People are going to be pissed off no matter who wins this election and that is a very important social dynamic I believe is vastly under appreciated by the majority of mainstream pundits and analysts out there. This is also very distinct from the environment that prevailed in 2008. Four years ago, the financial markets were crashing and the economic future of America was circling the toilet bowl, yet a majority of Americans embraced the potential of a young, inexperienced biracial politician from Illinois who was saying all of the right things. Despite the gigantic disappointment he has proven to be as President, there is no denying that he had all of the Democrats and most Independents under his spell on this day four years ago.

Fast forward to 2012 and the county isn’t “divided” as mainstream media talking heads like to say. The country is pissed off. Genuine and legitimate frustration permeates the land from sea to shining sea and rightly so.

– From my 2012 pre-election article: The Seventy Percent

Robert Reich is Professor of Public Policy at the University of California at Berkeley. I know of the man mainly from his frequent appearances on CNBC when I used to watch the channel (I’m proud to say I haven’t tuned in, even for five minutes, for several years now). He was always held up as the token “liberal,” who was more than eager to spar with CNBC’s endless parade of crony capitalist heroes and “socialism for the rich” supporting statists. During my post Wall Street years, I have from time to time come across his musings, but none have struck me like the insightful post he published three days ago.

The post is titled, What I Learned on My Red State Book Tour, and it’s an extremely important that all Americans read it. Here are a few excepts:

I’ve just returned from three weeks in “red” America.

It was ostensibly a book tour but I wanted to talk with conservative Republicans and Tea Partiers.

I intended to put into practice what I tell my students – that the best way to learn is to talk with people who disagree you. I wanted to learn from red America, and hoped they’d also learn a bit from me (and perhaps also buy my book).

