Injustice anywhere is a threat to justice everywhere. We are caught in an inescapable network of mutuality, tied in a single garment of destiny. Whatever affects one directly, affects all indirectly.

We know through painful experience that freedom is never voluntarily given by the oppressor; it must be demanded by the oppressed.

The answer lies in the fact that there are two types of laws: just and unjust. I would be the first to advocate obeying just laws. One has not only a legal but a moral responsibility to obey just laws. Conversely, one has a moral responsibility to disobey unjust laws. I would agree with St. Augustine that “an unjust law is no law at all.”

We should never forget that everything Adolf Hitler did in Germany was “legal” and everything the Hungarian freedom fighters did in Hungary was “illegal.” It was “illegal” to aid and comfort a Jew in Hitler’s Germany. Even so, I am sure that, had I lived in Germany at the time, I would have aided and comforted my Jewish brothers.

– From the post: Martin Luther King: “Everything Adolf Hitler did in Germany was Legal”

Last month, Anat R.Admati, the George G.C. Parker Professor of Finance and Economics at Stanford University’s Graduate School of Business, published a very important working paper titled, It Takes a Village to Maintain a Dangerous Financial System. At 26 pages, it’s a bit longer than what you might leisurely read in the course of your daily activities, but I strongly suggest you take the time. Of course, if you don’t have the time, I’ve provided some key excerpts for you below.

Despite deconstructing an intentionally complicated subject, the paper was both an enjoyable read and easily understandable. Additionally, the range of issues she successfully covered in such an short piece was nothing short of heroic.

I knew it would be good after reading the abstract…

Abstract: I discuss the motivations and actions (or inaction) of individuals in the financial system, governments, central banks, academia and the media that collectively contribute to the persistence of a dangerous and distorted financial system and inadequate, poorly designed regulations. Reassurances that regulators are doing their best to protect the public are false. The underlying problem is a powerful mix of distorted incentives, ignorance, confusion, and lack of accountability. Willful blindness seems to play a role in flawed claims by the system’s enablers that obscure reality and muddle the policy debate.

Here’s some more. Enjoy:

1. Introduction

“If it takes a village to raise a child, it takes a village to abuse a child.”

Policymakers who repeatedly fail to protect the public are not accountable partly because false claims obscure reality, create confusion and muddle the debate.

It is useful to contrast safety in banking and in aviation. Tens of thousands of airplanes take off, fly and land daily, often simultaneously within small geographical area. Yet, crashes are remarkably rare. It takes many collaborating individuals, from engineers and assembly workers to mechanics, airline and airport employees, air controllers, and regulators, to achieve and maintain such safety levels. In banking, instead, there are strong incentives to take excessive risk; banks effectively compete to endanger. The victims are dispersed and either unaware of the endangerment, misled into believing that the risk is unavoidable or that reducing it would entail significant cost, or powerless to bring about meaningful change. Most of those who collectively control the system benefit from its fragility or choose to avoid challenging the system, effectively becoming enablers.

Society’s interest in aviation safety is aligned with the incentives of those involved in maintaining it. Crashed planes and dead passengers are visible to the public and easy to understand. Airplane manufacturers and airlines stand to suffer losses from compromising safety. Radars, flight recorders and other technologies uncover the exact cause of most plane crashes, and those responsible face consequences. Screening procedures try to prevent terrorist attacks. The fear of being directly responsible for deaths prevents individuals involved in maintaining safe aviation from failing to do their part.

In banking, the public interest in safety conflicts with the incentives of people within the industry…Even if a crisis occurs, the enablers of the system can promote narratives that divert attention from their own responsibility and from the fact that much more can be done at little if any social cost to make the system safer and healthier.

Designing appropriate rules requires professional expertise. Experts, however, may provide biased or flawed advice. Sometimes experts are paid by interested parties to help tilt the rules in specific ways. Even supposedly neutral academics and other experts may provide poor policy guidance. For example, medical research about drugs and medical devices can get corrupted when pharmaceutical companies are involved in funding research or employ researchers or policymakers. In one case involving a spinal fusion product, researchers paid by the manufacturer suppressed serious side effects (Meier, 2012). In another, members of the Food and Drug Administration (FDA) in U.S. had direct ties with manufacturers that created conflicts of interest (Lenzer and Epstein 2012).

