I’ve known about Ripple for close to a year now. I’ve been meaning to write a post on it for several months, but since doing so is such a difficult effort I kept putting it off. The most accurate expression I’ve seen to-date describing the daunting task of explaining Ripple to someone who has never heard of it is the following line published in a recent Bitcoin Magazine article:

If you’re ever explaining Bitcoin to someone and they’re getting it, start talking about Ripple, just to confuse them again.

That was precisely how I felt when a friend of mine first introduced me to Ripple. I had only recently really gotten behind Bitcoin, and now I had to try to understand something else? Even worse, something that seemed far more complicated. While I was interested in the idea right off the bat because I have a huge degree of trust in this person’s opinion on technology, it seemed overwhelming so I put the entire thing to the side.

My perspective changed later in the year when another friend of mine asked me if I knew about Ripple. It turns out he is friends with the head of Markets and Trading at Ripple Labs, Phil Rapoport. Since Phil is based in NYC, and I was headed there, I decided to set up a meeting and develop a more informed opinion on the subject.

By the time I met with Phil, I had put a lot more thought into Ripple in order to ask good questions by the time he showed up. I was highly skeptical for many reasons.

Ripple is not particularly embraced within many areas of the Bitcoin community, and I can understand why. Going in, I had many doubts. It is first and foremost a payment protocol, and secondly a “math based currency.” Since I couldn’t grasp the payment aspect until my meeting with Phil, I had spent all of my time thinking about the currency aspect of it, and that part was not appealing to me when compared to Bitcoin.

First off, the currency is pre-mined. This means that all the units are already in existence from day one and controlled by the creators, as opposed to Bitcoin, where the currency is mined over time by computers confirming transactions and ensuring the system runs smoothly. The distinction is important since the distribution process for Ripple is entirely opaque, while the distribution process for Bitcoin is far more transparent. While you do not know who exactly receives the bitcoins as each block is created, you do know how many are being distributed and at what pace until that moment in 2140 when the very last BTC is mined. With Ripple (the native currency of the protocol is known as XRP), the only thing we know is that there are 100 billion in existence (the most there will ever be) and that the founders kept 20 billion for themselves. The remaining 80 billion have been allocated to a company called Ripple Labs, which is in charge of distributing the remaining XRP as they deem appropriate. To-date, about 9.5% of the 80 billion have been distributed and you can track the progress here.

From a business standpoint, I can understand why this would be the case. They can sell some of it into the market to pay day-to-day expenses (Ripple already has a total valuation of about $1.4 billion), they can allocate it to employees as compensation, they can give it away via charity such as their partnership with the World Community Grid, and most importantly they can gift them to strategic “Gateways” (more on those later) in order to grow the payment system into what it needs to become in order to succeed.

One of the things that I and many others in the Bitcoin community have loved about Bitcoin is the fact that some poor computer nerd could have started mining bitcoins from his home computer several years back and now be a millionaire. It is very grassroots in that way. The people who saw its potential early on had the ability to participate in what was kind of like a decentralized IPO. All you needed was a little vision and some computer chops. There is something brilliant and beautiful in that distribution process. While mining is now a very expensive affair and out of the reach of the average person, this wasn’t the case in the beginning when there was far more risk involved in the entire experiment.

With Ripple, a somewhat equitable early distribution process was never on the table. The founders have/are allocating the currency in a highly centralized and opaque manner. There’s something about this that rubs many in the crypto-currency community the wrong way. Moreover, because Bitcoin is such a grass roots creation, it is simply much more political than Ripple is or ever will be. Buying Bitcoin and supporting it is for many of us an expression of disgust with the Federal Reserve in particular, and the legacy banking system in general. While many supporters of Ripple will most definitely harbor similar sentiments, buying XRP isn’t really a statement, while buying and spending BTC very much still is.

So those are some of the “negative” aspects of Ripple. I think they represent much of the skepticism in the Bitcoin community. They certainly reflect many of my own sentiments before I learned more about the tremendous potential of the payment system.

I will now explain how I overcame my initial skepticism on Ripple and saw the enormous power and benefit of the payment protocol itself. Earlier, I described some of the main differences between Ripple and Bitcoin. I called your attention to many of the aspect of Ripple that folks within the Bitcoin community tend to dislike. I think it is also important to understand some similarities they share.

