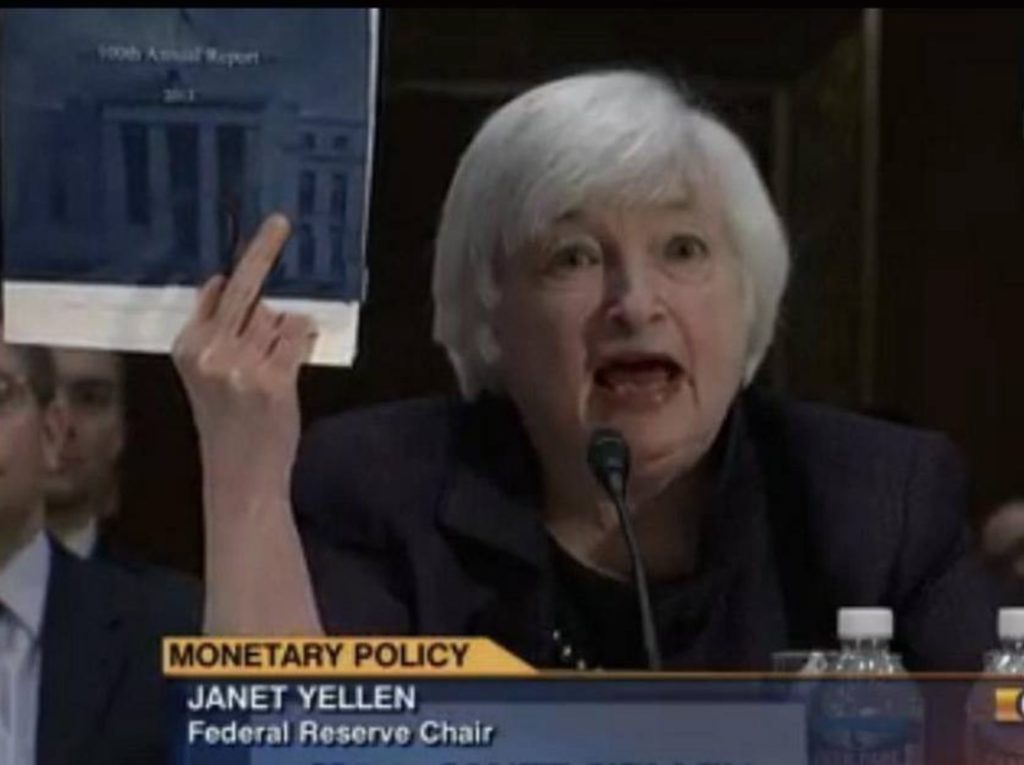

On December 23 of this year, the Federal Reserve will be 99 years old. And throughout that 99 years, regardless of boom, bust, recession or Great Depression, the biggest Wall Street banks have been enjoying a 6 percent, risk-free return on the capital they hold at the Fed in the form of dividends.

Have you looked at your checking or money market bank statement lately from JPMorgan Chase or Citibank? How about the statement showing the interest you’re earning on your mortgage escrow account with the big banks? While the country suffers through the lingering effects of the Great Recession caused by the biggest Wall Street banks, the public typically receives less than 1 percent on their deposits at the big banks, while the government has legislated a permanent, risk-free 6 percent guarantee to the Wall Street banks for their capital on deposit at the Fed. Now that’s an entitlement program that needs to die!

This corporate welfare program gets even better: if the shares of stock were acquired prior to March 28, 1942, the 6 percent risk-free dividend is tax exempt and the bank doesn’t have to pay corporate taxes on it.

– From the excellent 2012 Wall Street on Parade article: Kill This Entitlement Program: The 6% Risk-Free Dividend the Fed Has Been Paying Wall Street Banks For Almost a Century

Did you know that the Federal Reserve pays an annual 6% dividend to its shareholders, i.e., the member banks of the cartel? Must be nice, considering savers who had nothing to do with cratering the world economy, and failed to receive a taxpayer funded bailout, can barely earn 0.5% on their money. It’s also quite bizarre. How many other “public institutions” have private shareholders to whom they pay 6% risk free dividends?

None, which once again highlights the point that the Federal Reserve is NOT a public institution working on behalf of the citizenry, but is rather a banking cartel designed to enriched and protect its member banks (as we saw on clear display in 2008).

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.