Many aspects of the financial system in developed economies are unjust because they allow powerful, better informed people to benefit at the expense of people who are less informed and less powerful. The injustice can be described from a number of perspectives. First, the system contributes to distortions in the distribution of income and wealth, as some of those who benefit from it are among the most privileged members of society, while those who are harmed include the poorest. Second, by allowing the privatization of profits and the socialization of losses, the financial system distorts basic notions of responsibility and liability. Financial crises affect employment and the economic well-being of many segments of society, but those who benefit most from this system and who enable it tend to suffer the least harm. The persistence of this unjust system illustrates how democracies sometimes fail to serve the interest of the majority of their citizens.

2. Other People’s Money

“Traders risk the bank’s capital…. If they win they get a share of the winning. If they lose, then the bank picks up the losses…. the money at risk is not their own, it’s all OPM — other people’s money…. Traders can always play the systemic risk trump card. It is the ultimate in capitalism — the privatization of gains, the socialization of losses…. Traders are given every incentives to take risk and generate short-term profits.”

Business corporations use money from investors in exchange for financial claims such as debt or shares of equity. Outside banking, it is rare for healthy corporations, without any regulations, to fund more than 70 percent of their assets by borrowing, even though corporate tax codes typically favor debt over equity funding.

In banking, heavy borrowing is less burdensome than elsewhere, because banks’ lenders (such as depositors) are unusually passive and do not impose harsh terms even if banks take significant risk that endangers their ability to pay their debts. Depositors trust that the government (or a deposit insurance fund) will pay them if the bank cannot. Lenders who can seize some of the banks’ assets ahead of depositors also feel safe lending to banks under attractive terms.

Since many financial institutions are exposed to similar risks and interact extensively with one another, the financial system can become fragile and prone to crises when institutions are funded almost exclusively with debt. Fears of contagion or “systemic risk” lead governments and central banks to offer supports and bailouts that prevent the default of banks and other institutions. Whereas supports and bailouts prevent default, banks are often allowed to persist in an unhealthy state of distress and possible insolvency for extended periods of time, which distorts their decisions and makes them inefficient or dysfunctional (Admati and Hellwig 2013a, chap. 3, 11). Bailouts and supports help institutions to pay their debt in full, often to counterparties within the financial system itself, as happened with insurance company AIG.

Excessive fragility and inadequate safety rules have always affected banking. As governments created central banks and deposit insurance and thus allowed banks more privileged access to debt funding, equity levels declined consistently (Hoenig 2016). The problem has gotten more severe in recent decades. Financial innovations such as securitization and derivatives, which can be used to manage risk, have enabled financial firms to take more risk while hiding this fact within the increasingly complex and opaque global system. As privileged access to funding and opportunities to hide risk expanded, regulations and disclosure rules failed to keep up and counter the distorted incentives.

Just in case you’re still drinking the Kool-Aid that the financial system is much safer now following the crisis.

Contrary to claims by many, the reformed capital regulations are overly complex, dangerously inadequate and poorly designed. They are not based on a proper analysis of the costs and benefits of different approaches and fail to reflect key lessons from the crisis and the true relevant tradeoffs (Admati et al 2013, Admati and Hellwig 2013a, 2015). International minimum standards allow banks to fund as little as three percent of their assets by equity, and the details of how this ratio is determined are subject to lobbying and debate. The measures of financial health used by regulators are unreliable and can lull regulators and the public into a false sense of safety just as happened prior to the Crisis. They still count on problematic accounting rules, credit ratings, and complex “risk weights” that give the pretense of science while in fact being distortive, political and counterproductive. Banks are allowed, indeed encouraged, to persist in a permanent state of excessive, inefficient and dangerous level of indebtedness.

Society is made to tolerate an inefficient and dangerous system because policymakers contribute to and fail to counter distorted incentives and ability to endanger.

