Poverty demoralizes. A man in debt is so far a slave; and Wall-street thinks it easy for a millionaire to be a man of his word, a man of honor, but, that, in failing circumstances, no man can be relied on to keep his integrity.

– Ralph Waldo Emerson, Wealth

Most of you will be aware that it’s almost impossible to discharge of student loan debt once you have it. It stays with you for the rest of your life almost no matter what, even if you file for personal bankruptcy.

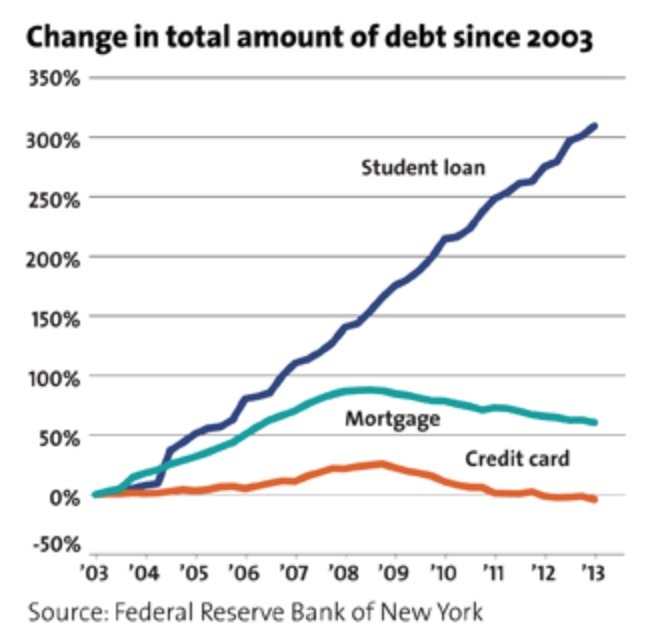

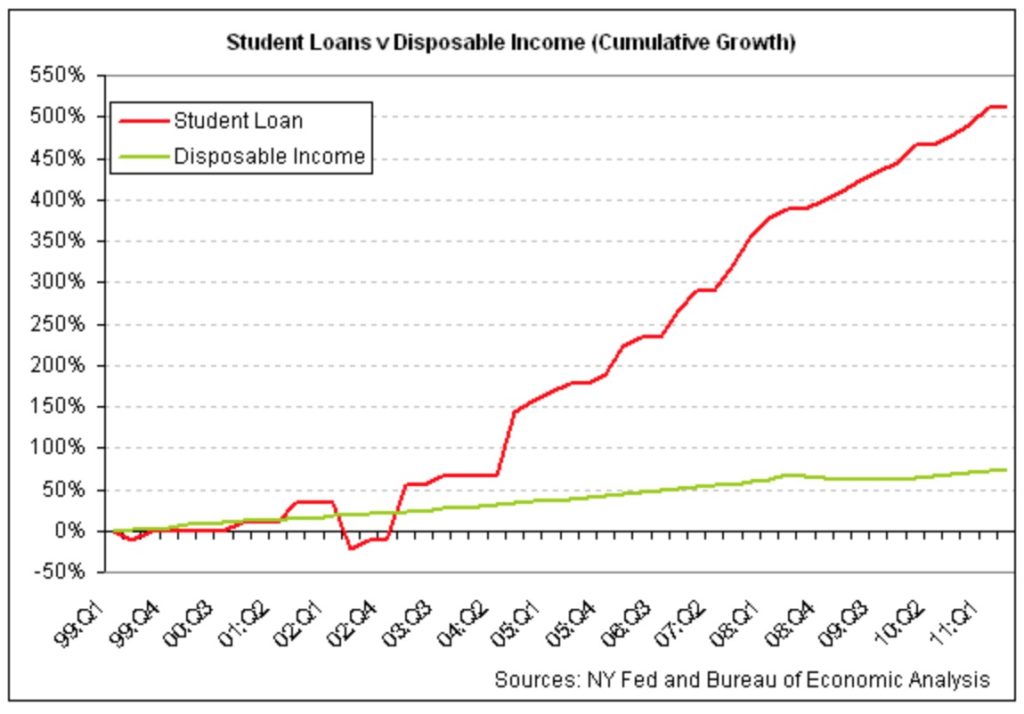

Why does this matter? Well, we’ve all seen charts depicting the disturbing surge in student loans outstanding over the past decade or so. Charts such as these:

So what do you produce when you encourage an explosion of debt that can never be repaid and can never be defaulted on? Debt serfs. Millions upon millions of hopeless debt serfs.

