Ms. Bailey, the Citizens Bank customer in Massachusetts, had sold a condo in Maine in 2013, a year after the death of her husband, who she says had handled their finances. She went to a Citizens branch in Arlington, a suburb of Boston, to deposit the money. She says bank employees pressured her not to just park the money in a savings account.

She says she was directed to Citizens broker Andrew Jurkunas, who steered her to a CD called the GS Momentum Builder Multi-Asset 5 ER Index-Linked Certificate of Deposit Due 2021. It is one of a series of CDs based on a Goldman Sachs-designed index that tracks the performance of up to 14 exchange-traded funds and a cash-like holding. The index aggregates the performance of different combinations of some or all of the underlying funds, relying on a complex formula designed to smooth volatility.

When Ms. Bailey received her first statement showing that the value of her CD had dropped by more than $4,000, she complained to Massachusetts state securities regulators. This January, the office filed civil charges against the bank alleging that Mr. Jurkunas, who wasn’t named or accused of wrongdoing, didn’t adequately disclose the risks of the market-linked CD.

– From yesterday’s excellent Wall Street Journal article: Wall Street Re-Engineers the CD—and Returns Suffer

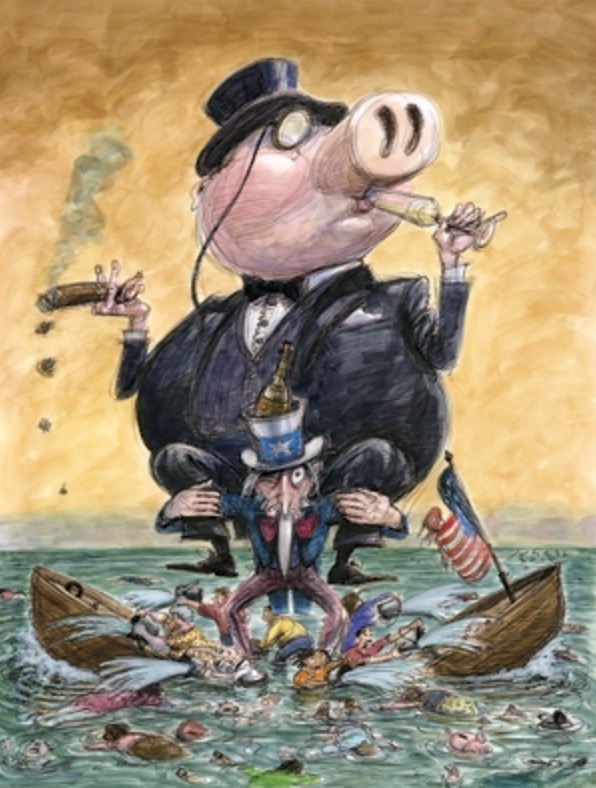

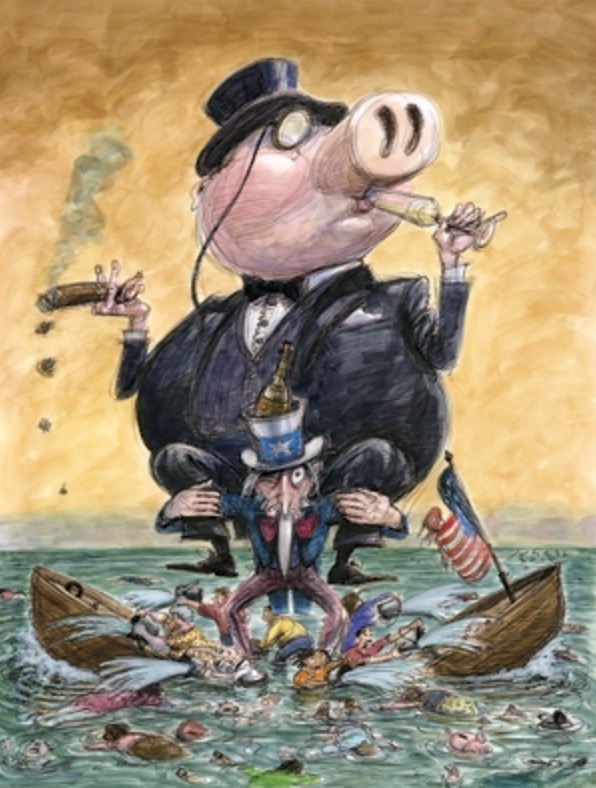

Wall Street is an industry that should have been allowed to go down in flames back in 2008. Bailing out these career criminals and sociopaths was one of the gravest errors in American history. An error that we as a nation continue to suffer from to this day.

As an example, yesterday’s Wall Street Journal reported on the industry’s latest scheme to pocket the hard earned savings of those dwindling Americans who still have a few pennies left — structured CDs.

What follows are some key excerpts from this must read article, Wall Street Re-Engineers the CD—and Returns Suffer:

Mary Bailey, a 79-year-old widow in Arlington, Mass., made a big deposit for her grandchildren at her Citizens Bank branch when a financial adviser there sold her on a newfangled $100,000 certificate of deposit. It would, he said, double her savings in six years, according to a later state enforcement action.

So she was irate when her first statement showed the CD’s value had fallen to $95,712, thanks to upfront fees. “This was not a CD as I know a CD,” Ms. Bailey says.

Read more

Follow me on Twitter.