The main beneficiaries from this situation are managers and executives in banks and other financial institutions, who have access to cheap funding and enjoy magnified profits and bonuses during prosperous periods, often while suffering little on the downside (Admati and Hellwig 2013a, chap. 8-10 and Kay 201, Admati 2015. Admati 2012, Bhagat 2016 and Bhagat and Bolton 2014). Auditors, credit rating agencies, law firms, consultants and lobbyists are offered many profitable opportunities from overly complex rules.

Those who manage other people’s money in institutions such as pension funds and mutual funds also tend to benefit on the upside and have little to lose if they take risk for which their investors or clients are not properly compensated. These institutions may not be run fully in the interests of the small investors whose money they invest (Bogle 2006 and Jung and Dobbin 2012), and may prefer to collaborate with banks; indeed, they may be partly owned or sponsored by banking institutions. Other enabler, as discussed later, benefit from the current rules or have reasons to avoid challenging the status quo.

This angle is a very dangerous one, and something I’ve covered repeatedly. See:

SEC Official Claims Over 50% of Private Equity Audits Reveal Criminal Behavior

Additional Details Emerge on How Hedge Funds and Private Equity Firms Loot Public Pensions

South Carolina Pension Shifts Assets Into “Alternative Investments” – Disastrous Performance Follows

The main losers from this system are taxpayers and the broader public. Those lured into borrowing too much in a credit boom face harsh consequences when boom turns to bust, and the economy is harmed by an unstable financial system that does not allocate resources efficiently (Taylor 2015). The harm, however, is diffused and difficult to connect to actions or inaction by specific individuals, and it persists because of a powerful mix of distorted incentives and pervasive confusion.

3. Many Enablers

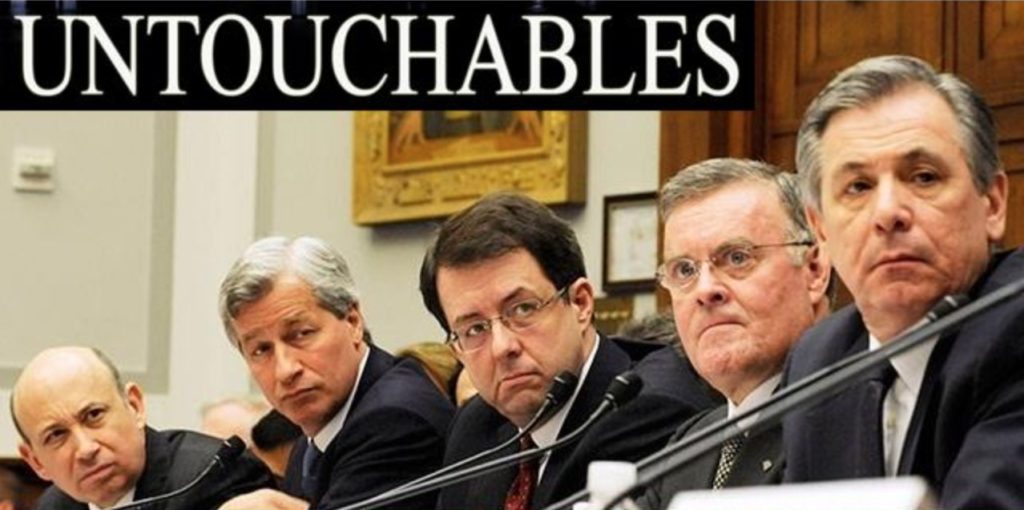

“Banks are still the most powerful lobby on Capitol Hill; and they frankly own the place.”

It takes many collaborating individuals, each responding to their own incentives and roles, to enable a dangerous financial system. Who are the enablers and what are their motivations? As we discuss in this section, enablers work within many organizations, including auditors and rating agencies, lobbying and consulting firms, regulatory and government bodies, central banks, academia and the media.

The enablers have reasons to defend the system and the regulations and to avoid challenging the financial industry and each other. Their actions, or failures to act, endanger and harm the public even as some of them are charged with protecting the public and most claim and are believed to act in the public interest. Some enablers are confused or misinformed, but as discussed later, the confusion is often willful.

