It appears the music may have finally stopped for one of the world’s largest luxury real estate bubbles: London.

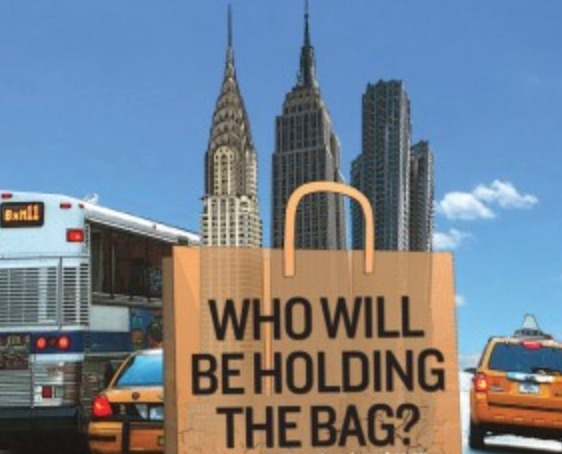

It’s well known that foreign oligarchs love London real estate as a means to launder funds, typically “earned” by soaking their host countries dry via corruption and fraud. This has caused absurd and irrational spikes in high-end residential real estate in the English capital, as well as a flood of new construction.

With emerging markets now completely collapsing, the seemingly endless flood of foreign money is drying up, and with it, London real estate.

So has the London real estate bubble popped? Probably.

– From the September 9, 2015 article: Luxury London Home Sales Plunge 26% – Has this Mega Real Estate Bubble Finally Burst?

The first real signs that the global luxury home price bubble had popped emerged last fall in the world’s capital of oligarch money laundering: London.

Since then, we have seen weakness in high end Manhattan real estate, but the trend has now spread and is starting to make itself apparent all over the place.

Yesterday’s Bloomberg article titled,The Surge in U.S. Mansion Prices Is Now Over, is really interesting. Here are a few choice excerpts:

The six-bedroom mansion in the shadow of Southern California’s Sierra Madre Mountains has lime trees and a swimming pool, tennis courts and a sauna — the kind of place that would have sold quickly just a year ago, according to real estate agent Kanney Zhang.

Not now.

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.