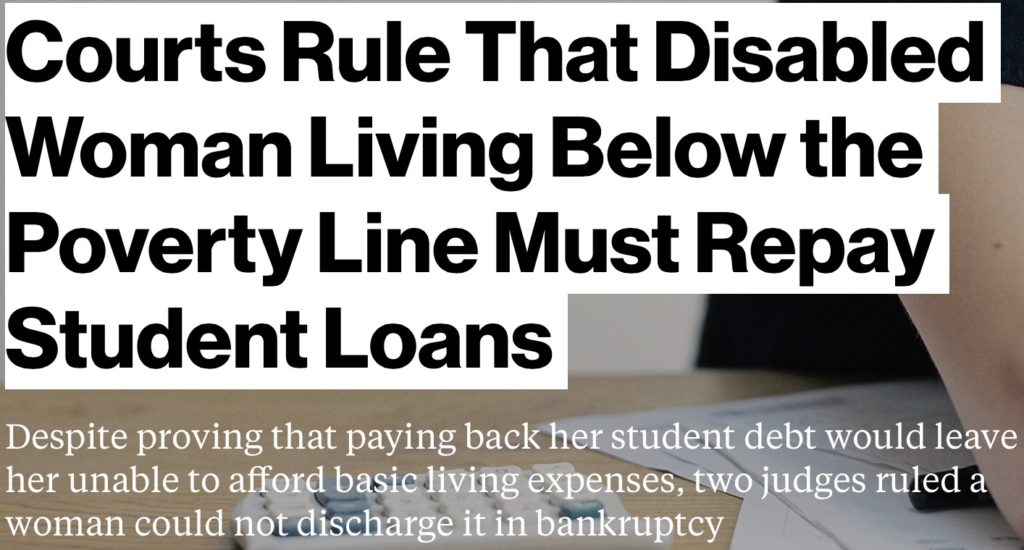

For those of you who still don’t realize how difficult it is to get rid of this financial millstone, I bring you the story of 45-year-old Monica Stitt. Here’s the title and tagline to the Bloomberg article:

Now here are some excerpts from the piece:

Monica Stitt, a 45-year-old woman, is unemployed, disabled, and living far below the poverty line. Still, a federal district judge decided in June that she could not cancel more than $37,000 in student debt in bankruptcy, because she hadn’t made a good-faith attempt at repaying the loans.

Her entire income—about $10,000 per year, according to the judge—consisted of Social Security disability benefits and public assistance. She has been unemployed since 2008.

Stitt had borrowed $13,250, which had increased with interest to $37,400 by the time she filed for bankruptcy. After the bankruptcy judge ruled she couldn’t shake the debt, the woman appealed to the U.S. District Court in Maryland without a lawyer, where a District judge upheld the bankruptcy court’s ruling on June 9.

The debtor didn’t meet the “undue hardship” test required by the bankruptcy code, U.S. District Judge Peter J. Messitte said in his opinion. Unlike credit card debt, student loans can almost never be discharged in bankruptcy. The only way people who have filed for bankruptcy can get rid of the debt is by proving that repaying them would impose “undue hardship” on their lives.

That standard is not defined in the law, so it has been left to the courts to decide exactly how bad someone’s circumstances need to be to qualify for relief.

If this woman doesn’t meet the undue hardship standard, then who will?

In order to understand how public policy works in America today, simply compare Monica Stitt’s situation to that of the giant TBTF Wall Street banks. After the rich and powerful manipulated and destroyed the global economy, trillions were spent and printed without any hesitation to save them, but when a broke, disabled, middle aged woman can’t handle her student loan debt then “that’s just capitalism.”

Socialism for the oligarchs, free market forces for the serfs. Get the joke yet?

For related articles, see:

Why Obama Allowed Bailouts Without Indictments by Janet Tavakoli

Profiting Off the “Law School Scam” and How Taxpayers Are on the Hook (As Usual)

In Liberty,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Some body tell this woman if she is totally disabled the DOE will forgive the entire balance. Been there done that.

Someone should tell her to pay what she owes. Wait, she was just told.

Always an angle?

Bankruptcy Cases: Disabled Poor vs. PEU

Contrast the bankruptcy case of Mrs. Stitt with The Carlyle Group’s Church Street Health Management, a children’s Medicaid dental provider. It went bankrupt in 2012. At the time Carlyle had nearly $40 billion in dry powder.

Church Street Health Management LLC’s filing with the Middle Tennessee U.S. Bankruptcy Court this week listed roughly $85 million of assets and $300 million of liabilities.

How much of that $300 million in liabilities came from a dividend recapitalization, where a private equity underwriter loads the affiliate with more debt, using proceeds to pay themselves a handsome dividend? Church Street, a serial ethics violator, was booted out of Medicaid for five years.

http://peureport.blogspot.com/2015/06/bankruptcy-cases-disabled-poor-vs-peu.html

The court records show she did to the disability discharge and was ignored by Dept of Ed (this was before they started a waiting period). She tried consolidation and the $10 payments were not enough.