Accounting rules and risk models used in regulations allow significant discretion. Exposing fraud in disclosures or flaws in models can be costly for individuals throughout the financial system or within watchdogs and regulatory bodies. Whistleblowers are often ignored or fired, and they are likely to lose career opportunities.

Regulatory dysfunction is often associated with the notion of “regulatory capture.” One cause of capture are the “revolving doors” where the same people rotate their roles within institutions in the financial system, politics and regulations, and other organizations, including the media. Connaughteon (2012, loc. 459), who worked in policy and as a lobbyist, describes Washington DC as

a place where the door between the public sector and the private sector revolves every day. A lawyer at the SEC or Justice Department leaves to take a position at a Washington Law firm; a Wall Street executive takes a position at the Treasury Department. The former will soon be defending the Wall Street executives his old colleagues are investigating; the latter will soon be preventing (or delaying or diluting) any government policy that Wall Street doesn’t like.

Government officials and staff routinely proceed to take positions in the financial sector, lobbying or consulting firms, or think tanks sponsored by companies. Government positions are often filled by people currently in the financial sector.

Revolving doors contribute to excessive complexity of regulation, because complexity provides an advantage — and creates job opportunities — to those familiar with the details of the rules and the regulatory process. Complexity also opens more ways to obscure the flaws of the regulations from the public and create the pretense of action even if the regulations are ineffective. Revolving doors do not ensure, as is sometimes claimed, that people who stay in policy throughout their careers are effective regulators; they might well be at a disadvantage relative to people in the industry. The best regulators are sometimes the few who have worked in the industry and have no plans to return.

This is also why bills passed by Congress tend to be thousands of pages. No one reads them. Lobbyists only care about the few pages they were allowed to write and then they go back to their clients and explain the relevant loophole to be exploited. Politicians only care that they handed out sufficient pork to their cadre of corporate sponsors.

Politicians write laws, and they appoint and monitor top regulators. A safe banking system is often not politicians’ top priority. Politicians may want banks to provide funding to particular industries and constituents or to help in political campaigns even if these actions put citizens and the economy at excessive risk.

Blanket guarantees to large banking institutions are particularly dangerous because banks have significant discretion as to how they use the subsidized funding, and guarantees are an effective license for recklessness, even lawlessness (Admati 2014). Politicians are rarely held accountable for the harmful effect of implicit guarantees combined with poor regulations.

Capture takes many subtle forms in the context of financial regulations. Social connections, shared experiences, and lack of expertise can make policymakers inclined to accept claims made by financial experts even when the claims are false or misleading. Situations in which policymakers’ worldview is strongly affected by those they interact with have been referred to as “cognitive capture” (Johnson and Kwak 2013), “cultural capture” (Kwak 2014), “social capture” (Davidoff 2010) and “deep capture” (Baxter 2011). Prins 2014 documents the ties between presidents and top bankers.

Regulators and politicians are subject to significant lobbying from interested parties as they set and implement the rules (see, e.g., McGrance and Hilsenbarth 2012). Lobbying played a role in reckless lending practices that were key to the Great Financial Crisis of 2007- 2009 (Igan et al. 2011 and Vukovic 2011). Between 1999 and 2012, regulators in the US were less likely to initiate enforcement actions against lobbying banks (Lambert, 2015), and lobbies are also involved in drafting laws (Connaughton 2012, Drutman 2015, Lipton and Portes 2013, and Mufson and Hamburger 2014). In one case, part of the U.S. financial reform law passed in 2010 was reversed in 2014 as part of a budget law, with the active participation of bank lobbyists in writing the law (Eichelberer 2014). Advisory committees to regulators are often stacked with industry participants (Dayen 2016 and Eisinger 2012b).

See: Wall Street Moves to Put Taxpayers on the Hook for Derivatives Trades

Economists and other experts become apologists for the status quo and enablers of ineffective policies when they fail to point out problems or, worse, when they provide “scientific” support that contributes to and obscures or justifies flawed rules. Some experts are employed by industry groups or sponsored organizations paid to produce specific research.

