The Justice Department and FBI have formally acknowledged that nearly every examiner in an elite FBI forensic unit gave flawed testimony in almost all trials in which they offered evidence against criminal defendants over more than a two-decade period before 2000.

Of 28 examiners with the FBI Laboratory’s microscopic hair comparison unit, 26 overstated forensic matches in ways that favored prosecutors in more than 95 percent of the 268 trials reviewed so far, according to the National Association of Criminal Defense Lawyers (NACDL) and the Innocence Project, which are assisting the government with the country’s largest post-conviction review of questioned forensic evidence.

The cases include those of 32 defendants sentenced to death. Of those, 14 have been executed or died in prison.

“These findings are appalling and chilling in their indictment of our criminal justice system, not only for potentially innocent defendants who have been wrongly imprisoned and even executed, but for prosecutors who have relied on fabricated and false evidence despite their intentions to faithfully enforce the law,” Blumenthal said.

– From the Washington Post article: FBI Overstated Forensic Hair Matches in Nearly All Trials efore 2000

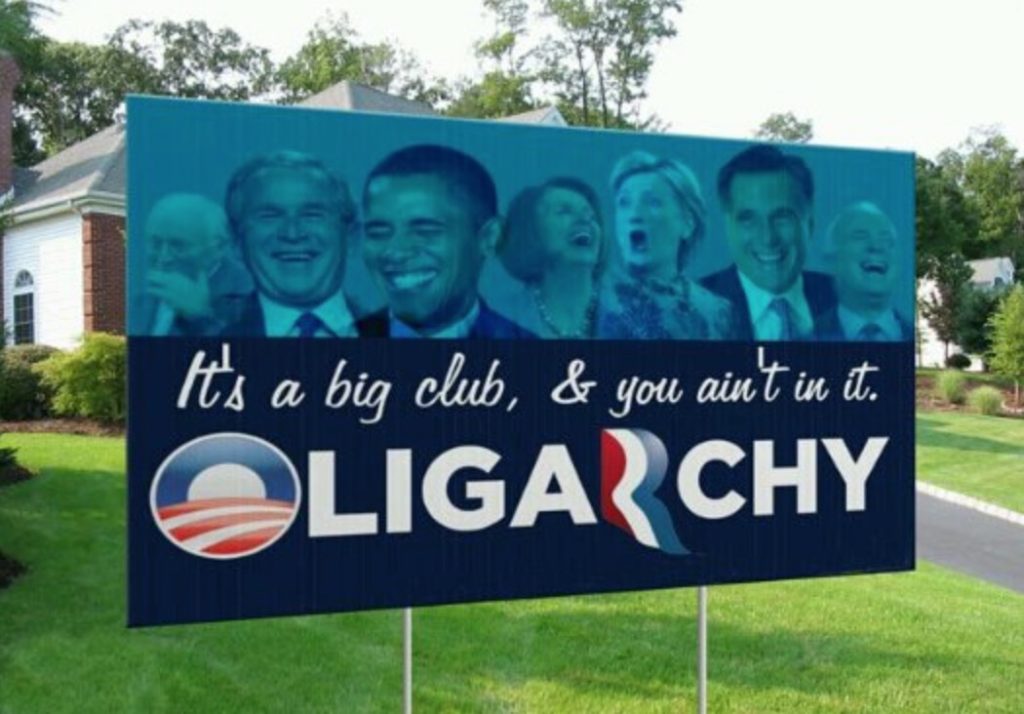

The American justice system is broken. Completely and totally broken. This has been one of the key themes here at Liberty Blitzkrieg since inception, and I’ve come to realize that the death of the rule of law is the single most important issue facing our society at this time.

This site has focused on the increased use of selective prosecution in these United States. If you are poor, disenfranchised, or a dissident, the full force of the law will rain down on your skull like a thousand tons of bricks. We have seen this repeatedly in cases such as the South Carolina man who was fined $525 and fired from his job when he failed to pay for a $0.89 soda refill. We saw it in the case of Aaron Swartz, the child prodigy was driven to suicide by overly aggressive and ambitious feds. Finally, we saw it in the case of Barrett Brown, who was threatened with over a century in jail for essentially exposing the criminality of certain very rich and/or powerful individuals.

On the other side of the fence, we see that anyone associated with the power structure can do whatever they want with zero repercussions. We saw this in the case of General David Petraeus, who received a slap on the wrist for passing on highly classified information to his mistress and biographer Paula Broadwell. We saw it in how DEA agents were’t even fired from their jobs despite participating in sex parties filled with prostitutes that were paid for by drug cartels, and sometimes taxpayer funds. Most despicably, we have seen it in the explosive use of deferred prosecution agreements when it comes to all the bailed out Wall Street banks, thus ensuring that no senior bankers went to prison and that their bonuses would be forever protected.

Read more

Follow me on Twitter.