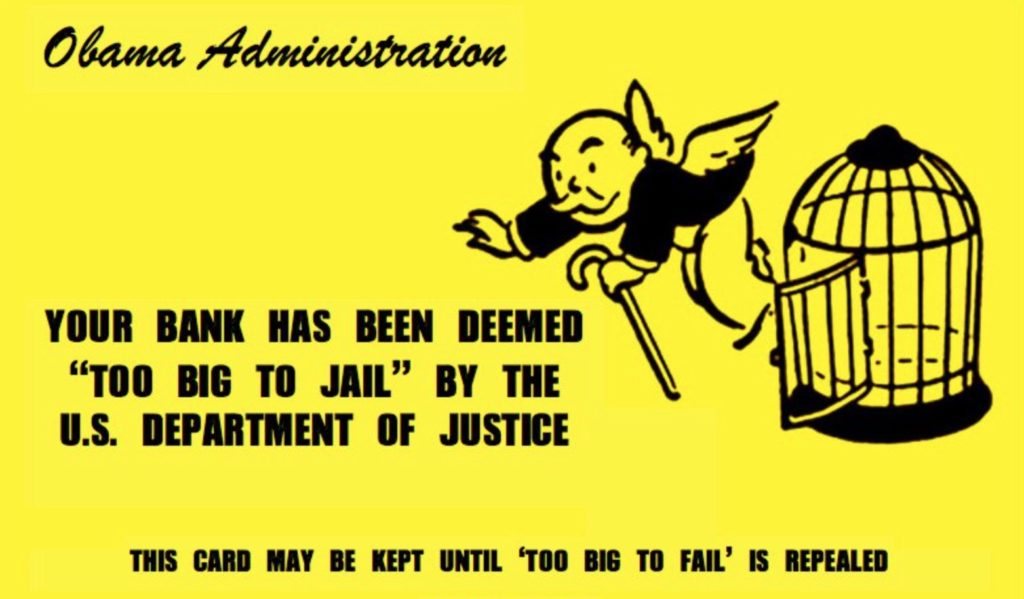

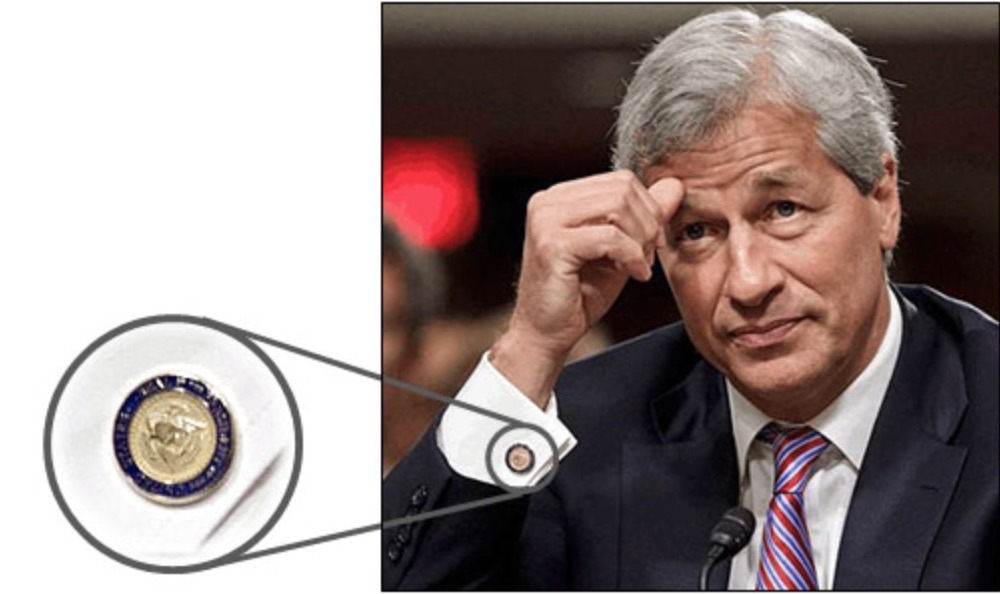

President Donald Trump’s naïve (or willfully blind) notion that Wall Street will work better at raising capital if it is unleashed from strident Federal regulation is unhinged from the facts on the ground. Those facts, as illustrated above, are that the Boards of two of the largest banks in the U.S. are utterly spineless when it comes to holding their CEOs and employees accountable in the face of a tsunami of crimes.

– From the Wall Street on Parade article: What JPMorgan and Citigroup Have in Common When It Comes to Crime

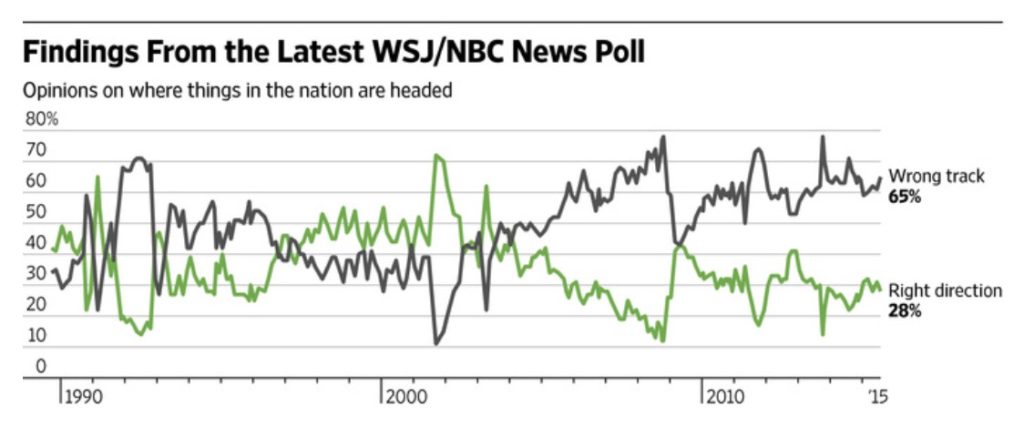

Opposition to Trump is extremely important, particularly when it comes to someone like me who sees his Wall Street love affair and disregard for civil liberties as serious threats to the nation. That said, it is absolutely imperative to see Trump as a symptom of a sick and broken system as opposed to the root cause of anything. The corporate media and legions of mourning Hillary cultists continue to present the Trump threat in extraordinarily simplistic and unhelpful terms. They act as if he’s the head of some evil snake, and that disposing of him as an individual will get America back on track. This couldn’t be more wrong.

I spent most of the Obama years warning about the dangers of his policies. I didn’t do this for kicks, or because I thought he would try to stay in power forever, but because I knew his monumental cronyism would only pave the way for major problems down the road. Well the backlash to Obama came quick, and we the people won’t do the country any good if we focus on Trump the man, as opposed to the entirely corrupt, billionaire/special interest-controlled cesspool of a society we inhabit. We need to focus on Trump’s policies, not Trump the man.

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.