Research conducted within government and regulatory bodies can be tainted, especially if key individuals are affected by lobbying or political pressure. Staff economists or other experts are often expected to produce research to support pre-set policies.18 Bureaucratic approval processes scrutinizes staff research before it becomes public. As a result, approved research tends to promote the “official” narratives, while research whose conclusions would contradict the preferred policy may be suppressed, possibly by the researchers themselves.

Even experts considered neutral, such as academic economists, are not immune to the forces of capture (Zingales 2013, 2015). Their incentives may be colored by the desire for job or consulting opportunities, positions on advisory or corporate or policy boards, prestige, sponsorship of research or conferences, data, and research collaborations. Challenging people within the financial system or other enablers is inconvenient or costly.

It is easier and more convenient for academics and other experts to find ways to collaborate with the many other enablers and to express themselves vaguely rather than directly contradict the viewpoints favored by policymakers. When issues appear technical and confusing, claims by people considered “big shots” may resonate or even sound profound to many who do not see their flaws. Making claims that serve the interest of powerful people can pay off, and with enough caveats there is little if any downside risk.

Writing clever mathematical models and elaborate empirical studies is valued and rewarded within economics. The desire to motivate and present research as relevant for the real world and for policy can blind researchers to the possibility that the model’s conclusion may depend critically on implausible or false assumptions and thus be inadequate for such applications. Just as a bridge built on faulty assumptions may be prone to collapse, the use of inadequate models in banking regulations can support reckless practices and dangerous and flawed laws and regulations.

Central banks play a critical role in the financial system and in the economy, and this role has expanded dramatically during and since the Great Financial Crisis. They are often involved in designing and implementing regulations and among their key role is providing “liquidity supports” to banks and sometimes to other financial institutions so as to prevent defaults. Institutions that have access to such supports are able to borrow more easily than they would otherwise. By providing excessive supports, central banks enable weak, even insolvent “zombie” institutions that are dysfunctional and do not help the economy, to persist for extended periods of time. Among the benefits of ensuring that banks are safer and less opaque is that they would be less likely to run into liquidity problems. Because central bank supports are loans, the supports do not reduce indebtedness; if central banks lend at below- market rates, the loans provide hidden subsidies to commercial banks and other firms.

Whereas they are meant to be independent, central banks are subject to political pressure (e.g. Conti-Brown 2016 and Nyborg 2016). Their decisions regarding whether and under what terms to provide support are often made with little if any scrutiny. The supports can obscure not only banks’ weakness but also the failure of regulators (sometimes within the central bank itself) to intervene early and reduce the likelihood of banks needing supports. Excessive interventions by central banks distort markets, and dysfunctional banks interfere with other central bank objectives (Gambacorta and Shin 2016). These issues are often ignored.

Although financial instability and excessive subsidies to the financial sector distort the broader economy, few business leaders speak up on financial regulations. Some may be unfamiliar with the issues, believe that regulatory reform is not working, or are inclined to view regulations as bad in themselves. Business leaders may also prefer to avoid challenging financial firms or policymakers whose collaboration may be useful.

Democratic governments should ultimately be accountable to citizens. Policy failures can persist, however, if citizens are unaware of the problem, confused about the issues, or powerless to bring about change. Enablers often come from across the political spectrum, leaving citizens few if any choices of effective advocates. Financial regulation is often not a salient topic in political campaigns. Even when there is anger about the financial system (as is the case currently in the U.S.), some key issues are not well understood.

Bernie Sanders was the only one really hammering home this issue. If Hillary gets the nomination, neither of the major party candidates will do anything about the parasitic and cancerous financial system.

News and commentary, however, may get distorted. Most media companies are for-profit businesses. In an extreme example, a newspaper avoided covering a story to protect advertising revenue (Osborne 2015). The interests of media owners, and even their lenders, may also affect coverage (Zingales 2016). Investigative reporting has declined because it can be expensive and adversarial (Starkman 2014).

