Late last month, New York Magazine published a lengthy and very important article titled: Stash Pad – Why New York Real Estate is the New Swiss Bank Account. The entire article is well worth a read, and left me shaking my head in disbelief the entire time. As someone who grew up in New York City, it’s a real shame to see the continued transformation of Manhattan into nothing more than an oligarch playground, or as I sometimes like to call it, “Disneyland for Wall Street.”

Late last month, New York Magazine published a lengthy and very important article titled: Stash Pad – Why New York Real Estate is the New Swiss Bank Account. The entire article is well worth a read, and left me shaking my head in disbelief the entire time. As someone who grew up in New York City, it’s a real shame to see the continued transformation of Manhattan into nothing more than an oligarch playground, or as I sometimes like to call it, “Disneyland for Wall Street.”

One of the most shocking and disturbing revelations from that article was the fact that:

“The Census Bureau estimates that 30 percent of all apartments in the quadrant from 49th to 70th Streets between Fifth and Park are vacant at least ten months a year.”

One of the highlighted building in the New York Magazine article is the 1,000 foot ultra-luxury development known as One 57. We learn more about this beast from My FOXNY:

NEW YORK (MYFOXNY) – New York City has never been known for its affordability, but a new crop of mega-luxury buildings in Manhattan are redefining sky-high prices. One 57 is the 1,000-foot high building looming over Central Park where an apartment has closed for as much as $90 million.

Jonathan Miller appraises the units at One 57. He said if you were to walk by at night the skyscraper would be largely dark because a majority of the units’ owners are international and don’t live here. They are using the apartments strictly as investments.

The new mega-luxury developments are part of the changing face of New York City real estate, said Mitchell Moss, a professor of urban policy and planning at NYU’s Wagner School.

In the video segment attached to the article, Mr. Moss (who looks a bit like a younger Barney Frank) notes: “New York is a safe haven for financially powerful people from around the world.” Indeed, a safe haven for bailed out criminal global bankers. I agree.

I’m sorry, but there is nothing healthy about this. As I highlighted yesterday, it appears The Bank of China is facilitating money laundering for wealthy Chinese to move dirty money overseas and park it in real estate. The article is titled, Chinese Purchases of U.S. Real Estate Jump 72% as The Bank of China Facilitates Money Laundering, and noted that in some California communities 90% of purchases are being made by the Chinese.

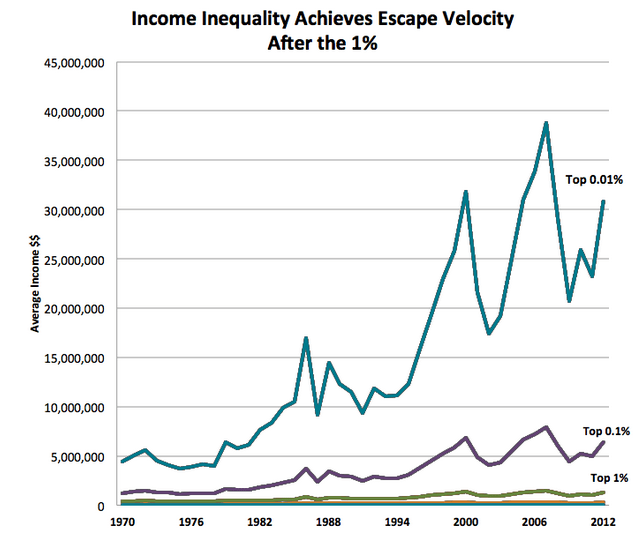

This should not be seen as a surprise given the fact that Central Bank and government policy worldwide is to funnel all money to the 0.01%, while the rest of the 1% treads water, and the 99% are rapidly pushed into debt serfdom. Never forget the extremely powerful chart below from the post, Where Does the Real Problem Reside? Two Charts Showing the 0.01% vs. the 1%:

Welcome to Planet Oligarchy, where empty skyscrapers loom over the hordes of freedom-hating, destitute slaves.

In Liberty,

Michael Krieger

[dfads params=’groups=5364&limit=1&ad_html=p&return_javascript=1′]

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

The next terrorist attack in NYC will be an insurance fraud scam of epic proportions – as the Chinese investors realize that the insurance payouts on their properties dwarf the actual value of those properties.

Ok i get the general outcry from a grumpy New Yorker that things are expensive and foreigners are buying for empty space investment but prove that the money is “dirty” and being “laundered.”

The US is constantly barking at China for its capital controls and now it (the FED) just prints money that the Chinese hold in return for all the cheap junk that the US no longer makes and keeps inflation down over there. What does the US have to offer in return but its real estate (and military hardware)? The Chinese may have their own rules against it, but they can’t just sit on ever larger stashes of dollars.

A little to gripey for my tastes. I live in London and this happens all the time – live with it. Its just the end result of US monetary policy anyway.

Who’s the grumpy New Yorker? First, I haven’t lived anywhere near New York City for 4 years. Did you even read the post?

Second, the Chinese government seems to think the money is dirty: http://www.bloomberg.com/news/2014-07-09/china-state-tv-says-some-banks-violating-currency-rules.html

Third, no I won’t live with it. Yes, it is a result of U.S. monetary policy, something I have been opposed to from day one. In fact, much of my writing over the past six years have specifically been critiques of the Fed. So why should I “live with it.” Slaves just “live with it.” Sad, defeatist attitude matey.

Best,

Michael Krieger

your looking at it wrong. It(Real Estate) is a giant heat sink for monetary supply globally, via pyramiding prices both from price takers buyers and price makers developers whom re-invest into more grandiose developments at more outrageous prices. and yet the money never enters the real economy except other than construction wages and other aspects which is very minor compared to the value embeded and eventually destroyed once the psychological price anchoring implodes and carries both buyers and developers into abyss.

Why do u think Chinese are so quiet illuminati is for real and don’t trust everyone they are coming to save us from this so called gov we have

Oh dear. He throw the I bomb.

The arson started getting wound up in 2009, and it will be huge this time. We just had a 7-alarm “Lightning” in Brooklyn on Friday Night – Records storage building on the waterfront It would take years to empty it, so now it is gone in a week and will be cleared as one of the choicest condo sites in the entire US. Just like a few blocks away in 2006. They blamed that one on a Polish drunk.

FDNY – good luck. Terror? We shall see. Simple arson can go into 10 figures in NYC.

Here is a thought: 432 park Ave and a “bad wind” Can you say “Dominoes”? Let the 7WTC conspiracy guys have fun with that one. Keep safe and be honorable – other probably won’t be.

I have been saying this for a couple of years now – that Americanos can’t afford to buy and the only ones buying are RICH foreign investors, mainly Chinese and Russians. The mainstream USA media is too busy covering up this fact and trying to sell the lie that there is a recovery in USA. All rubbish! It is also no coincidence that many of these same media have gotten rid of readers’ comments as too many were questioning “the truth!”