“We aren’t releasing that data,” said a Visa spokeswoman in response to a query about whether the company had noticed a recent dip in card use. A MasterCard spokesman declined to comment.

– From yesterday’s New York Times article: Newly Wary, Shoppers Trust Cash

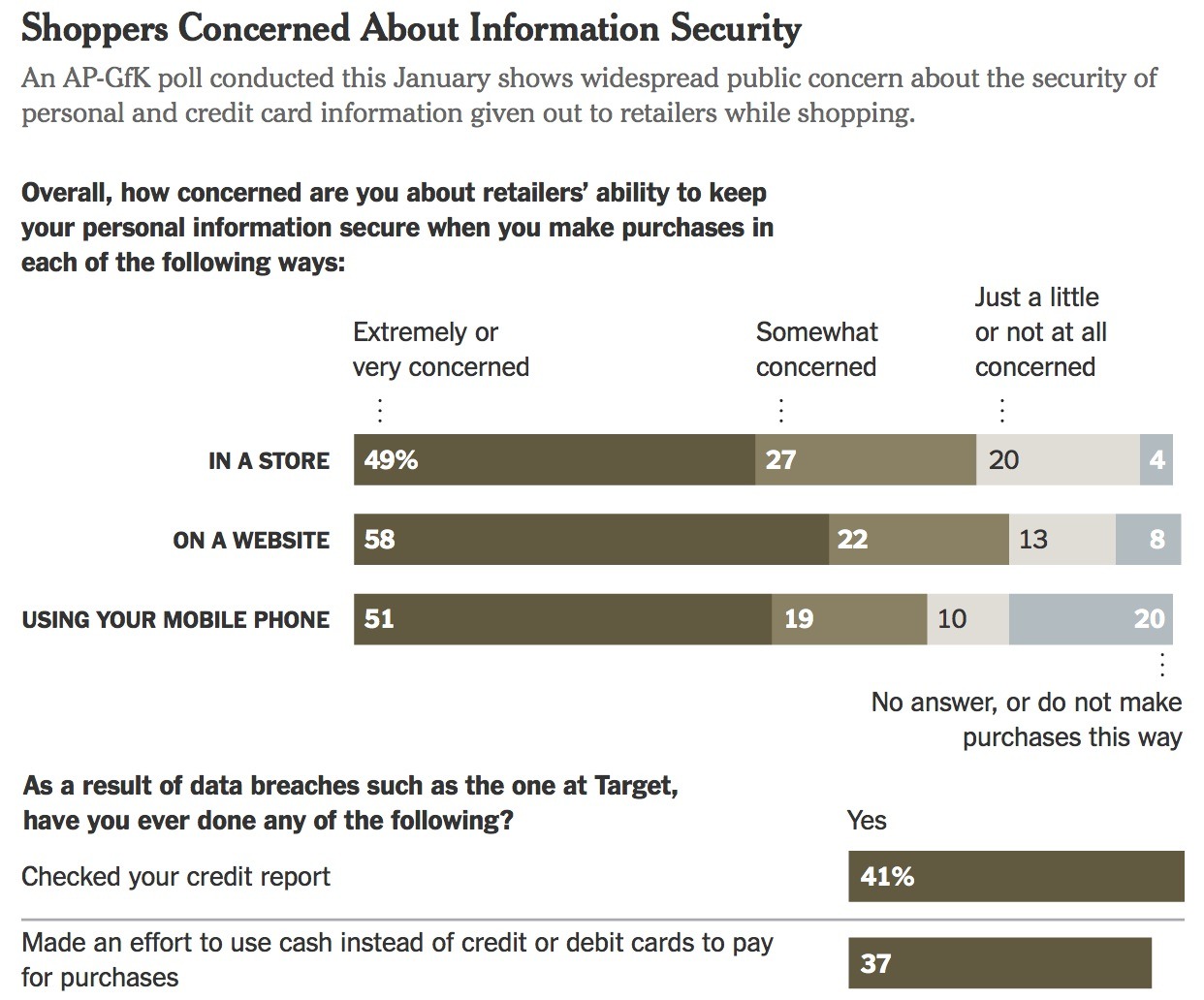

A very interesting article was published yesterday by the New York Times. It highlighted the fact that according to an Associated Press poll, 37% of Americans “had made an effort to use cash instead of credit or debit cards to pay for purchases as a result of the recent data thefts.” While I certainly agree with the assessment that people will likely only switch to cash temporarily and move back to plastic as soon as their low attention span minds allow, doubt regarding credit cards has been firmly planted in people’s minds. The more breaches we see in the future, the more people will look for alternatives.

Fortunately, we already have Bitcoin, and the more people learn about it, the more people will continue to adopt it. While the criticisms remain with people saying “but where can you spend them,” this is becoming an increasingly false critique. You can now buy airfare with Bitcoin, all the items on Overstock.com as well as also precious metals. In fact, the precious metals part has me particularly excited, and Amagi Metals is a local company that has led the way in BTC payments for PMs. They are also running a series of specials on silver all of February which you should definitely check out.

Now from the New York Times:

Like dieters vowing to trade cupcakes for carrots, a number of American shoppers are making a new pledge: cash only.

The drumbeat of disclosures about credit and debit card breaches at major retailers (and hints of more to come) has unnerved consumers to the point where chatter online and at the water cooler is filled with people promising to curb their plastic habits.

“This is CRAZY. First my Target card, now this,” wrote Lorraine McCullough on the Michaels Stores Facebook page last week after the arts and crafts chain said that it was investigating whether customer data had been exposed. “I am going to pay cash from now on.”

