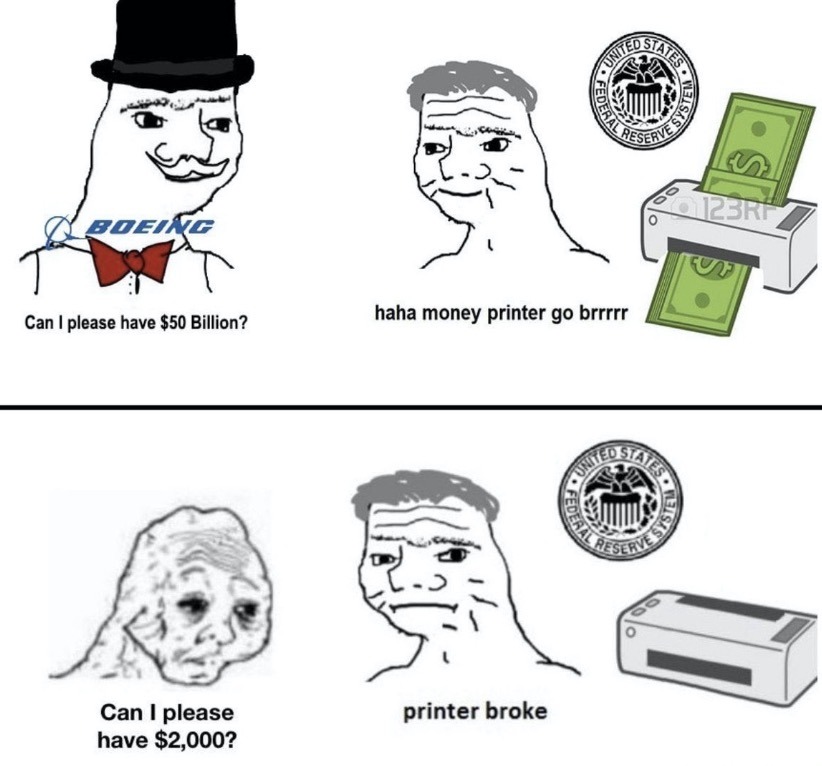

Tucked into the recent recovery bill was a provision granting the Federal Reserve the right to set up a $450 billion bailout plan without following key provisions of the federal open meetings law, including announcing its meetings or keeping most records about them, according to a POLITICO review of the legislation.

The provision further calls into question the transparency and oversight for the biggest bailout law ever passed by Congress. President Donald Trump has indicated he does not plan to comply with another part of the new law intended to boost Congress’ oversight powers of the bailout funds. And earlier this week, Trump dismissed the government official chosen as the chief watchdog for the stimulus package.

The changes at the central bank – which appear to have been inserted into the 880-page bill by sympathetic senators during the scramble to get it approved — would address a complaint that the Fed faced during the 2008 financial crisis, when board members couldn’t easily hold group conversations to address the fast-moving economic turmoil.

The provision dispenses with a longstanding accountability rule that the board has to give at least one day’s notice before holding a meeting. Experts say the change could lead to key information about the $450 billion bailout fund, such as which firms might benefit from the program, remaining inaccessible long after the bailout is over.

The new law would absolve the board of the requirement to keep minutes to closed-door meetings as it deliberates on how to set up the $450 billion loan program. That would severely limit the amount of information potentially available to the public on what influenced the board’s decision-making. The board would only have to keep a record of its votes, though they wouldn’t have to be made public during the coronavirus crisis.

A Fed spokesperson did not comment on the changes in the law or whether the Fed would continue keeping records of its meetings.

– Politico: Recovery Law Allows Fed to Rope off Public as It Spends Billions

An era can be said to end when its basic illusions are exhausted.

– Arthur Miller

Before going any further, I want to share a graphic that accurately summarizes my position on the current pandemic affecting the world.

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.