I don’t comment frequently on the state of financial markets these days, but the following article from Bloomberg really grabbed my attention.

It relates to interest coverage ratios across corporate America, and quite frankly, I was stunned to see how badly balance sheets have deteriorated during the recent pitiful cyclical economic rebound which I have dubbed the oligarch recovery.

From Bloomberg:

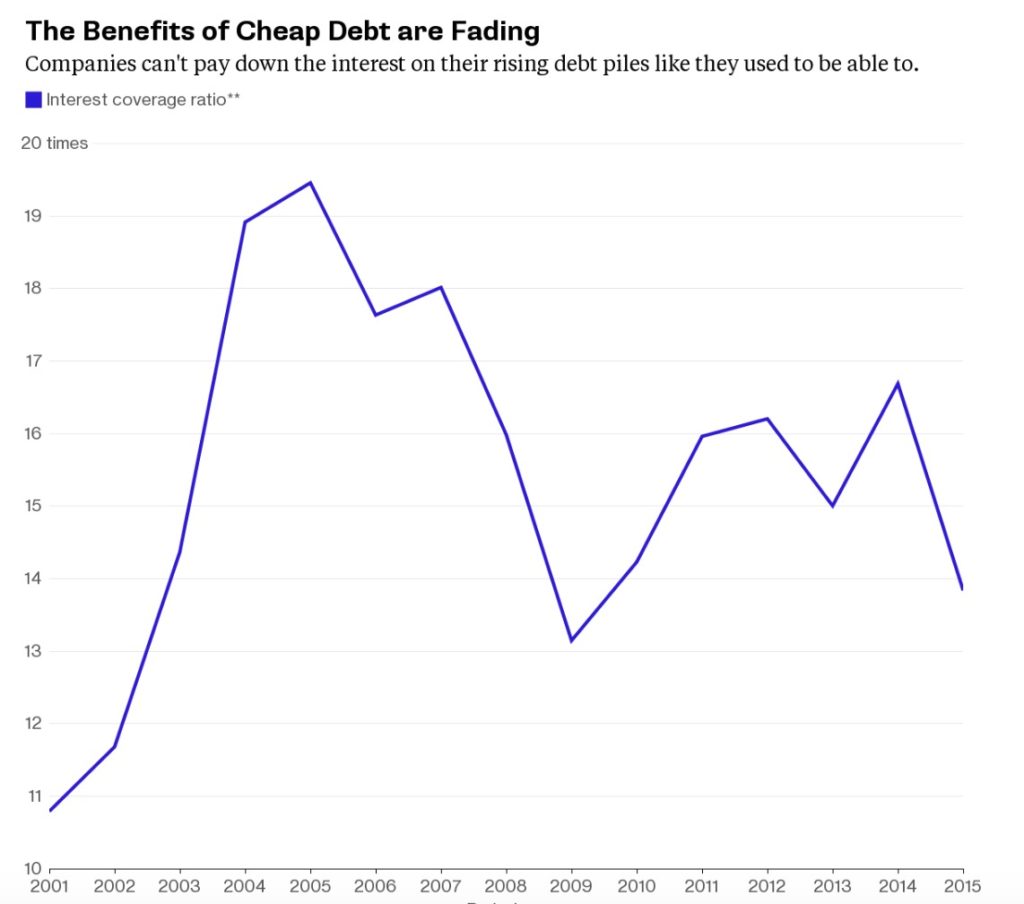

It’s more expensive for even the most creditworthy companies to borrow or refinance even as the Fed has kept its benchmark at near-zero the last seven years. Companies have loaded up on debt. They owe more in interest than they ever have, while their ability to service what they owe, a metric called interest coverage, is at its lowest since 2009, according to data compiled by Bloomberg.

Think about how terrifying this is for a moment. 2009 represented the nadir of a devastating economic and financial collapse. Earnings had plunged, and as you might expect, interest coverage fell into the gutter. This was a cyclical low, and so that sort of thing should be expected.

See:

The reason the current situation is so concerning, is because we aren’t in the nadir of an economic cycle at the moment. In contrast, we are constantly told how good things are going for the U.S. economy. All the while, the Fed funds rate is still stuck at near zero, with clueless central planners completely terrified to raise it a mere 25 basis points. Despite all this, the interest coverage ratio is near the 2009 low. Can you imagine what it’s going to look like when the next economic downturn really gets going?

The deterioration of balance-sheet health is “increasingly alarming” and will only worsen if earnings growth continues to stall amid a global economic slowdown, according to Goldman Sachs Group Inc. credit strategists led by Lotfi Karoui. Since corporate credit contraction can lead to recession, high debt loads will be a drag on the economy if investors rein in lending, said Deutsche Bank AG analysts led by Oleg Melentyev, the bank’s U.S. credit strategy chief.

As of the second quarter, high-grade companies tracked by JPMorgan incurred $119 billion in interest expenses over the last year, the most for data going back to 2000, according to the bank’s analysts. The amount the companies owed rose 4 percent in the second quarter, the analysts said.

The fallout of more borrowing coupled with lower earnings has raised concern among the analysts who track the debt and the money managers who buy it. Yet it seems the companies themselves are acting as if it’s not happening. They’re still paying out record amounts in buybacks and dividends.

Exactly. Oligarchs and corporate executives continue to strip-mine their companies, with absolutely zero regard to the long-term balance sheet health. Why should they care? They’ll be fat, rich and protected by the time the companies they run crash and burn.

In the second quarter, the most creditworthy companies posted declining earnings before interest, taxes, depreciation and amortization. Yet they returned 35 percent of those earnings to shareholders, according to JPMorgan.

That’s kept their cash-payout ratio — how much money they give to shareholders relative to Ebitda — steady at a 15-year high.

Since May, stocks of companies that have spent the most buying back their shares have performed even worse than the S&P 500 index. That comes after buyback stocks outperformed the S&P 500 each year since 2007, according to data compiled by Bloomberg.

The above paragraph should be seen as a major warning. The tide is beginning to go out.

Servicing the debt got tougher for companies in the second quarter, too, at least on paper. Interest coverage, an estimate of how many times a company could pay off its interest using its Ebitda, fell in the last year to a median 13.8 times from 16.7 times for companies with top credit ratings, excluding financial firms, who’ve issued debt, according to data compiled by Bloomberg.

Companies that have already issued $9.3 trillion in new debt since the financial crisis are trying to keep the cheap-debt party raging as long as they can. Some investors are joining them for what may turn out to be a nightcap, according to Stephen Antczak, head of U.S. credit strategy at Citigroup Inc.

“There are more people that want to buy into the bullish argument than I would expect,” Antczak said. “Maybe because the buy-the-dips mentality has worked so many times in the past.”

Famous last words. Brace yourselves, it’s gonna get ugly.

For related articles, see:

Leverage in PE Deals Soars Despite Fed Warnings; Amidst Insatiable Demand for Risky Fannie Mae Debt

Junk Borrowers Are Increasingly “Adjusting Earnings” to More Easily Sell Debt

Another Tale from the Oligarch Recovery – How a $1,500 Sofa Costs $4,150 When You’re Poor

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

If corporate balance sheets are frightening, think of this. According to S&P researcher Howard Silverblatt the gap between reported (adjusted) earnings and GAAP has gone from 9% to 16% most recently. As in creative accounting. Anyone remember Arthur Anderson?