A poll released last week by The Associated Press and GfK Public Affairs & Corporate Communications found that 37 percent of Americans had made an effort to use cash instead of credit or debit cards to pay for purchases as a result of the recent data thefts — almost as many as those who checked personal credit reports because of the thefts. (Just 29 percent said they had changed passwords or requested new cards.)

Nicole McNamee of Germantown, Tenn., used a card for almost everything, even the $1 cups of coffee she routinely bought at the local McDonald’s drive-through. Then, last month, she and her husband learned of fraudulent charges — some $1,200 worth of purchases in Minnesota and California, including $400 at a Toys “R” Us on Christmas Eve — on her personal American Express card and a card he uses for his business.

Startled, they decided to follow the lead of some friends and take the pledge: cash only, whenever possible.

“We said, ‘Let’s just give ourselves a dollar value and pay cash for everything,’ ” Ms. McNamee said.

So far, they have found that the shift has had benefits beyond making them feel more secure. Since they can only spend what they have in their wallets, Ms. McNamee noted, “It has indirectly helped us keep on a better budget and save more.”

She starts the week with $100 and, when the money in her wallet is low, has found herself forgoing purchases she wouldn’t have hesitated to buy with a card. She has even come to value the spare pennies, nickels and dimes that she once tossed into random receptacles at home. Now she uses it for that McDonald’s coffee.

Rather than resorting to paying cash, it is more important for people to monitor their bank and card statements every day, he said, and to make sure never to use a debit card for an online purchase. “You’ve got to live your life,” he said, “but you’ve got to add one additional layer of vigilance.”

One word: Bitcoin.

“I told myself I’m just going to start using cash more,” she said.

That worked well for a week or so. But then a new debit card arrived in the mail.

“When I got the new card, I just felt safe again,” she said. And now she’s back to using it routinely.

“It’s just more convenient,” she said. “I try to keep cash on me but it’s just always gone.”

Just in case you had any lingering doubts regarding the intellectual and financial wizardry that is the American public.

Full article here.

In Liberty,

Mike

Donate bitcoins: 35DBUbbAQHTqbDaAc5mAaN6BqwA2AxuE7G

Follow me on Twitter.

1 thought on “Consumers are Switching to Cash in the Wake of Recent Credit Card Data Breaches”