Most of the time, the impact of private interests on news media is subtle. The same forces that cause cognitive and other forms of capture also operate here. One important factor in news media is reporters’ need for access to sources of news and stories, which brings them in frequent contact with those they cover (see e.g. Luyendijk 2015, chap 9). Publishing negative reports, or asking challenging questions, can interfere with access to stories or interviews. “Balanced” reporting may involve quoting false or misleading statements from industry or enablers (e.g. Oreskas and Conway 2010 and Admati and Hellwig 2013a, 2015, note 3).

Editorial decisions about topics, content and prominence of news and commentary can have important impact on public perception and policy. Those who make such decisions face implicit and explicit pressures from individuals and organizations keen to have favorable coverage and prevent unfavorable coverage, and who seek to use the media to promote their image and views. People and institutions with significant power, status and name recognition tend to be more successful in impacting media. Utterances by “important” individuals are reported as news, and these individuals are interviewed and quoted frequently with little if any scrutiny. Power and status also enables easier access to opinion pages where desired narratives can be promoted.

Even worse, totally discredited and provably harmful individuals in America continue to be supported and profiled by the media simply because they represent the status quo. Larry Summers is a perfect example. The man is a cultural disease with no cure.

Classic Larry Summers: more worried that Trump will cancel the TPP than he is about Trump being “authoritarian.” https://t.co/OFm9ObyjpI

— Matt Taibbi (@mtaibbi) June 6, 2016

If the news media gives more access and coverage to the industry and its enablers, and if it echoes rather than challenges flawed claims and fails to clarify issues in investigative reporting or commentary, it helps maintain or exacerbate confusion and diffuse accountability. Sometimes reporters or commentators accept claims made by people considered experts because examining the claims’ validity requires expertise that reporters lack. When media is used to explain the issues properly, it can elevate the discussion and help the public.

4. Spin and Narratives

“The few who understand the system will either be so interested in its profits or be so dependent upon its favors that there will be no opposition from that class, while the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.”

The financial system is dangerous and ineffectively regulated largely because the industry and the many enablers get away with their “spin” on reality and on specific issues.

Powerful people are not immune to confusion and to putting trust in people who may be conflicted or misinformed. Anecdotal evidence and discussions with many insiders suggest that “blind spots” about key issues related to banking and finance are pervasive. People are reluctant to question the assumptions behind convenient narratives and to engage with alternative and less convenient ones. They often display “motivated reasoning” (Kahan 2016) and variations of Upton Sinclair’s famous quip: “it is difficult to get a man to understand something when his salary depends upon his not understanding it!”

What people want to know becomes at least as important as what they actually know. Codes of silence evolve from collective blindness and an implicit agreement to maintain the silence. We may lie to ourselves and live in hope.

Recall what Larry Summers said to Elizabeth Warren: Stunning Quote – Larry Summers to Elizabeth Warren in 2009: “Insiders Don’t Criticize Other Insiders”

Misleading jargon obscures the issues and excludes many from the discussion. Lanchester (2014, 6) writes that when hearing the economists speak, “it’s easy to think that somebody is trying to con you… [or] trying to put up a smoke screen” and expresses the “strong feeling that a lot of the terms … were deliberately obscure and confusing.” The jargon can also muddle the debate by suggesting false trade-offs.

The problem goes much beyond jargon and the meaning of words. A bestselling textbook, written by an academic economist who served in high level policy positions, includes fallacious statements contradicting material in introductory finance courses. As already mentioned, basic economic forces are often denied and ignored in banking, and models in which risk is assumed to be unpreventable imply that regulations are futile or costly. Financial crises are portrayed as akin to natural disasters, for which emergency supports are the main tool. In fact, as discussed earlier, effective regulations can do much at little social cost to dramatically reduce the incidence and cost of crises and to correct other distortions.

Bankers and some enablers of the system often warn that tough regulations will have “unintended consequences” such as restricting credit and growth. In fact, healthier and safer banks can make loans more consistently and with fewer distortions, and credit suffers when banks have too little equity. The claim also presumes that all lending is good for the economy when excessive credit is typically a precursor to bust and crises. Ironically, such claims are made even as banks seek, and are allowed to deplete their equity by making payouts to shareholders that they could have used to make loans.

