“Complaints that active military personnel and National Guard members were losing their homes while deployed in war zones set off national outrage and prompted Congressional hearings in 2011. The case of Sgt. James B. Hurley, a disabled veteran whose home outside Hartford, Mich., was sold two months before he returned from Iraq, dragged through the courts for years, highlighting the devastating effect of foreclosures.”

– From the recent New York Times article: Banks Find More Wrongful Foreclosures Among Military Members

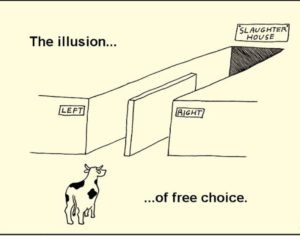

The above is part of a very depressing theme I have covered in the past. Most recently in my piece from last November titled: Big American Banks Particularly Enjoy Ripping off Active Duty U.S. Soldiers. Today’s post follows up on that one and what we find; unsurprisingly, is that the more you peer behind the curtain, the more filthy the whole thing becomes. That’s precisely why the oligarchs don’t want anyone to peer behind the curtain for too long. From the New York Times:

The nation’s biggest banks wrongfully foreclosed on more than 700 military members during the housing crisis and seized homes from roughly two dozen other borrowers who were current on their mortgage payments, findings that eclipse earlier estimates of the improper evictions.

Bank of America, Citigroup, JPMorgan Chase and Wells Fargo uncovered the foreclosures while analyzing mortgages as part of a multibillion-dollar settlement deal with federal authorities, according to people with direct knowledge of the findings. In January, regulators ordered the banks to identify military members and other borrowers who were evicted in violation of federal law.

These four banks just keep popping up in criminal schemes don’t they?

The analysis, which was turned over to regulators in recent days, provides the first detailed glimpse into the extent of wrongful foreclosures amid the collapse of the housing market. While lenders previously acknowledged that they relied on faulty documents to push through foreclosures, the banks claimed borrowers were rarely evicted by mistake, including military personnel protected by federal law.

Read more

Follow me on Twitter.

One reason we know voters will embrace populism is that they already have. It’s what they thought they were getting with Obama. In 2008 Obama said he’d bail out homeowners, not just banks. He vowed to fight for a public option, raise the minimum wage and clean up Washington. He called whistle-blowers heroes and said he’d bar lobbyists from his staff. He was critical of drones and wary of the use of force to advance American interests. He spoke eloquently of the threats posed to individual privacy by a runaway national security state.

One reason we know voters will embrace populism is that they already have. It’s what they thought they were getting with Obama. In 2008 Obama said he’d bail out homeowners, not just banks. He vowed to fight for a public option, raise the minimum wage and clean up Washington. He called whistle-blowers heroes and said he’d bar lobbyists from his staff. He was critical of drones and wary of the use of force to advance American interests. He spoke eloquently of the threats posed to individual privacy by a runaway national security state.