One major similarity is that they both represent new payment systems that at their core allow for transfers of value from one person to another across the world at essentially zero cost. Both run on open source code and empower merchants and economic growth generally by eliminating the middlemen currently taking anywhere from 2%-3% for merely processing payments. The tens of billions of dollars spent on such fees can be repositioned as fuel for the global economy and put to more productive uses.

They were both released to the world for free. This represents a huge revolution not just in payments, but in potentially how some startups might choose to fund themselves in the future. Within Bitcoin, the unit of exchange, BTC, is needed in order to participate in the payment protocol. In that way, bitcoins, can be seen as the equity of the network. Early adopters bought or mined bitcoin, and as they increased tremendously in value, many of them have used their wealth and knowledge to greatly advance the protocol to where it is today.

Ripple also has a currency, called XRP, which can also be seen as the “equity” of the payment system. Here is where we start to see a major difference between the two systems. Within the Bitcoin network, you will use BTC, whereas the Ripple network is currency agnostic for the most part. The system does not discriminate between one currency or the other. Using Ripple, you can send payment to someone quickly and at essentially no cost whether it is USD, gold, XRP, or bitcoins.

That said, the currency XRP does play two major roles in the system.

1) Since it is the native currency on the protocol, it is the only currency traded or exchanged on the system that does not have any counter-party risk. Anyone with a Ripple wallet can send anyone else XRP at any time with no exceptions, sort of like Bitcoin. By contrast, in order to receive any other currency or asset of value on the system you must trust certain “Gateways.”

2) There is also a certain amount of XRP that is destroyed with every transaction on the system. The amount is a negligible .00001 XRP (a extraordinarily tiny fraction of a penny), and is used to prevent spam transactions from clogging the protocol. As such, each wallet on Ripple needs to have a minuscule XRP reserve balance of 20, which is at total of $0.28 at current prices.

In a nutshell: XRP has value as the reserve currency of the payment system. It is the grease in the wheels of the whole thing.

Ok, so I probably lost a lot of you above with the whole “Gateway” and “trust” concept. Let me explain.

First of all, no other currencies or items of value are actually held within the Ripple payment system. Gold traded on Ripple will be held in a vault somewhere, and U.S. dollars (USD) traded will be held in some sort of external financial institution, a bank, credit union or whatever. This is where “Gateways” come into play. “Gateways” are essentially companies that serve as the custodians for non-XRP assets that trade on Ripple.

To make this easy to understand, I will use the USD example. If you are a U.S. citizen and want to hold USD in your Ripple wallet the best “Gateway” to use at the moment is SnapSwap. SnapSwap has a bank account at Bank of America and you “fund” your Ripple wallet with USD by sending the currency to SnapSwap’s bank account. At that point your USD enters the Ripple network and you can purchase XRP and send it to anyone, or you can send your USD to anyone on the Ripple network who also “trusts” SnapSwap. As I mentioned earlier, you don’t need “trust” to send or receive XRP, you only need “trust” to send other items of value that have counter-party risk. Since there is obviously counter-party risk associated with your USD (risk resides at both SnapSwap and Bank of America) a Ripple user must conduct due diligence to determine whether or not they “trust” SnapSwap in order to receive USD via Ripple. The choice is yours.

For more information on how SnapSwap funding works, I suggest reading this explanation.

This brings me to what I think is one of the most exciting parts of Ripple, the ability to trade physically backed, deliverable precious metals. All you need is a “Gateway” with a vault (or access to one) that is willing to allow the metals to trade instantaneously and in fractional amounts on the payment system. While my mind was already excited about this potential after I met Phil in NYC, one of the things holding me back from writing this article was the lack of a solid option for doing so. Well that option arrived in January with the launch of Ripple Singapore as a “Gateway” in late January.

In the press release describing the service they explained:

People around the world can buy, sell and trade Gold and Silver on Ripple.

Ripplers have yet more reason to be happy; they are now able to invest, speculate and even spend the king and queen of money. Any fraction of a troy ounce of gold can now be held in your Ripple wallet and exchanged for any currency or unit of value anywhere, anytime with anyone – instantly.

Ripple Singapore has integrated the efficiency of Ripple, the free market of Singapore and the world’s most trusted commodities: Gold and Silver.

All issued ounces are 100% backed by investment grade physical bullion and held in world class vaults in the Republic of Singapore. The result is the birth of the most efficient and transparent physical bullion market in the world. Singapore, as the bustling financial capital of the South East Asia, is the perfect location for a Precious Metals gateway given its reputation as the world’s most open and trusted jurisdiction for investment and trade.

