Some of you will read the title of this post and wonder why I chose to cover this in light of all the other things happening in the world. While the rapidly growing subprime auto market might seem unimportant on a relative basis, I think it’s very significant as a microcosm of the many failures within the U.S. economy since the financial crisis, during which oligarchs were bailed out and the rest of the nation was left hung out to dry.

I best summarized how disturbing current trends in the U.S. economy are in the post, Land of the Debt Serf – How “Auto Title Loan” Companies are Ruthlessly Preying on America’s Growing Underclass. With regard to trend toward debt serfdom, I noted:

Think about how troubling this is for a second. In the run-up to the last crisis, Americans borrowed on their home equity and used the proceeds to remodel kitchens, etc. Now these same Americans are so completely broke, the only asset they can borrow against is their cars, and they are desperately using the money to purchase groceries, pay cable bills, etc. Thank you Ben Bernanke.

Even worse, more than 10% of these debt serfs end up losing their cars. What will they end up borrowing against after the next crisis, their organs?

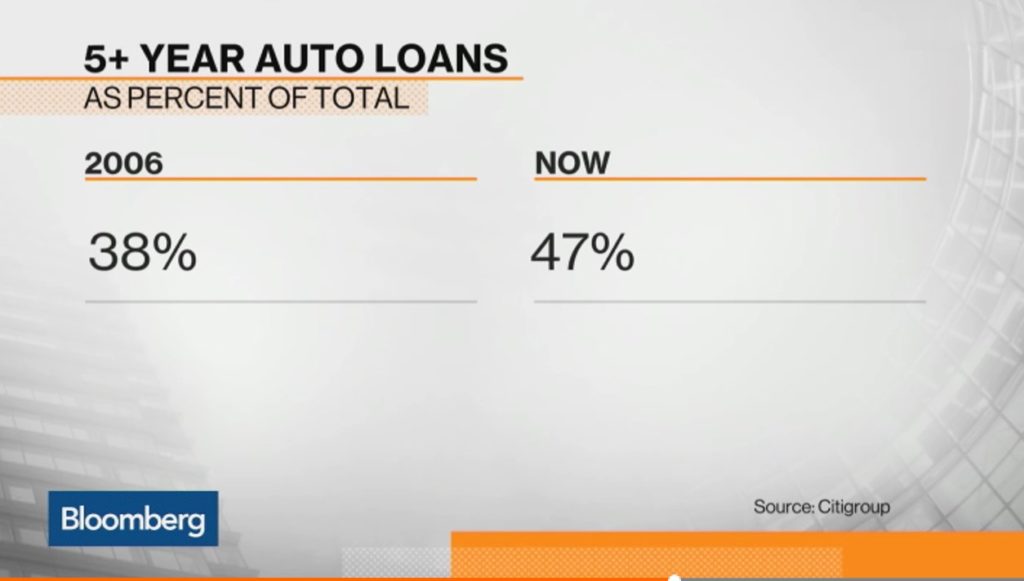

This brings up the key concern with regard to subprime auto loans. Americans are being forced to extend the duration of loans because they simply can’t afford the payments otherwise. This isn’t beneficial in any real sense to the debt slaves who are lured into taking out these loans. However, it is very beneficial to the financial oligarch status quo, which needs to create more and more debt every single year just to keep their fraudulent financial system alive. As I alluded to in that prior piece, after the next crisis, Americans will be so broke they’ll be shut out of even subprime auto loans. You’ll see the emergence of seven year subprime loans to purchase groceries at Walmart.

Now, from Bloomberg:

The man who created one of the biggest U.S. subprime lenders says there’s nothing dangerous about borrowers being given longer car loans.

When Thomas Dundon helped start the lender that’s become Santander Consumer USA Holdings Inc. in the 1990s, subprime borrowers typically were offered four-year car loans, he said Monday in an interview. Now, the standard is six years, he said, partly because wages haven’t kept up with vehicle prices.

Using longer terms to lower payments makes sense when the alternative for consumers and lenders is “a shorter term with an older, cheaper, less-reliable piece of transportation,” he said, after being replaced as the lender’s top executive this month when Banco Santander SA bought out his minority stake.