You have to pay a lot before you can be accepted for consolidation. The loans have to be brought out of default: according to written regulations. And the other payment plans can not happen until the loans are consolidated. Of course, $0 dollar payments are not really a payment plan, and she already pay $0 because of no earned income. But if the loans are already 25 years old with 20 years of default, who would want to add another 25 years.

My guess is she’ll get put on one of those zero repayment plans the government offers…they have to keep these loans on the books no matter what or else they can’t pretend that it’s an asset to the system that’s been leveraged 100 times…

A judge can not use just one magic bullet to say someone is not in good faith. Deferment, attempt at disability discharge, attempts to improve can also show good faith. In Re Janet Rose Roth (Adv No. 10-0764-RJH). The Roth case had a number of things going against her, although she clearly could not pay. The Stitt case has a number of good faith things going her way, but they were ignored by the judge.

Consolidation requires payments. Ms. Stitt’s $10 payments in 1997 was not enough to bring her out of default. The loans were from 1990. The $0 payment plans require consolidation and requires a non-defaulted person (according to the written regulations). So what regulations is the judge using. This judge is just discriminating against her.

What regulations is the judge using?

“the woman appealed to the U.S. District Court in Maryland without a lawyer,” I think that pretty much says it all.

I don’t feel overly bad for anyone who went to college and did not pay there own fucking way and now is totally fucked, yes the system is totally rigged but people should know that by now and that college is usually not the answer. I don’t have empathy nor sympathy for the .1% – 1% nor the 99% because I myself and the blue collar fucktards shouldered with the bill never even had the chance to go to college so quit fucking whining you pussy ass worthless pieces of shit. Life without the global elite and the lazy, worthless dependent class (both so called lower & middle) would be great. The only people that deserve well-fair should be the truly disabled e.g. retarded from birth or (truly) fucked up from an accident. Lets stop coddling people who just don’t want to work and fuck those cunts who keep shipping off good jobs, while stealing billions.

There is one thing I do agree with the global elite about (just not who) and thats an 80% population reduction. Lets start with Wall Street and Washington D.C. and then work our way through the rest of the filth ridden places of this world. Politicians, Bankers, Multinational CEO’s, Attorney’s , bureaucrats and their interns, royal families , war lords. gang banger pieces of shit, meth dealers , heroin dealers, etc. etc.

I’m pretty much sick up being a host for a good for nothing leaching dependent parasitic upper, middle and lower class. Yes I get that the former is the cause of the latter but a piece of shit human being is a piece of shit human being no matter where their station resides. Most of peoples debt problems are because they are entitled little cunts who don’t have a fucking clue and want someone else to shoulder their fucking responsibility, go fuck yourselves you sniveling little bitches.

I was going to reply with a similar post.but your last paragraph summed it up pretty much.

lol – hark at Tough Guy here … hahahaha

So you admit the system is totally rigged, and yet then kick someone (like the lady in this article) who’s been scr*wed by this rigged system set up by the banksters and is already down. And then expect her to have “paid her own way” to begin with? That’s the whole point of going to college, getting the skills and certs to make more money, she probably got sick or maybe injured in a car accident and so couldn’t make those loan payments.

The crime here, which will probably be leading to guillotines against the banksters creating this debt slavery, is the interest rate on her loans. Her initial loan (less than $15K) was quite reasonable, in what outrageous sytem is this allowed to balloon up to more than $30,000? And while I agree that college shouldn’t be pushed on so many Americans, the fact of the matter is that HR depts in US companies simply toss our applications without a college degree, i.e. de facto it’s become a requirement for employment, which is not the students’ fault and there’s not a lot they can do about it.

@Walden, did someone force her to sign the loan papers? If not she should pay her debt. It is that simple.

” the system is totally rigged but people should know that by now and that college is usually not the answer.”

With accrued interest almost 1.5 times the amount borrowed, she must have gone to college in the ’90s. Back then the system wasn’t rigged. It became rigged when the bankruptcy code was revised in 2005 to make student loans nondischargeable.

But actually, I suspect that you are facetiously mimicking the attitude of the elites and their minions, showing the absurdity of it.

That was my emotional rant last night , now that I’ve come down a bit.Hard times do fall on us all and this lady sounds like a legit case but none the less my feelings about entitlement stands. For the few people that actually need the help there are in my opinion a few times more people who have decided to for go personal responsibility and ride the dole train for their free lunch and that fact crosses all economical stations (elite,middle,working & poor). Every time a student defaults it falls on the dwindling productive class’s shoulder’s, just like a fucking banker bailout does. I’m tired of it man, been literally working since I was ten, fifteen legally and I know I’m not even close to the only one who is just plain exhausted. I hear the great sucking sound come from the top, the bottom and the middle and I’m just really tired of it. I know dam well what the cause is but the effects of the entitled,lazy and ignorant are just as fucking real. A tiny few deserve any type of well fair.

perhaps if she declared herself to be a billionaire, they would forgive the debt.