So to get your head around how this works in real life think back to the USD and SnapSwap example. Let’s say I own an 1 oz of gold backed by Ripple Singapore in my Ripple wallet and I want to send it to you. The only way you can accept it is if you “trust” the Ripple Singapore “Gateway.” You would want to do due diligence on them first of course, but once you felt comfortable, we would be able to trade fractional, fully backed precious metals (gold, silver and platinum) on the Ripple platform.

So what about delivery? This is the key question all precious metals investors always ask. Ripple Singapore offers delivery, but only in 10 oz amounts for gold and platinum and 500 oz amounts for silver. Additionally, delivery is only available in Singapore. Of course, this is quite convenient for people in Asia, much less so for those in the U.S. For specifics on how the delivery process works, read Ripple Singapore’s description here.

That said, these are early days and you need to think about how this could evolve. Ultimately, if Ripple succeeds, you will have trusted vaults all over the world functioning as “Gateways.” If the system gets built up sufficiently, we could have the first ever fully backed, global, digital precious metals payment network on planet earth. This is essentially what gold bugs have been complaining about with regard to Bitcoin. Well, it is already here and possible today. The network simply needs to grow.

Moreover, it’s not just precious metals, fiat currencies and crypto-currencies that can be exchanged on Ripple. Anything can be traded or exchanged as long as there is a trustworthy “Gateway” backing it. Coal in a warehouse, airline frequent flier miles, anything you can think of. Imagine the possibilities. This could revolutionize currencies, finance, trading. Everything. Forever.

Of course, something similar has been tried before. Most notably with GoldMoney and E-gold, but with limited long-term success. The main problem with those attempts is the fact that they were centralized systems. The vault provider was not only responsible for safekeeping the metals, but was also in charge of the payment system itself. With Ripple, the vault provider is responsible for safe-guarding the metals, but does not run the payment system. The payment system itself is decentralized and open source and the “Gateway” is merely providing the user access and promises to store your metals safely.

As you can probably tell by now, while Bitcoin doesn’t need massive scale to be successful (it has already succeeded with only a tiny fraction of the world participating), in my opinion Ripple needs tremendous scale to really succeed. The key to Bitcoin is merchant participation, whereas the key to Ripple is “Gateway” participation. The more relevant and significant “Gateways” that can be added, the more powerful and robust Ripple will be at allowing the free market to determine the true “value of things.”

Conclusion: While there are some very legitimate concerns from the Bitcoin community with regard to Ripple, I don’t think we should view them as competitors. From my point of view, they are compliments to one another and each payment system can be utilized to achieve different goals. Bitcoin had a more equitable beginning, it was and is much more grassroots, with a political and wild west edge to it. Ripple is more traditional and in some ways serves as a bridge between the legacy banking and currency system into something different, while Bitcoin represents a complete and total break from the existing system.

One of the major problems is that some executives at Ripple Labs have previously referred to Ripple as “second-gen Bitcoin” or “Bitcoin 2.0,” which was unfortunate because it turned a lot of people off. The good news is they are no longer talking in such terms, nor should they. Bitcoin is a remarkable piece of technology, something that has given me great hope about our future as a species.

Ripple does the same, but in its own way. And for the “gold bugs” that like the idea of Bitcoin, but don’t like its lack of backing, well here you go. We aren’t going back to gold coins in people’s pockets, nor should we ever want to. A state-backed gold currency would also be a mistake and a major step backwards. Ripple allows precious metals as money to be taken to a whole new level and it is something we should try to grow and encourage.

If I’ve still got your interest, check out this interview of Ripple Labs CEO Chris Larsen:

*Note: I previously had a donate via Ripple option here, but it has been removed as I am no longer accepting XRP donations.