Stretching out how long it takes buyers to pay off loans is helping to make cars affordable at rising prices and stoking sales. As volume of subprime auto debt rebounds after collapsing during the credit crunch in the wake of the 2008 financial crisis, the wisdom of lending over ever-expanding periods is being questioned.

The average loan term for new vehicles reached a record 67 months in the first quarter, with the figure for subprime new-car debt approaching 72 months, according to Experian Automotivedata. For used cars, the average reached a record of 62 months, with the length for the least reliable consumers exceeding 56 months, the data show.

“There’s a lot of people in the world that are in different situations and the fact that this industry has become very efficient and helps people keep their costs down to get something that a lot of us take for granted, I think that’s a good thing,” he said. “Unfortunately it seems to be painted as something bad, and I’m not sure why.”

Because asking the opinion of the “titan” who made so much money creating these loans makes so much sense.

Meanwhile, I strongly suggest watching the actual interview at Bloomberg. What you’ll see is neither Mr. Dundon nor the anchors seem to care about what all this says about the U.S. consumer, or should I say U.S. debtor. All they’re concerned about is whether or not investors buying the stuff will be made whole as they were during the financial crisis as millions of Americans lost their homes. Truly disgusting.

For related articles, see:

Gotta Keep Dancing – Honda Executive Laments “Stupid” Auto Loans Driving U.S. Sales Higher

Chinese Homebuilders Expand in America as U.S. Auto Loans Hit Record Levels

Is the Auto Loan Bubble Bursting? Delinquent Loans Jump 27% Year-Over-Year

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

The rich rules over the poor, and the borrower is the slave of the lender. ”

-(Proverbs 22:7 ESV)

I used to work for Santander Consumer USA at the HQ; I started in the call center but ended in IT. SCUSA prides itself on being an arm of Banco Santander, the largest bank in the world outside the United States, but SCUSA’s real game plan is to bleed and to punish those who deviate from expectations. This philosophy is applied to employees in the call center (by far the largest aspect of the company) where the company bleeds them of time, energy, and talent, hoping they’ll quit before becoming benefits-eligible. There are no raises anywhere in the company, bonuses are frequently denied on obscure technicalities, and work schedules are intentionally burdensome– if you’re lucky, working hours don’t follow you home (this specific complaint mainly relates to salaried employees). Yet, the company competes employees against each other for bonuses (usually consumer electronics instead of cash) based on who can squeeze the most blood from “stones.” “Stones” are the clientele who are overwhelmingly in desperate situations where even a $20,000, decade-old, high-mileage, 24.9%-interest-rate, $400-per-month vehicle, used as their vital connection to a workplace or a hospital, is the one strand keeping them from free-falling into oblivion. Quite often, these customers earn minimum wage at 39.5-hour jobs, are under some form of substantial court-ordered obligation, have lost a loved one (and their income), or are struggling to afford care for advanced illnesses. These customers routinely discover vehicles repossessed due to their inability to make full payments regularly, which commonly costs them their job as collateral damage, but the monthly car payment is still due until the original loan is satisfied AND– here’s the kicker– the repossessed vehicle is auctioned-off or resold at retail (both are gravy in the company’s pocket) only to then return to SCUSA under some other poor soul’s new loan. Yes, there are plenty of loans disconnected from a vehicle, and there are plenty of vehicles with multiple active loans for unrelated customers. Everyone– customer or employee– is either miserable or angry; dozens of employees come and go seemingly weekly, company-wide. SCUSA exploits an IT department populated by immigrants utterly chained to their employer; few are broadly knowledgeable about technologically or even basic business practices (or even intermediate English), while most are essentially captive labor. I could go on and on, and I very nearly have. This company needs to be exposed and killed… but we all know that will never happen.

MK – Google “sub prime retailer” and you’ll be shocked. It is an entire biz model, metastasized out of the old rent-to-own big ticket segment. It is where Wal-Mart customers have slid down to now that they rely on EBT for their groceries at WMT.