5. Is Change Possible?

“Collective moral disengagement at the social system level requires a network of participants vindicating their harmful practices.”

Good people can do harm and feel good about themselves, especially when many reinforce one another and remain unaccountable, and when the harm is diffuse, abstract and invisible (Bandura 2015). Spreading flawed claims that cannot be definitively contradicted, as lobbyists and enablers often do, is no crime. Distorted incentives, ignorance, and confusion combine for a powerful mix. How might those strong forces be overcome?

Some of those who understand that current regulations are ineffective focus on symptoms and overlook steps that can produce huge benefits at small cost. For example, the excessive size of too-big-to-fail institutions is enabled by their privileged access to subsidized debt funding, which creates enormous harm and distortions. These distortions can be addressed at little cost, and the likelihood of failure would also be reduced, if these institutions were forced to rely much more on equity and thus reduce their dependence on subsidized debt funding.

As discussed in this chapter, those at the controls of the financial system do not have strong incentives to protect the public; instead they stand to benefit from actions that contribute or tolerate harm and endangerment. Making the financial system safer would require better rules as well as better monitoring of the system, akin to radars in aviation. Yet, disclosures in banking remains poor and systems to track financial transactions and contracts have been slow to develop. The main obstacle is not the technical difficulty of controlling risk in banking, but rather the lack of political will to do so.

I have been intensely involved in the debate about banking regulation since 2008, first through discussions with colleagues and academic writing, and, starting in 2010, engaging with a broader set of people. The impetus for this deeper involvement came from individuals within regulatory bodies who alerted me that flawed claims are having an important impact on policy and urged me to speak up and help clarify the issues. Many of the references in this chapter reflect efforts to alert policymakers and the public to the remaining danger and distortions in the financial system and to propose ways to address them.

Luyendijk 2015 classifies the moral attitudes of the people he met within the financial system and describes his reaction to these attitudes. One type he finds ethically most disturbing he calls “cold fish.” Cold fish believe anything that is legal is perfectly fine to do.

For those who adhere to this philosophy, I’d like to remind you of the following: Martin Luther King: “Everything Adolf Hitler did in Germany was Legal”.

There are well-intentioned people in government and elsewhere, including within the financial system itself, who would want to act to promote the public interest, but are often prevented or deterred from doing so by political constraints, institutional policies and more subtle forms of discouragement. In a system dominated by powerful industry players and supported by powerful enablers, the need to promote institutional objective puts many people in conflict with the public interest. Regulators and financial practitioners may put their careers, status and prestige at risk if they challenge certain narratives.

Tenured academics, who have the most expertise, job security and academic freedom to express themselves and to engage in policy without being conflicted, are in a unique position to bring about positive change. Yet, some academics are important enablers of the badly regulated and dangerous financial system. By such behavior as making false statements in textbooks, creating models and narratives with assumptions that distort reality in critical ways, misusing or tolerating the misuse of research to propose or support bad policy, or making vague and misleading claims whose flaws, often subtle, can be difficult to detect, these economists exacerbate confusion, muddle the debate, and harm instead of promote the public interest. Someone with sufficient background to understand the academic literature, who has been employed by major financial institutions, quipped recently when discussing some statements by academic economists: “with such friends, who needs lobbyists?”

Ultimately, in a functioning democracy political change comes from public pressure, which requires better awareness and understanding. Education is extremely important, so that people become savvier in their own interactions with the financial system, and so they come to see past the fog of confusion.

I couldn’t agree more with the above paragraph. Indeed, it’s precisely why I dedicate so much of my time to writing this website.

Excellent work, Professor Admati. Here’s a link to the entire working paper: It Takes a Village to Maintain a Dangerous Financial System.

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Excellent work, but in need of a good proofreading.

It looks like this paper correctly outlines the problems, but (if I’m not mistaken – I haven’t dug into it yet) fails at the end, by assuming these problems are fixable by such methods as public education. This is very doubtful to me, and it may be the system you describe could not end up any other way. Problems are fixed not by reform, but by revolution. And, the fixes will never be permanent, but the new system will inevitably degrade over time until the next revolution ends up happening.