, exchanges are being used for top ups, not primary transactions).

Typically, this year has been largely 66% buyers — 33% sellers in the OTC market according to my sources, but since the Brexit last week and the recent run-up, even more buyers have entered the OTC market — which is not being reflected in the price.

My key point in this blog post is that exchange volume doesn’t represent true market based Bitcoin demand and supply. Traders are technically trading on only a portion of the deals being transacted. Also, a lot of trading on the exchange market is back and forth arbitrage trading — not true demand (for e.g. buy and hold), so trade volumes are heavily inflated. For example, I could take $10,000 and trade (buy & sell) that volume at least 5 times per day using a bot and generate over $1m in exchange volume during the course of the month. This means nothing, but it inflates the volumes we see on exchanges. Exchange to Exchange price arbitrage also makes up a large portion of the volume.

OTC brokers are also heavily used in cases where individuals are trying to circumvent exchange controls and so this is going to become an even more common use case, as exchanges cannot operate in those markets effectively.

I’ve been giving this volatility a lot of thought this past week — and this post sums up why I think that using exchange data, although somewhat reliable, doesn’t tell the whole picture on a supply/demand basis. High New Worth Individuals are not buying Bitcoin through exchanges — they need to use brokers for the amount that they are buying or will not move the dial for them on their goals.

This also infers that, technically, exchanges today are thinly traded. If I wanted to buy $50m in Bitcoin, what would prevent me from shorting the market by with $2–5m, forcing the price down and then buying $50m in volume from OTC traders who have clients panicking? Market manipulation, although seemingly unlikely, is entirely plausible in a thinly traded market where large trades happen outside the exchange. This will change if and when the Bitcoin price and market cap is sufficiently large and liquid enough that 10k BTC trades (enough for an OTC tranche) would not move the price significantly.

Another point worth noting is that large BTC buyers who are looking to diversify their portfolios are typically buy and hold buyers. They do not get panicked (they don’t care if they lose it as they are already wealthy) — so it’s a diversification strategy and when these transactions happen, the coins are permanently removed from the market (for a couple of years, at the very least). This means that if we’re looking at exchange data, the number of short positions in the market could be quickly squeezed out if there is a price rise to a point of high liquidity where buy transactions move from OTC back into the exchanges (causing the short squeezes I have been predicting in prior posts).

In summary, until we have a marketplace where OTC brokers are not needed to fulfill large orders, Bitcoin will be volatile. There is a significant amount of money from the global financial elite that is still sitting on the sidelines and now looking to get in, given the Brexit and other unfolding global politicol events and once it does there will be a short squeeze on traders currently shorting Bitcoin because the exchange volumes do not accurately reflect the demand side of the equation and the upcoming halving day is going to choke the supply of new coins.

I’ve been highlighting a lot of Vinny’s work as of late. Here are a few prior examples, in case you missed them:

June 2016: Deconstructing the Bitcoin Market Cap by Vinny Lingham

May 2016: Vinny Lingham on the Bitcoin Price – Prepare for the “Mother of All Short Squeezes”

April 2014: Guest Post: Why is the Bitcoin Price So Weak?

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.