As a financial advisor to distressed US grads dealing with the outrages of American student loan debt serfdom, I’ll say this again: EMIGRATE!!!

You owe nothing to a country– the modern USA– taken over by bloodsucking, parasitic traitors like the vultures who now rule the banking system and academia, and who are forcing you into serfdom via such usurious interest. There are scores of countries across the world, and while the other Anglo lands or stupidly copying the US model, most of them just about anywhere in the world– Europe, South America, Asia– see the idiocy of handing the power of government to the bankers and parasites, and will not enslave an entire generation of grads to debt. (In Germany for example, university is tuition-free even for Americans, as is the case through much of Europe.) Even if you can’t get to a top-notch country like Germany, Sweden or France right away, you can start elsewhere and those EU movement rules to get there later. Just learn a language (esp. German) and prepare to move.

Obviously, yes, you’ll have to cut ties with your former life to some extent, possibly change your name and not visit the US again, but why would you even want to return to a deb gulag like the US anymore? The US system is now designed to make you a debt slave and in the US there’s no escape from it. Far better to start fresh overseas as someone else (as many of our own ancestors did). The bankster-parasites in the US, as greedy as they are, won’t bother to track you down since it would cost them more to shake you down than they could get back. There is no excuse for the interest costs nearly tripling the cost of this loan.

She has to go through it used to be dept of ed but its through a different name now but if she calls the DOE they can give her the number of who she has to go through its a pain in the ass and takes time with all the forms and info she will have to fill out but they will discharge the debt every so many years they will check to make sure she doesn’t get any money other then what she gets now but its the only way to get past a student loan I paid mine and they said I still owed the interest but how do you get interest on a paid debt they aren’t suppose to charge interest on interest but that’s just what was done either way I had to go through all that to get it relieved of it, good luck from trying to force people with no money to pay student loans to taking the disabled and elderly people’s pain medication away because its and I love this (not safe) and we have suddenly become to stupid to take our meds without them telling us how we need babysitters now and they don’t give a damn how much we suffer but yet they want to give us antidepressants that don’t do anything but screw us up more for pain and on top of it they are damn right dangerous to take for any length of time as for mental pill they are useless so they poison us with everything toxic food ,water, soaps, toothpaste,but yet we can’t take pain meds cause they’re not safe God help us with our gov. deciding our health and medicines we should or shouldn’t take, who says suicide isn’t legal or should I say gov. Assisted suicide, or suicide by Frankenfood Monsanto, and Obama are.

When our local NFL retired millionaire football star closed his local restaurant, he screwed several local mom & pop businesses by filing bankruptcy on the restaurant and not paying anything out of pocket.

I read this timely piece just yesterday about the true nature of our higher ed system. It no longer serves to create informed and civilized ‘citizens’ but has instead morphed into a lottery system whereby a graduate has a decent chance at becoming an inside player in our Scamocracy (formerly USA). As such, it is priced appropriately for its new function.

http://boingboing.net/2014/06/24/piketty-goes-post-secondary-w.html

Read it and see if you don’t agree.

What really is wild is that banks who barely give any percent interest on your money, are using your money for wild investments making a ton of monies and profits for their own executive lines and bonus packages. Besides this, are the nation’s bailouts, whereas, your money was injected into the banking system and instead of using the monies to help people keep their homes or run their businesses, banks tightened up even more but gave their executive heads huge bonuses like a million to seven million dollars a piece just for being there! On top of that, every year the government makes a huge profit on student loans, so big, that that profit alone could afford half of the USA a full education. When I red how large the profits were, I was just in awe at the audacity for the government to hackle and heckle over student loans, while it raises the interest rates consistently and politicians spend huge sums of money bartering education away from Americans by cutting down on grants and no interest loans.

As for the disabled who may have a hard time gaining employment in their college fields, well let’s assume and look at discrimination, which is so common, or gender discrimination, even more common, and then let’s look at America’s fascist values, which it hides behind words, such as “democracy” and then study democracy and realize it came from a fascist Greek Nation that hated its own women, deprived them any voice, career, philosophy, or position for all its existence and then let’s realize that America is as nuts as it has always been, filled with hippocracy, male controlled fascism that oppresses women overall and did not go out of its way to help this woman achieve anything but debt because it likes that male macho power control over the weak, the poor, and keeping people in fear, confusion, so it can roam around as a tyrant with its ugly head.