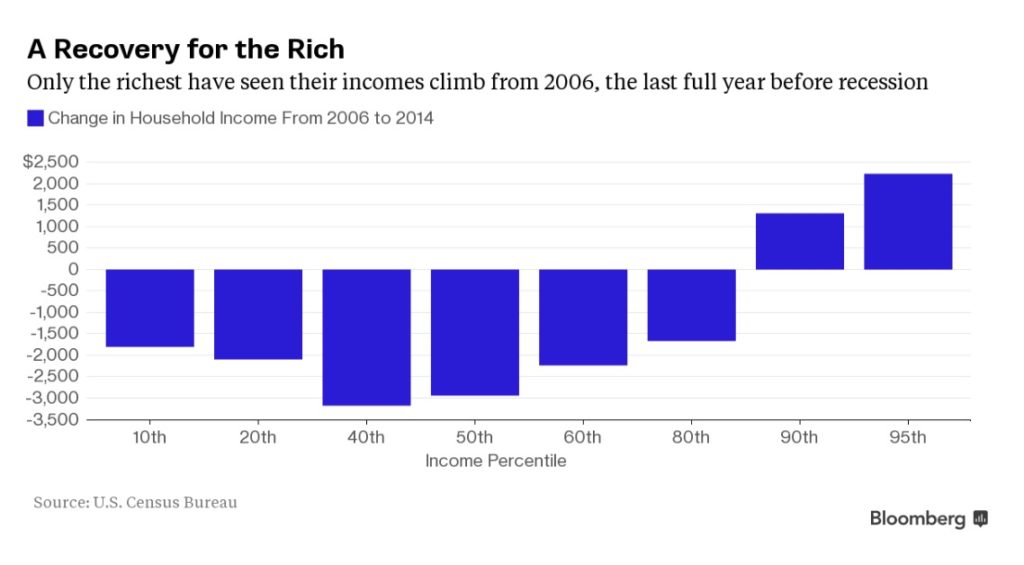

Bernanke and the Federal Reserve are nothing but criminal butlers for the oligarchy. The proof is undeniable at this point. While this unaccountable banking cartel promised us that 0% rates would help the economy, America’s growing underclasses are paying 100% rates for loans to buy sofas and pay for food, more than five years into this so-called “recovery. Meanwhile, the only segment of society with access to low interest rates are the very wealthy financial oligarchs who leverage this cheap money to speculate on financial assets and real estate. So yes, the Fed (Central Banking in general) is completely to blame for the world’s growing inequality, as are their submissive, compliant defenders in academia, “journalism” and within the halls of power in Washington D.C.

From the post: Another Tale from the Oligarch Recovery – How a $1,500 Sofa Costs $4,150 When You’re Poor

There is no recovery. The only thing we’ve experienced over the past eight years of Obama is a historic plundering and strip mining of the U.S. economy by a handful of oligarchs and their political and bureaucratic minions.

The evidence has been clear for years. Fully employed Americans have been borrowing from payday lenders at egregious rates in order to pay for normal everyday living expenses, while a small group of executives grab as much as possible for themselves. You can see this in corporate profits margins at historically high levels and in the use of cash to buyback shares as opposed to paying employees a living wage. To see just how grotesquely out of whack the economy has become under the crony policies of Obama and the Federal Reserve, let’s revisit what I like to call the “Serfdom Chart.”

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.