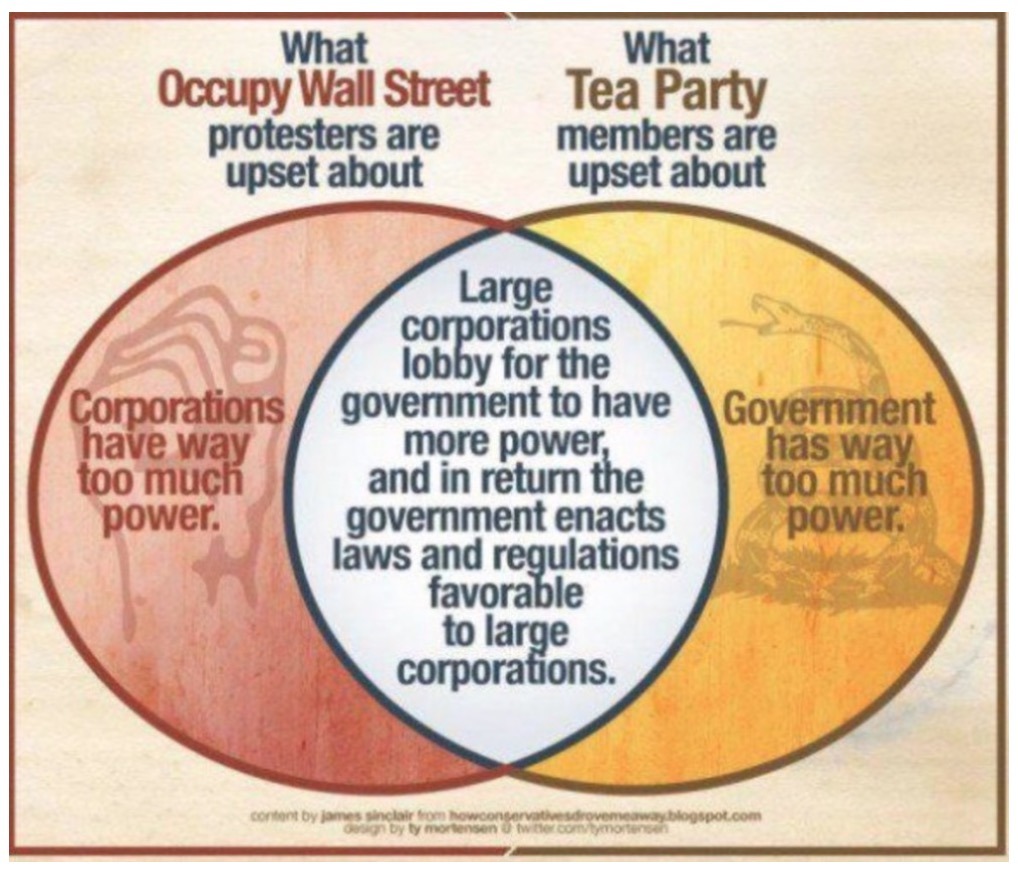

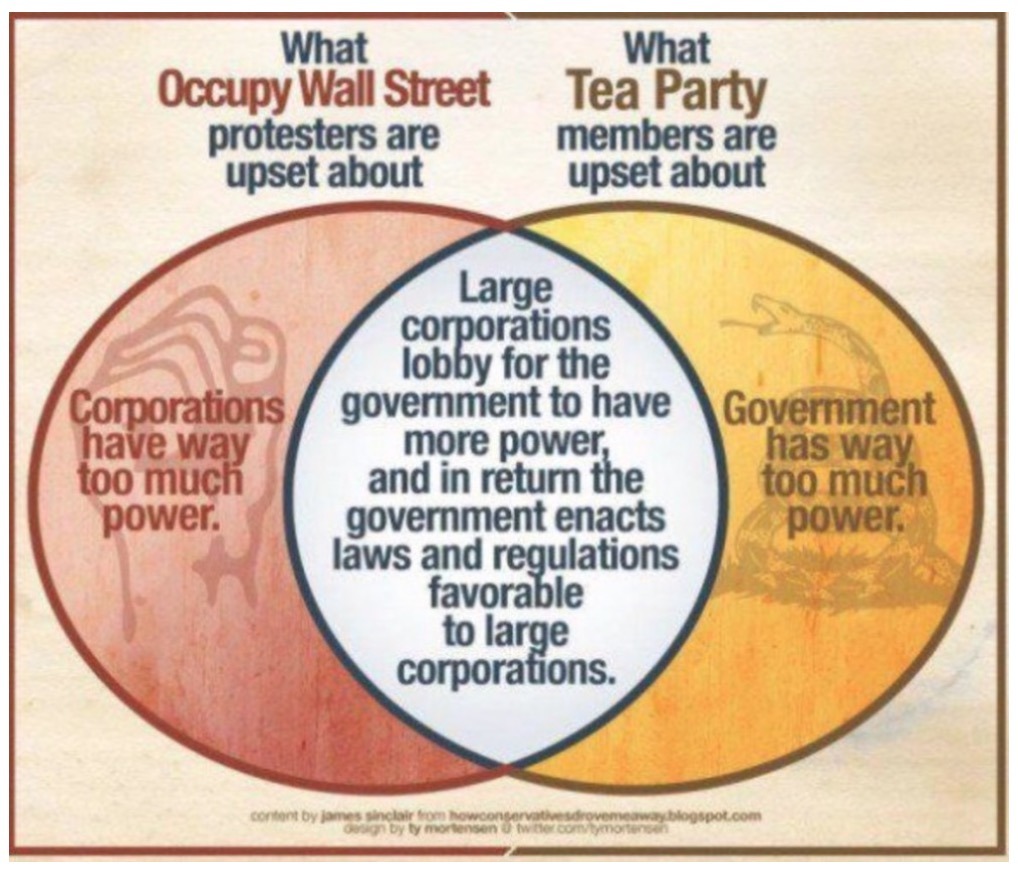

But something odd happened. It turned out that many of the conservative Republicans and Tea Partiers I met agreed with much of what I had to say, and I agreed with them.

Read more

Follow me on Twitter.