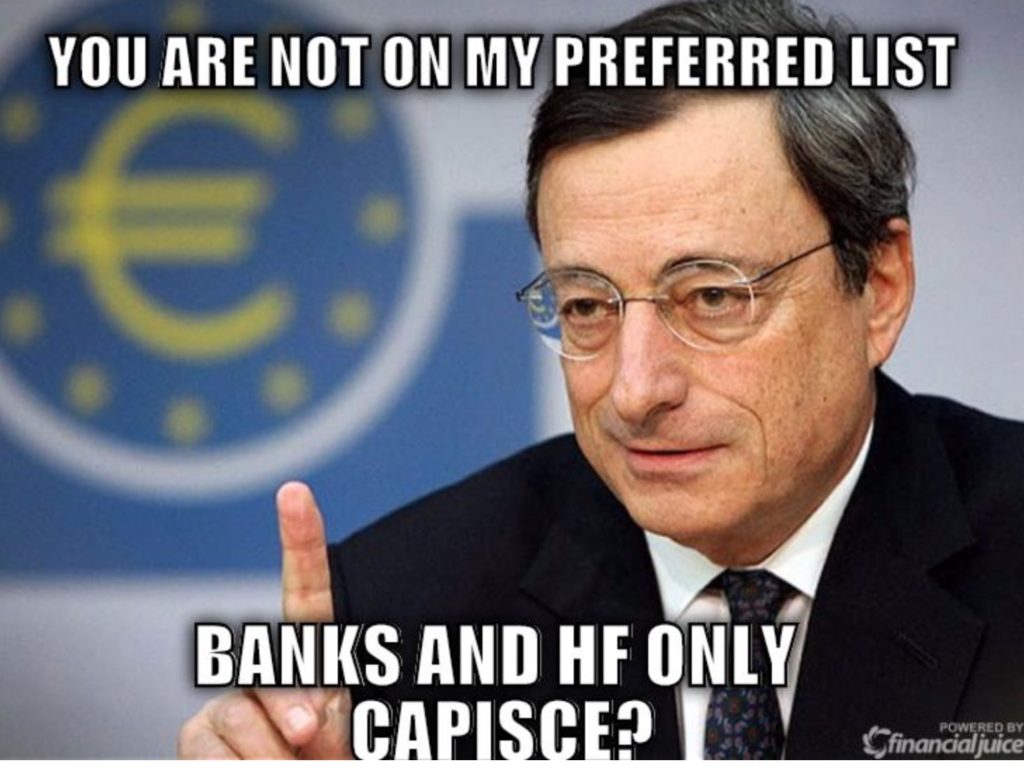

One of the most catastrophic things central banks have done in the post financial crisis period is destroy financial markets. Investors are no longer investors, they’re merely helpless rats running around the lunatic central planning maze desperately attempting to survive by front running the latest round of central bank purchases.

While actual macroeconomic and corporate fundamentals do still exert influence on financial asset prices from time to time, the far bigger driver of performance over the past several years is central bank policy. To understand just how destructive this is, recall what we learned in last month’s post, Japan’s Bond Market is One Gigantic Joke – “No One Judges Corporate Credit Risks Seriously Anymore”:

TOKYO — Fixed-income investors in Japan are increasingly assessing bonds based on their likelihood of being bought by the central bank, rather than the creditworthiness of the issuers.

Still, the fund manager desperately wanted to get hold of the bond because he bets that debt issued by Mitsui and other trading houses will be picked up by the Bank of Japan in its bond purchase program.Even if an investor buys a bond with a subzero yield, the investor could sell it to the central bank for a higher price, the thinking goes.

“It goes to show that no one judges corporate credit risks seriously anymore,” said Katsuyuki Tokushima at the NLI Research Institute.

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.