You can still Donate via Bitcoin:

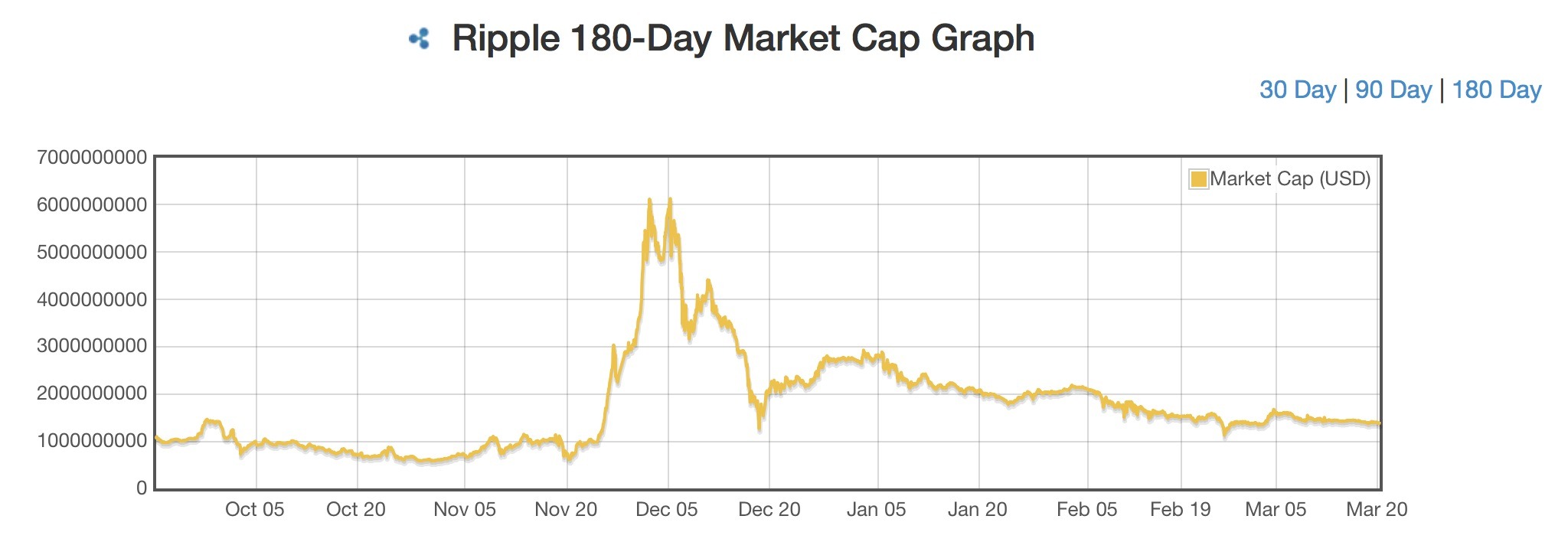

Disclosure: I own some XRP, but my exposure is only a fraction of my Bitcoin position. It is not for the weak of heart and can be even more volatile than Bitcoin. Furthermore, the distribution process is opaque and 90% of what will be distributed has still not be given out. As of today, it has the second largest market cap of any crypto-currency after Bitcoin.

The a chart of the last 180 days can be seen below:

Like with many things in the crypto-currency world, getting your head around Ripple can be extraordinarily difficult. I’d love to hear reader comments on this post and get a little dialogue going.

In Liberty and Crypto-Currencies,

Michael Krieger

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

Great article and thank you for the education. I have been talking to a number of people about Bitcoin lately (great to see how many people are becoming aware of it) and the one thing I always tell them, and the only negative in my mind, is that is isn’t back by anything. I will have to let the Ripple information sink in and probably re read this article and look into the ‘Gateways’ more but this certainly has my interest now. The idea seems similar to what I have envisioned as the ideal decentralized currency/payment system and look forward to learning more. Another glimmer of hope for a future.

Gold also isn’t backed by anything.

You don’t get it. It IS backed by something. BTC is backed by an algorithm. That’s the entire point. Why is the algorithm good?

1. You can’t steal it.

2. You can’t change it.

3. You can’t transfer it to someone else.

4. You can’t re-hypothecate it.

5. You can’t fake it.

6. You can’t duplicate it.

7. You can’t use paperwork to screw it up.

It’s better backing than anything else out there. There is no stopping the crypto-currency movement. It will transform the financial structure of this world.

That’s like saying the US dollar is backed by the ability to pay off a tax bill.

“Having a reason to trust it” is distinct from “what I can get for it.”

The USD is backed by “faith and credit of the USG” which has no value. The backing has nothing to do with taxes.

“Faith and credit” backing is totally different than an algorithm which has perceived value because we know exactly how it works, it’s transparent and cannot be changed. “Faith and credit” changes every day, with every administration, with every large financial fiasco that occurs. It’s not stable.

The sheeple think the USD has value because they trust it has value even though it does not.

