Characterizing the upward transfer of virtually all American wealth to a handful of oligarchs a “recovery,” represents a grotesque insult to the english language as well as common sense.

The writing was on the wall from the very beginning. I knew as soon as TARP passed that we as society would regret the day we bailed out the bankers who destroyed the world economy. It didn’t take long.

Bailed out Wall Street banks went ahead and paid themselves record bonuses less than one year after the bailouts. Then, in early 2013, the financial community’s next scheme to feed off the carcasses of the American public became crystal clear. They wanted to become America’s slumlord by buying millions of foreclosed homes and then renting them back to former homeowners. When I realized what was happening I published the post, America Meet Your New Slumlord: Wall Street. Here’s the opening paragraph:

Well they aren’t really your “new” slumlord in the sense you have been debt slaves to the financials system for decades. What I really mean is that it is now becoming overt and literal. Literal because financiers are now the main players in the real estate market and are buying all the homes ordinary citizens were kicked out of over the past few years. Yep, we bailed out the financial system so that financiers with access to cheap credit can buy up all of America’s real estate so that they can then rent it back to you later.

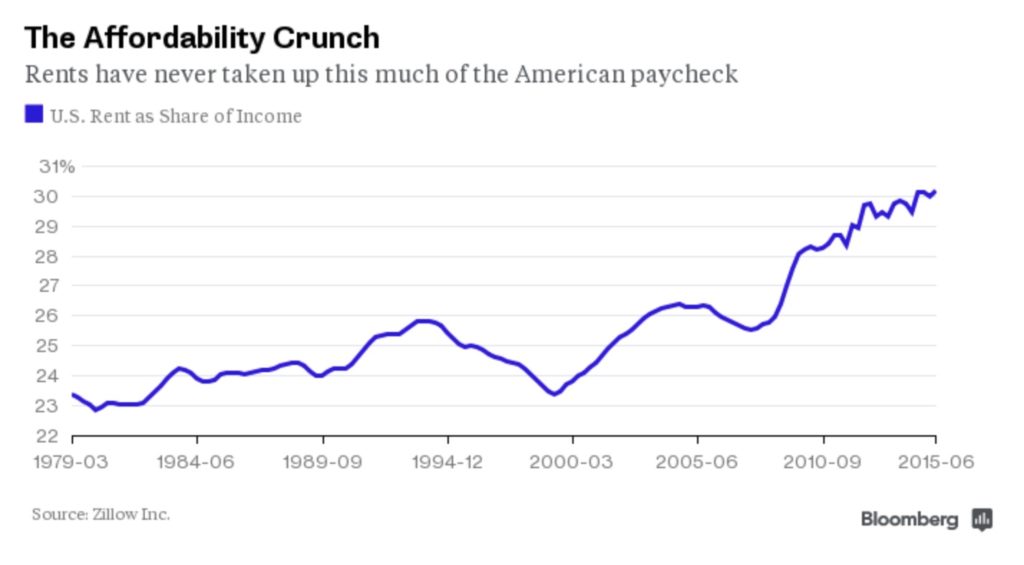

Two and a half years later, the results are clear. Landlords getting paid, renters getting shafted. As Bloomberg reports:

Americans living in rentals spent almost a third of their incomes on housing in the second quarter, the highest share in recent history.

Rental affordability has steadily worsened, according to a new report from Zillow Group Inc., which tracked data going back to 1979. A renter making the median income in the U.S. spent 30.2 percent of her income on a median-priced apartment in the second quarter, compared with 29.5 percent a year earlier. The long-term average, from 1985 to 1999, was 24.4 percent.

While mortgages remain relatively affordable, landlords have been able to increase rents because demand for apartments remains strong. The U.S. homeownership rate fell to the lowest level in almost five decades in the second quarter, as strict lending standards and tight inventories keep many families in the rental market.

Bull market in serfdom:

What do you expect to happen when you bailout sociopathic criminals?

For related articles, see:

America Meet Your New Slumlord: Wall Street

A Closer Look at the Decrepit World of Wall Street Rental Homes

Welcome to the Housing Recovery: Rents are Rising, Incomes are Falling

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Mike, you hit the target again. I also at the time of the TARP proposal wrote may senator and stated to them basically the same as what you were saying. I don’t think they understood or they were just trying to protect their own pocket book.

the real problem is perhaps, after the next economic collapse, that expensive rents won’t be the problem. it will become extremely expensive to be homeless and , as in brazil, there will be death squads, i mean, swat teams, to deal with dissappearing the homeless problem or jailing the homeless agianst their will ( which is already occuring on the pretext of homeless people needing to be protected).

all of this is being done through combination s of vagrancy and mental health laws. the psychology profession has been co-opted to being a spy network that legitimizes psycho babble in order to take people’s freedom away and meanwhile anti-vagrancy laws have always existed and will be escalated in scope to allow violence against huamns beings essentially for liquidating them or forcing them elsewhere.

Start printing 3D homes and stop moaning about it.The time is now.

This article is so relevant and prescient it makes me cry. As an elderly, poverty-level, single female, I am barely able to dog-paddle in terms of my housing needs. Currently on multiple USDA Rural Subsidized Housing lists, I am told there will likely be a “5-year Wait.” My solution? Have rented a barn with hose and one electrical plug for a decade, in process of moving into my station-wagon for a year so I can save a little and have more to spend on food and my self-curing, plant-based Cancer Medicines which are not reimbursed or recognized as medicine in my Food Stamps application (I have been receiving $16/month in FS). I am a former Social Work Manager and fully respectful of system abuse; however, we no longer have any safety net capacity for the aging, low-income boomers and housing is the #1 unmet need NOW. What is going to happen in 5 years when I can no longer self-advocate, collect foraged apples, wild blackberries, and Dandelions Greens? What do I see ahead for our society? A Generational War between the Oldest Boomers (the mouse going through the snake) who need services and entitlements but are no longer producing VS. the increasingly extracted and over-stressed younger generations roughly represented by the Middle Age / Middle Class and the un-launched, debt-ridden Millennials who face an even worse job market and the psychological set-backs caused by Cultural Abandonment. I do not see any generation coming up which has enough awareness to take back our Beloved Country. At nearly 3/4 century of age, I fear for Humanity because America is our last and best hope.

Mortgages may be available? No dear, credit is tighter than the asshole of a recently evicted former homeowner in a Michigan winter. There’s also discrimination and profiling. No, the people can’t buy homes, they’re all being rented out by the same people. It’s a filth!