The sheeple have no real reason to trust the USD. But since they are sheeple, they do trust it, and therefore, it has perceived value, and they can get something for it at the moment. Once the people lose faith, it’s all over. Which is why the money changers have to keep control of the media. Without that control and censorship, the sheeple might start to figure things out. They can’t let that happen.

You’re confused.

“Full Faith And Credit” isn’t a reason to trust it, OR something you can get for it.

What you CAN get for dollars is you can make the taxman fuck off, and that does have objective value, so to the degree that ‘backing’ means ‘exchange value,’ that is the ultimate basis of the US Dollar.

That doesn’t mean we have a reason to trust it – all fiat currencies always approach their intrinsic value.

I don’t know why you’re talking about what ‘sheeple’ think. The mass psychoanalysis of society is good for seeking scapegoats, or airing your inner demons, but isn’t useful.

IMHO Ripple really screwed up with the “pre-mining” thing. While they have added some innovative features, they ultimately removed half the security of crypto currencies by enabling a central authority to potentially rapidly dilute the value of the currency. Scarcity is value. It’s not enough to guarantee the total pool. It’s necessary to guarantee the quantitative rate of growth of said pool.

Additionally, Ripple rests upon “trust” on multiple levels. We must trust Ripple Labs not to dilute the currency at too great a rate. We must “trust” the gateways. We must “trust” that SnapSwap doesn’t abscond with our deposits. These elements of trust are not small issues. They’re the entire ‘thing’, and in these post MtGox days one can’t place too much emphasis on trust as a potential point of failure.

Lastly, they have a massive critical-mass problem. As someone who has read hundreds, if not thousands of web-based business plans — this is a weak point I see often. They are presenting a model that works only at massive scale. But does not work effectively until that scale is reached. Would you invest in a business that starts out by saying, “So imagine we have half a billion users actively using our platform…”… Yeah… Right… There are a lot of business ideas that sound great when the tipping point of hundreds of millions of users is reached. But how do you get there? And can they? The odds as deeply against them as there isn’t an incentive to use the platform until the user base is already there. It’s a Catch 22 that likely would have been avoided had they allowed users to mine XRP and participate in growth on the way up to critical mass.

Ripple is a cool idea. I imagine a less greedy, grassroots company will come along and implement much of what they developed. That company will see explosive growth.

I think their plan is to grow it, but not by a grassroots campaign. But to “bribe” their way into large business deals with large companies that have big customer bases. It might work. They have to start announcing big partnership deals to get more companies coming on board. With just a few deals they can easily do more volume than BTC. So the growth could go real fast once they start doing deals. That’s the only way I see them expanding.

They have said as much on their website.

Remember that during inflationary periods, speculative investments tend to look better, other things being equal. More people are looking for a trustworthy alternative, including billions of Indians and Chinese, than ever before.

Being on the right side of the fiat currency collapse means they aren’t equal, on top of that.

I don’t actually see the difference between buying gold with dollars in Singapore. I still have to trust the vault. I still have to trust the transfer. I still have to declare my overseas gold to US authorities. I still have to declare appreciation on my assets, when sold including gold.

Question: are ripple “gains at sale” reportable. Rickards says Bitcoin is, so I assume all these crypto currencies are reportable for “gains.”

You don’t have to do anything. If the speed limit says 30 you don’t have to go 30. You can go 25 or you can go 35. Or 45. You always have choice.

If you mention the word “ripple” or “crypto-currency” to anyone in gov. or a tax preparation company, or try calling up the IR$ they would have no idea in the slightest what you are talking about. There’s your answer for now.

I think it’s hilarious that any gov. entity is interested in regulation when they don’t even know what they are regulating.

The benefit of using RIpple is that you can spend gold anywhere, even in places that only accept USD. You can deliver USD to the merchant but pay from your gold balance.

Ripple enables people who store value in different currencies to transact seamlessly, without either party getting financial exposure to an asset he doesnt want. (As long as there’s a market maker who wants to facilitate that risk transfer..)

Ripple dramatically improves the ease of use of gold.

Not knowing what the Hell they’re doing has never stopped government from doing without knowing.

can’t steal bitcoin? really? it’s already happened

Bitcoin is a scam and so is ripple, but all the “end the fed” lemmings will gladly lose their money

Ripple should bribe new users to join as well as partners. I was early on PayPal and they gave $5 to $10 for each new user. Ripple could give either XRP to new users or stock in the company(better). Or give a “special XRP” amount that could not be converted until it changed hands between at least 20 different people.